Europe & Africa Market Update 24 Oct 2024

Bunker benchmarks in European and African ports have increased with Brent, and bunker fuel availability has improved in Barcelona.

Changes on the day to 09.00 GMT today:

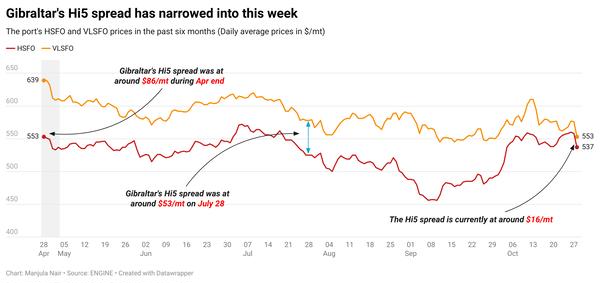

- VLSFO prices up in Durban ($8/mt), Gibraltar ($7/mt) and Rotterdam ($4/mt)

- LSMGO prices up in Rotterdam ($36/mt), Gibraltar ($9/mt) and Durban ($8/mt)

- HSFO prices up in Rotterdam ($15/mt) and Gibraltar ($6/mt)

- Rotterdam B30-VLSFO at a $201/mt premium over VLSFO

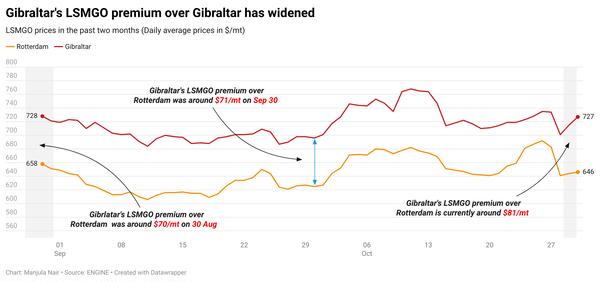

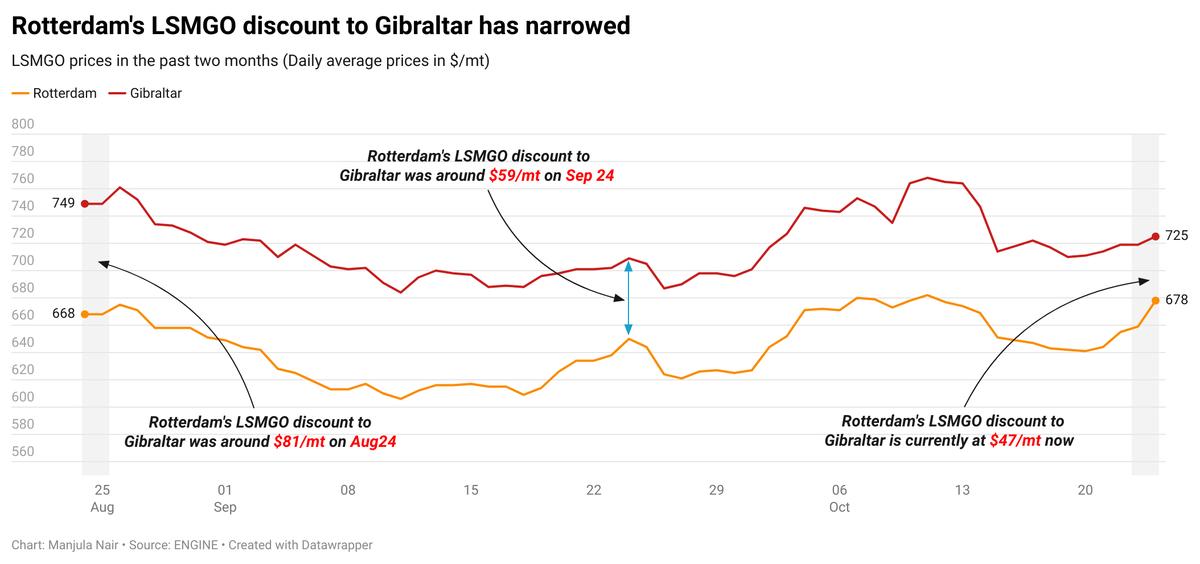

Rotterdam’s LSMGO price has increased more than the other two grades in the port and outpaced Gibraltar's LSMGO gain in the past day. The price moves have narrowed Rotterdam’s LSMGO price discount to Gibraltar by $27/mt.

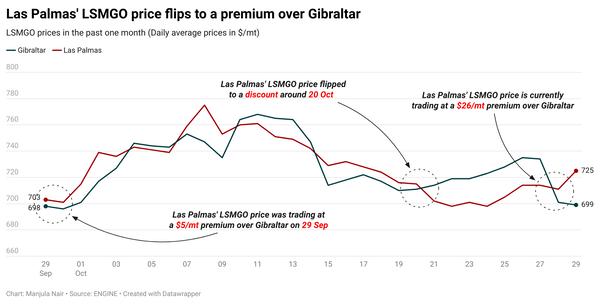

In the Canary Islands port of Las Palmas, HSFO tightness continues amid delays in the arrival of replenishment cargoes. Lead times of 7–10 days are advised for the grade. Prompt availability of VLSFO and LSMGO is good in Las Palmas, with lead times of 3–5 days recommended.

Bunker fuel availability in Barcelona has improved significantly compared to last week when the port faced a severe supply shortage for all three grades, especially HSFO. Lead times have now come down to 3-5 days for all three grades.

In Angola’s Luanda, VLSFO supply resumed on Wednesday, a source said. A bunker supplier temporarily halted offering the grade in August. LSMGO availability in Luanda is good. Both grades are currently supplied at anchorage by barge, a source said.

Brent

The front-month ICE Brent contract has increased by $0.77/bbl on the day, to trade at $76.16/bbl at 09.00 GMT.

Upward pressure:

Brent’s price surpassed $76/bbl as concerns over supply disruptions continued to put upward pressure on oil.

Oil traders are “hypersensitive” to any news that could push oil prices up, especially with brewing geopolitical tensions in the Middle East, SPI Asset Management’s managing partner Stephen Innes remarked.

He further explained, “For example, an Iran-backed drone recently came alarmingly close to [Israeli Prime Minister Benjamin Netanyahu] Netanyahu’s residence.” This news rattled market participants because any further escalation between Tehran and Israel could imply severe risks to the energy facilities in Iran.

“The see-saw battle over Middle East risk premium continues,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent’s price felt some downward pressure due to simmering demand growth concerns in the world’s largest oil consumer – the US.

Commercial crude oil inventories in the US increased by 5.5 million bbls to touch 426 million bbls on 18 October, according to data from the US Energy Information Administration (EIA).

A rise in US crude stocks indicates a decline in oil demand, which can put downward pressure on Brent’s price. “[Brent] crude oil fell after US inventories posted an unexpectedly high build,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Additionally, expectations of a ceasefire deal in the Middle East have capped some of Brent’s price gains this week. The recent killing of Hamas leader Yahya Sinwar has “opened new possibilities” for ending the conflict in Gaza, Hynes said.

“The market continues to be caught between supply risks related to ongoing Middle East tension and lingering demand concerns,” two analysts from ING Bank said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.