Europe & Africa Market Update 14 May 2024

Most regional bunker benchmarks have dipped in the past day, and bunkering has been suspended in Las Palmas' outer anchorage due to rough weather.

PHOTO: Ships docked in the Port of Las Palmas, Gran Canaria, Spain. Getty Images

PHOTO: Ships docked in the Port of Las Palmas, Gran Canaria, Spain. Getty Images

Changes on the day, to 09.00 GMT today:

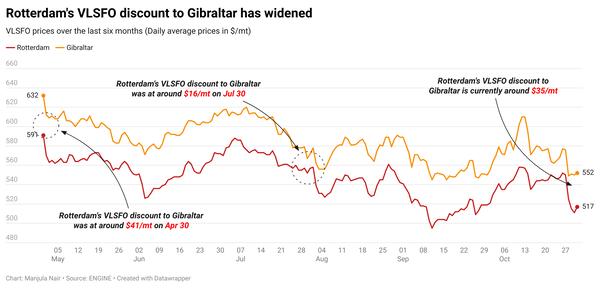

- VLSFO prices unchanged in Gibraltar, and down in Durban ($6/mt) and Rotterdam ($2/mt)

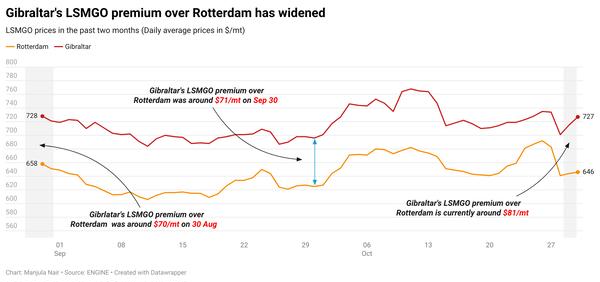

- LSMGO prices up in Durban ($5/mt), and down in Rotterdam ($5/mt) and Gibraltar ($1/mt)

- HSFO prices up in Gibraltar ($1/mt), and down in Rotterdam ($12/mt)

Rotterdam’s HSFO has dropped steeply to erase gains made in the previous day. In contrast, the port’s VLSFO price has dipped marginally. The price moves have widened the port’s Hi5 spread from $70/mt yesterday to $80/mt now.

Calm weather has brought down lead times in Gibraltar from 4-6 days noted last week to 2-4 days now. Availability is normal across all grades, and the port is currently not facing any congestion, a trader said.

There is no supply available at Las Palmas’ outer anchorage till Friday afternoon due to rough weather conditions, a trader claims. Suppliers are delivering stems at the port's more sheltered inner anchorage or alongside, the trader added. Availability is normal across all grades. Lead times for all grades have increased from 3-5 days advised last week to 4-6 days now.

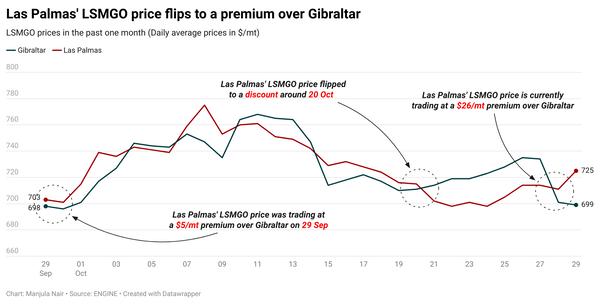

A higher-priced LSMGO stem fixed in Las Palmas for prompt delivery in the past day has raised the benchmark by $13/mt to $827/mt now. Las Palmas’ LSMGO premium over Gibraltar's has widened by $14/mt to $22/mt now.

Brent

The front-month ICE Brent contract moved $0.11/bbl up on the day, to trade at $83.21/bbl at 09.00 GMT.

Upward pressure:

Brent futures gained following China’s latest economic measure that boosted hopes about demand growth in the country.

The country announced that it will start selling the first batch of its 1 trillion yuan ($138 billion) ultra-long term special treasury bonds this week. Ultra-long term special bonds are bonds issued by a country with an exceptionally long maturity period of 10 years or more.

“This move [by China] is seen as a significant step in boosting economic activity and supporting infrastructure projects, which in turn could increase demand for oil,” SPI Asset Management’s managing partner Stephen Innes said.

Brent’s price also gained on hopes of a surge in travel activity in the US during the summer holiday season in the country.

“The combination of China's economic measures and the anticipated surge in US holiday travel is driving optimism in the oil markets,” Innes added.

Brent’s price found additional support after Iraq’s oil minister Hayyan Abdul Ghani reiterated that the OPEC member is fully committed to supply cut pledges made within the oil producers’ group.

“Crude oil edged higher on signs of tightening supplies,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent futures felt some downward pressure as interest rates in the US remain at elevated levels amid strong inflationary pressures.

The US Federal Reserve’s (Fed) monetary policy measures have not been sufficient to bring inflation under the central bank's target of 2%, Dallas Fed President Lorie Logan said while speaking at the Louisiana Bankers Association conference last week.

The oil market’s focus will be on the US Consumer Price Index (CPI) number due tomorrow as it will “shed more light on the path the US Federal Reserve may take in the months ahead,” two analysts from ING Bank said.

“US CPI data for April will probably be the biggest driver for oil markets,” they added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.