East of Suez Market Update 30 Dec 2024

Prices in East of Suez ports have moved in mixed directions, and supply of all grades remains stable in Zhoushan.

Changes on the day, to 17.00 SGT (09.00 GMT) today from Friday:

- VLSFO prices up in Singapore ($1/mt), unchanged in Zhoushan, and down in Fujairah ($1/mt)

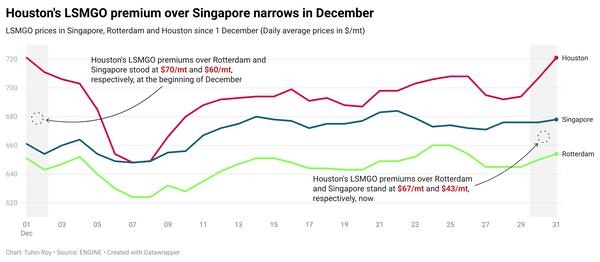

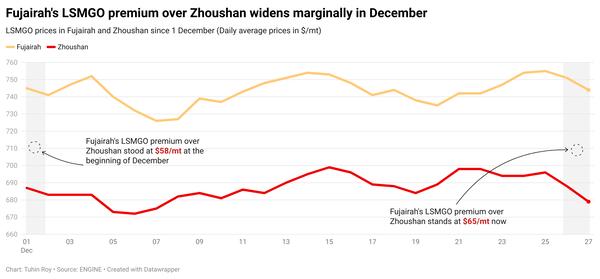

- LSMGO prices up in Zhoushan ($5/mt) and Singapore ($2/mt), and down in Fujairah ($2/mt)

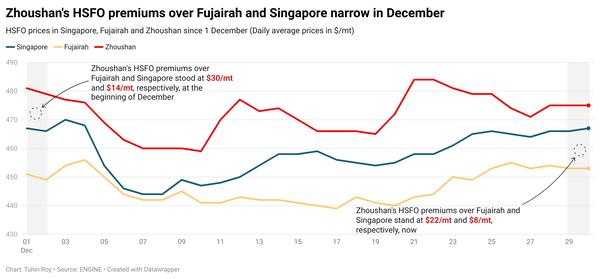

- HSFO prices up in Singapore and Zhoushan ($4/mt), and down in Fujairah ($6/mt)

VLSFO prices in East of Suez ports have remained largely stable over the weekend, with no significant changes. Zhoushan's VLSFO price remains higher than other regional benchmarks, with premiums of $37/mt over Fujairah and $25/mt over Singapore.

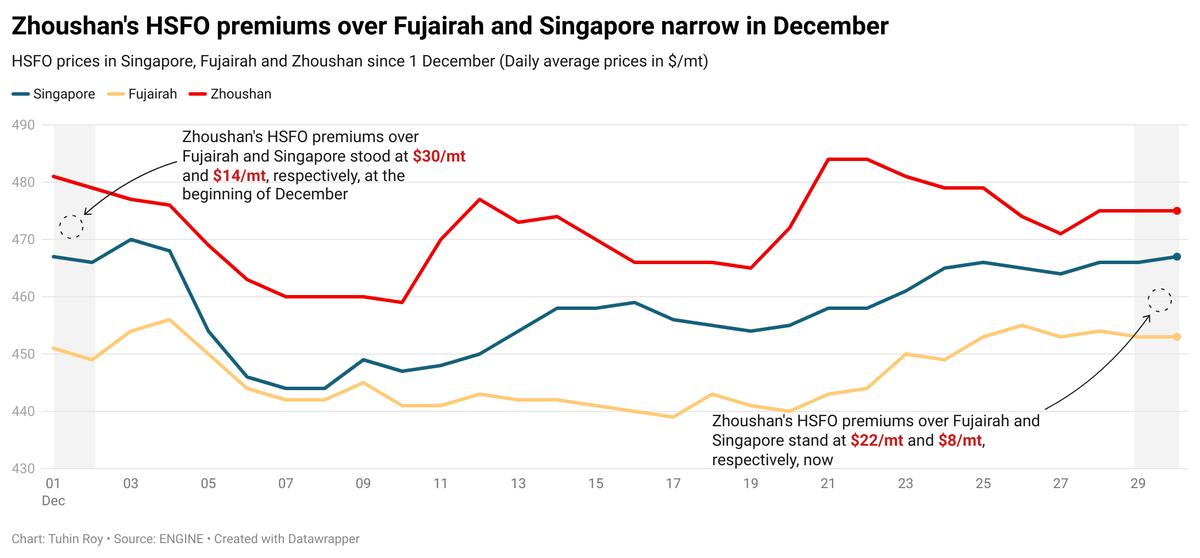

Similarly, Zhoushan's HSFO is at premiums of $22/mt and $8/mt over Fujairah and Singapore, respectively.

Lead times for VLSFO in Zhoushan have slightly increased from 4-6 days last week, to 5-7 days now. HSFO lead times have also risen from 3-5 days to 5-7 days. In contrast, LSMGO lead times have marginally decreased from 4-6 days last week, to 3-5 days now.

In Fujairah, prompt availability remains tight, with lead times for all grades stable at 5-7 days, consistent with last week.

In Taiwan, VLSFO and LSMGO supplies are steady in Hualien, Taichung and Keelung ports, with lead times of around two days. Kaohsiung port requires about two days for VLSFO delivery, but supplying LSMGO can be difficult due to barge maintenance since 26 December.

Brent

The front-month ICE Brent contract has lost $0.42/bbl on the day from Friday, to trade at $73.83/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices have been supported by optimism for Chinese economic growth in the coming year, which could increase demand from the world’s largest crude oil importer.

Chinese authorities plan to issue 3 trillion yuan ($411 billion) in special treasury bonds next year to stimulate the economy. The World Bank has also raised its growth forecasts for China in 2024 and 2025, Reuters reported. This could boost oil demand in the country and support Brent's price.

Additionally, data from the US Energy Information Administration (EIA) revealed a larger-than-expected drawdown in US crude inventories for the week ending 20 December. US crude stocks fell by 4.2 million bbls as refiners increased activity and the holiday season led to an increase in fuel demand, Reuters reported.

Prices were further supported by “bigger-than-expected weekly slumps in US crude and distillate fuel stocks reported by the Energy Information Administration for the week ended December 20,” according to Vandana Hari, founder and analyst at VANDA Insights.

Downward pressure:

Meanwhile, market participants remain cautious and are awaiting economic data from China and the US later this week to evaluate growth in the world’s two largest oil consuming nations.

The market is focused on China’s PMI factory surveys, set for release on Tuesday, and the US ISM survey for December, which will be published on Friday. This uncertainty has contributed to put some downward pressure on Brent futures.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.