Americas Fuel Availability Outlook 3 Oct 2024

Dockworkers' strike at East and Gulf Coast ports

Low demand in Houston

Raizen starts bunker operations off Itaqui

PHOTO: Oil refinery in Texas City, Texas, located just south of Houston on Galveston Bay. Getty Images

PHOTO: Oil refinery in Texas City, Texas, located just south of Houston on Galveston Bay. Getty Images

North America

Dockworkers across the US East and Gulf Coasts ports launched their first major strike in nearly 50 years on Tuesday, raising concerns about potential supply chain disruptions.

While the strike action directly affects container and cargo operations, sources warned that bunkering services may also face indirect delays if barge movements are hindered.

“We haven’t seen an impact on port [fuel] reserves yet, but we’re anticipating disruption,” Stone Oil’s chief operating officer Anthony Odak told ENGINE. The company supplies bunker fuels at ports along the US Gulf Coast.

Prolonged congestion at the ports could also affect the availability of bunker fuel. Although oil and gas shipments are handled through separate operational facilities, disruptions in containerized cargo movements could tighten fuel oil supply chains.

Bunker demand has been very low in Houston for prompt dates. However, the availability of all fuel grades has remained good so far this week. Most suppliers can offer VLSFO and LSMGO stems with a lead time of 5-7 days in Houston.

Bunkering was proceeding normally in the Galveston Offshore Lightering Area (GOLA) on Thursday amid pleasant weather conditions. The weather is forecast to remain calm through the weekend and most of next week. Despite this, bunker demand in GOLA has been very low this week.

The Port of New Orleans, a key Gulf Coast hub for dry bulk commodities like grains, is also experiencing severe delays in loading and unloading ships. These delays are raising shipping costs and risking supply chain disruptions. Prolonged strikes could worsen congestion and further impact industries relying on these trade routes, shipping technology company Signal Ocean stated.

All grades are tight for prompt delivery dates in the West Coast ports of Long Beach and Los Angeles. Most suppliers require more than seven days of lead time to deliver VLSFO and LSMGO stems in both ports.

Bunker fuel availability has not been affected by the ongoing strike action in the East Coast port of New York. Most suppliers are still able to offer VLSFO and LSMGO stems within five days of lead time.

Caribbean and Latin America

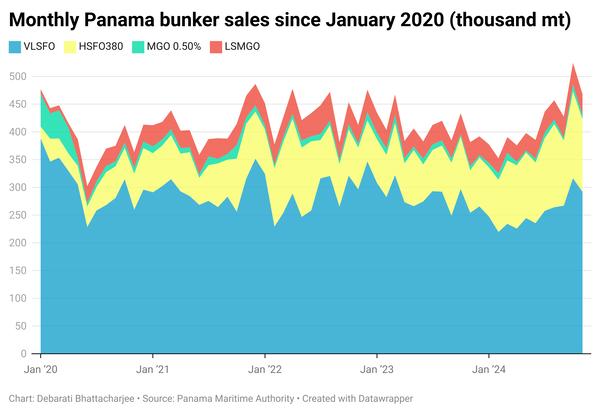

Bunker demand has been good in Panamanian ports amid more daily transits through the Panama Canal. Availability has also remained good for prompt dates in both Balboa and Cristobal.

Denmark's The Bunker Firm has launched new bunker operations in Cartagena, Columbia, supplying VLSFO and LSMGO.

VLSFO and LSMGO grades are readily available at Argentina’s Zona Comun anchorage. Demand has picked up this week for both the fuel grades.

Bunker fuel demand has been good in most Brazilian ports this week. VLSFO availability is good in most of the ports, according to most suppliers.

Brazilian energy company Raízen has also launched new bunker operations at Itaqui Outer Anchorage, supplying VLSFO and LSMGO.

By Debarati Bhattacharjee

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.