Global Market Update 31 Dec 2024

VLSFO and LSMGO prices across global ports have moved up, and availability of all grades remains good in China’s Zhoushan.

Changes on the day to 09.00 GMT today:

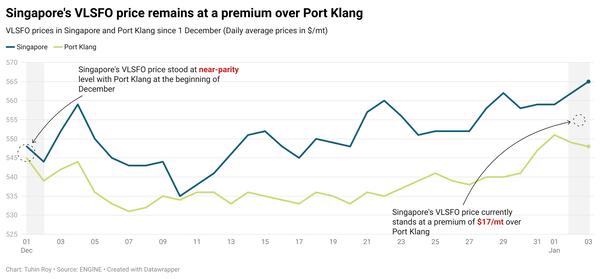

- VLSFO prices up in Fujairah ($7/mt), Gibraltar, Singapore ($5/mt), Houston and Rotterdam ($4/mt)

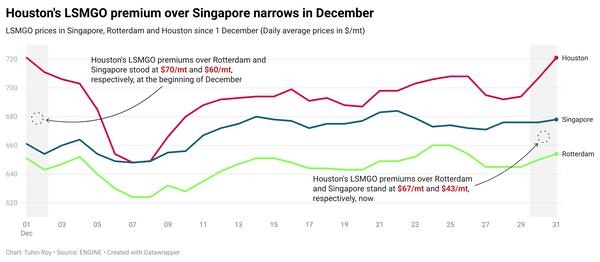

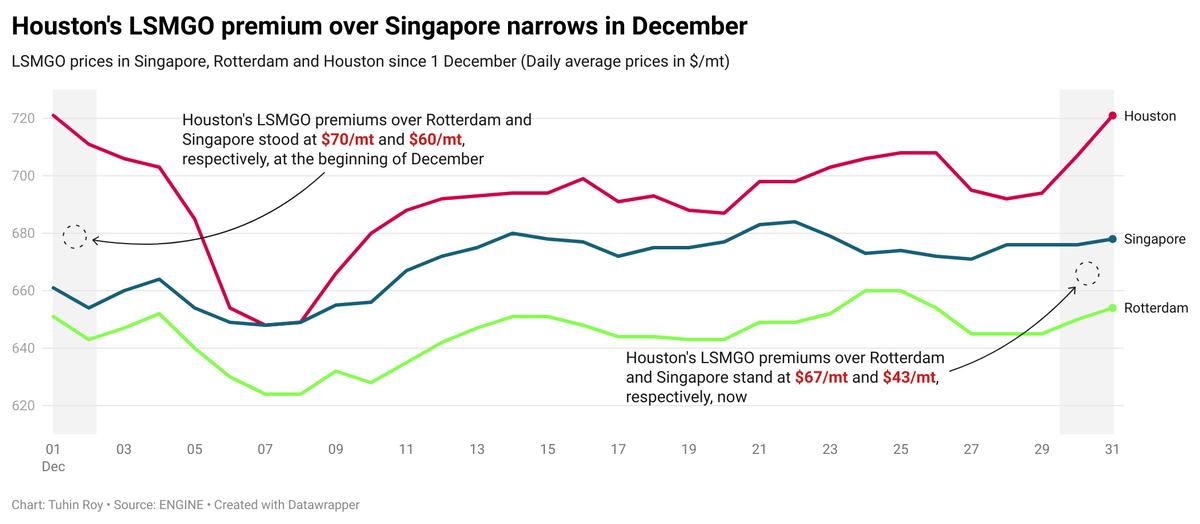

- LSMGO prices up in Houston ($24/mt), Singapore ($12/mt), Gibraltar ($7/mt), Rotterdam and Fujairah ($5/mt)

- HSFO380 prices up in Fujairah, Singapore ($4/mt), Gibraltar, Rotterdam ($3/mt), and down in Houston ($7/mt)

VLSFO availability in Singapore has improved, with standard lead times reduced from around 10 days last week, to 6-9 days now. HSFO lead times remain largely unchanged at 10-13 days, while LSMGO lead times vary significantly between 4-14 days.

In Zhoushan, VLSFO lead times have slightly increased from 4-6 days last week, to 5-7 days now. Similarly, HSFO lead times have risen from 3-5 days to 5-7 days. Conversely, LSMGO lead times have marginally decreased from 4-6 days last week, to 3-5 days now.

Gibraltar's LSMGO price has increased by $7/mt, while the grade's price in Rotterdam has risen by $5/mt. A steeper rise in Gibraltar's price has widened the port's LSMGO premium over Rotterdam by $2/mt to $78/mt now.

Bunkering is progressing smoothly in the nearby Ceuta port. Ten vessels are due to arrive for bunkers in Ceuta today, according to shipping agent Jose Salama & Co. A supplier is experiencing some delays, the shipping agent said.

In Long Beach, one supplier can offer LSMGO for very prompt delivery dates (0-3 days), while another supplier cannot offer the grade due to tight availability.

VLSFO can be tight to secure for very prompt dates in Florida's Fernandina. One supplier is not quoting for prompt supply there due to limited availability.

Brent

The front-month ICE Brent contract has risen $0.77/bbl higher on the day, to trade at $74.60/bbl at 09.00 GMT.

Upward pressure:

Brent futures rose slightly after China's manufacturing activity expanded for the third consecutive month in December, according to an official factory survey reported by Reuters.

Additionally, Chinese authorities plan to issue a record 3 trillion yuan ($411 billion) in special treasury bonds in 2025 to stimulate economic growth, potentially boosting the country's oil demand and supporting Brent prices.

Colder temperature forecasts for the US and Europe in the coming weeks are expected to increase diesel demand, which will further support Brent futures.

Oil prices are likely to rise, “driven mainly by forecasts of cold fronts in parts of the US and Europe in the coming days, fuelling expectations of a surge in natural gas and middle distillates consumption,” Vandana Hari, founder and analyst at VANDA Insights, noted.

Moreover, data from the US Energy Information Administration (EIA) showed a larger-than-expected drawdown in the US crude inventories for the week ending 20 December, with stocks falling by 4.2 million bbls. This decline was attributed to increased refinery activity and higher fuel demand during the holiday season, as reported by Reuters. The drop in US crude stockpiles has provided short-term support for oil prices.

Downward pressure:

The International Energy Agency (IEA) forecasts that global oil supply will exceed demand in 2025, even if OPEC+ production cuts remain in place, as increased output from the US and other non-OPEC producers outpaces sluggish demand, Reuters reported. This outlook has pressured oil prices.

Market participants are closely watching the Federal Reserve's monetary policy direction after the central bank projected only two rate cuts for 2025, down from four in September, due to persistent inflation, according to Reuters. Lower interest rates typically encourage borrowing and economic growth, which could boost oil demand.

However, shifting expectations around US interest rates and the widening gap between US and other nations' rates have strengthened the dollar, weighing on other currencies. A stronger dollar makes oil more expensive for buyers using other currencies, potentially reducing demand and exerting downward pressure on prices.

By Tuhin Roy, Manjula Nair and Nithin Chandran

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.