East of Suez Market Update 30 Oct 2024

Prices in East of Suez ports have moved in mixed directions, and bunker deliveries at Zhoushan’s outer anchorages remain suspended due to bad weather since yesterday.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Singapore ($10/mt), Fujairah and Zhoushan ($6/mt)

- LSMGO prices up in Zhoushan ($8/mt) and Singapore ($1/mt), and down in Fujairah ($8/mt)

- HSFO prices up in Zhoushan ($1/mt), and down in Singapore ($5/mt) and Fujairah ($1/mt)

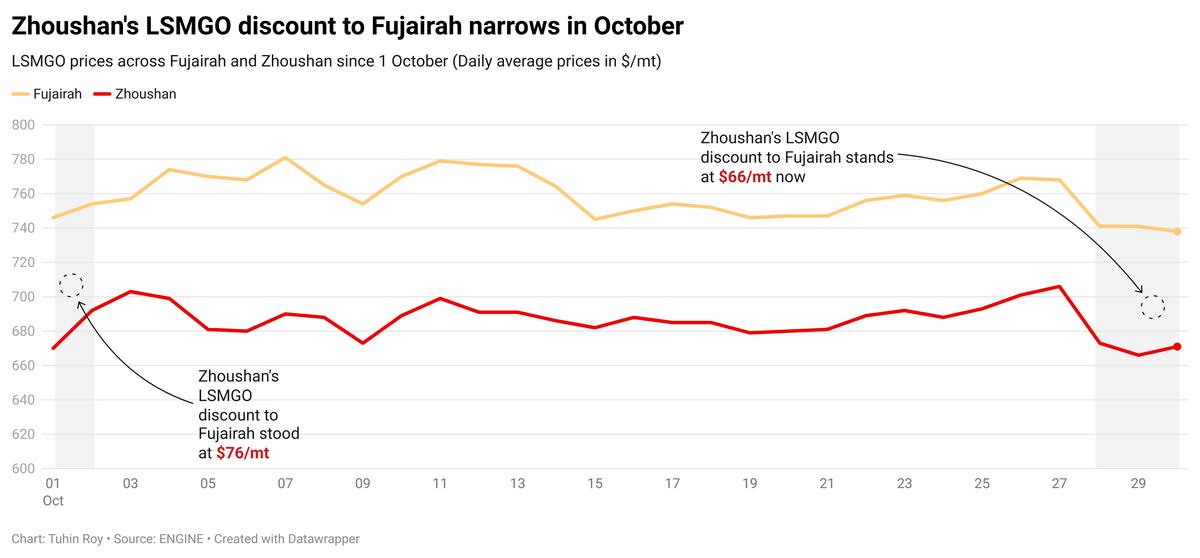

LSMGO prices in East of Suez ports have moved in mixed directions in the past day. Zhoushan’s LSMGO price has risen by $8/mt, while Singapore's price has held steady. The grade's price in Fujairah has declined by $8/mt. A higher-priced LSMGO stem fixed in Zhoushan has contributed to push its benchmark up. Despite the rise, Zhoushan's LSMGO price is at a $66/mt discount to Fujairah, while at a $29/mt premium over Singapore.

Zhoushan's VLSFO price has come down by $6/mt. However, it remains at premiums of $32/mt and $23/mt over Fujairah and Singapore, respectively.

LSMGO and VLSFO supplies have improved in Zhoushan, with recommended lead times of 5-7 days, but HSFO stocks are limited in the port and require longer lead times of 7-10 days.

Bunkering at Zhoushan's Tiaozhoumen and Xiazhimen anchorages has been suspended due to rough weather conditions since yesterday. Although operations continue at Xiushandong and Mazhi anchorages, these may halt soon as conditions worsen.

Brent

The front-month ICE Brent contract inched $0.05/bbl lower on the day, to trade at $71.74/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices gained some upward momentum after the American Petroleum Institute (API) reported an unexpected decline of 573,000 bbls in US crude stocks in the week that ended 25 October.

A drop in US crude stocks indicates growth in oil demand, which can put upward pressure on Brent’s price.

Additionally, oil market traders and analysts are bracing for the US elections on 5 November. A change in the US government could impact economic policies in the world's top oil consuming nation, which could have several implications for oil.

However, according to SPI Asset Management’s managing partner Stephen Innes, “the US labour market is stabilising, potentially giving the Fed more confidence to proceed with rate cuts—even as election-related uncertainties loom.”

Lower interest rates in the US can further boost demand growth for dollar-denominated commodities like oil as it makes the greenback weaker against other currencies.

Downward pressure:

Brent’s price moved lower as Israel's latest attack on Iran was not directed toward the country's oil facilities.

Israel launched over 100 missiles into Iran on Saturday, but none were directed toward the latter’s energy or nuclear facilities. As a result, supply-related concerns in the global oil market have eased, capping Brent’s price gains.

Oil moved lower due to “a deflation of Mideast risk premium on easing Israel-Iran tensions,” VANDA Insights’ founder and analyst Vandana Hari said.

Meanwhile, Israeli Prime Minister Benjamin Netanyahu revealed plans to hold a diplomatic meeting this week to resolve the conflict in Lebanon, Reuters reported. This news has added some downward pressure on Brent’s price.

“The prospect of a ceasefire in Gaza and the apparent de-escalation of tensions across the broader Middle East has seen the market almost completely remove the geopolitical risk premium it had priced into the [oil] market last week,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.