Europe & Africa Market Update 25 Oct 2024

Regional bunker benchmarks have dropped with Brent, and prompt bunker availability is tight in Rotterdam.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($16/mt), Rotterdam ($7/mt) and Gibraltar ($6/mt)

- LSMGO prices down in Durban ($25/mt), Rotterdam ($14/mt) and Gibraltar ($5/mt)

- HSFO prices down in Gibraltar ($5/mt) and Rotterdam ($2/mt)

- Rotterdam B30-VLSFO at a $184/mt premium over VLSFO

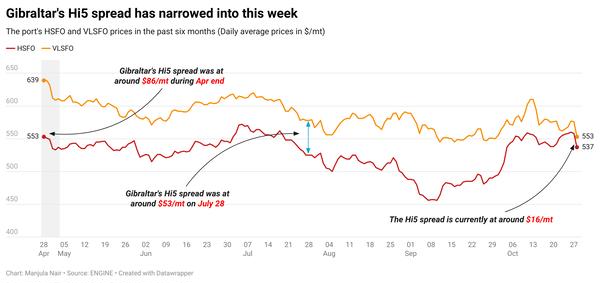

Rotterdam’s VLSFO price drop has outpaced its HSFO price drop in the past day. The price moves have narrowed Rotterdam's Hi5 spread from $43/mt to $38/mt now. All bunker grades are tight for prompt deliveries in Rotterdam and in the wider ARA hub amid barge loading delays. Availability has tightened further this week, stretching out lead times from 5–7 days to 7–10 days now.

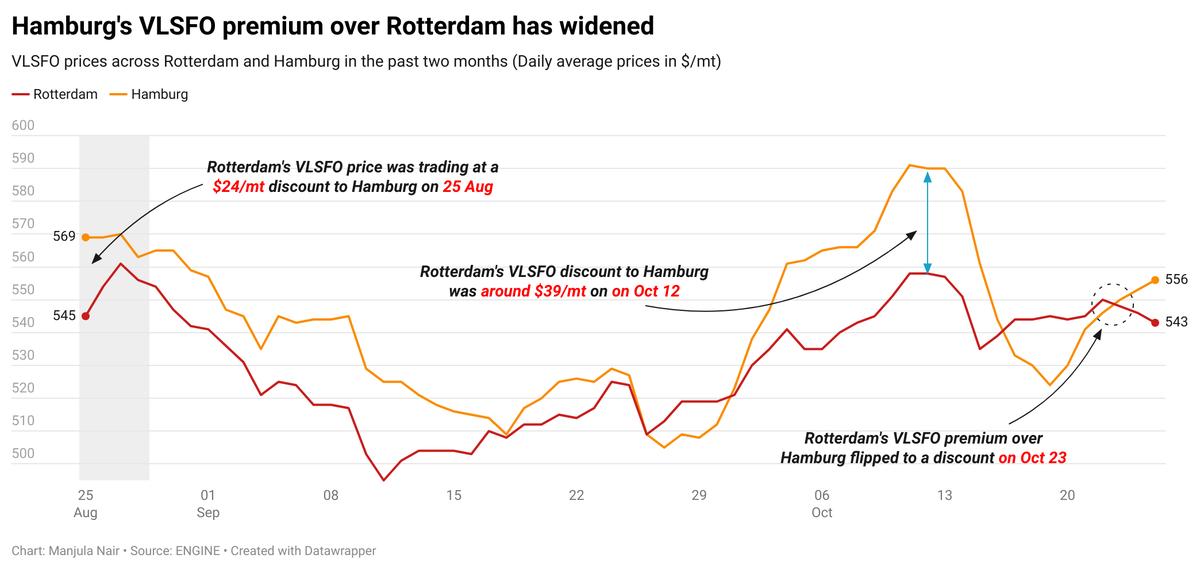

In Germany's port of Hamburg, prompt availability is ample across all bunker grades. Lead times have remained unchanged in the past few months, with suppliers able to offer all three grades within 3–5 days. Hamburg's VLSFO price traded at a discount to Rotterdam for most of last week, before flipping to a premium this week. Currently, Rotterdam's VLSFO price is trading at a $13/mt discount to Hamburg.

Bunker deliveries by truck in Spain may be affected by the nationwide truck drivers’ strike on Monday. The strike action will impact truck deliveries across all Spanish ports, a source confirmed.

Prompt VLSFO bunker availability is still tight in South Africa’s Durban and Richards Bay, a trader told ENGINE. Lead times of 7–10 days are recommended for full coverage from suppliers. In Durban, LSMGO availability continues to be dry. The grade's availability is subject to enquiry in the port, a trader said.

Brent

The front-month ICE Brent contract has plunged by $1.67/bbl on the day, to trade at $74.49/bbl at 09.00 GMT.

Upward pressure:

Geopolitical risk premium amid growing hostilities in the Middle East has been the key reason behind the Brent's price rise this week.

Earlier this week, an Iranian missile landed dangerously close to Israeli Prime Minister Benjamin Netanyahu’s private residence. This news comes days after the killing of Hamas leader Yahya Sinwar.

Oil market investors have been on the edge this entire week as such developments can quickly escalate the Israel–Iran conflict.

“The volatility reflected ongoing uncertainty over the Middle East situation,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Oil demand growth in the US and China has been a major concern for the global oil market this week. It has put some downward pressure on Brent futures.

Commercial crude oil inventories in the US increased by 5.5 million bbls to touch 426 million bbls on 18 October, according to data from the US Energy Information Administration (EIA).

A rise in US crude stocks indicates a decline in oil demand.

In China, economic growth, measured by real gross domestic product (GDP) growth, came in weaker at 4.6% in July-September, below the 4.7% achieved in the previous quarter, Trading Economics reported citing data from China’s National Bureau of Statistics (NBS).

“[Brent crude] oil dropped amid… rising [US] inventories, and weak Chinese demand,” analysts from Saxo Bank noted.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.