Europe & Africa Market Update 31 Oct 2024

Bunker benchmarks in European and African ports have gained with Brent, and Gibraltar is experiencing adverse weather conditions today.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($12/mt), Rotterdam ($9/mt) and Gibraltar ($3/mt)

- LSMGO prices up in Rotterdam ($8/mt) and Gibraltar ($5/mt)

- HSFO prices up in Rotterdam ($9/mt) and Gibraltar ($3/mt)

- Rotterdam B30-VLSFO at a $191/mt premium over VLSFO

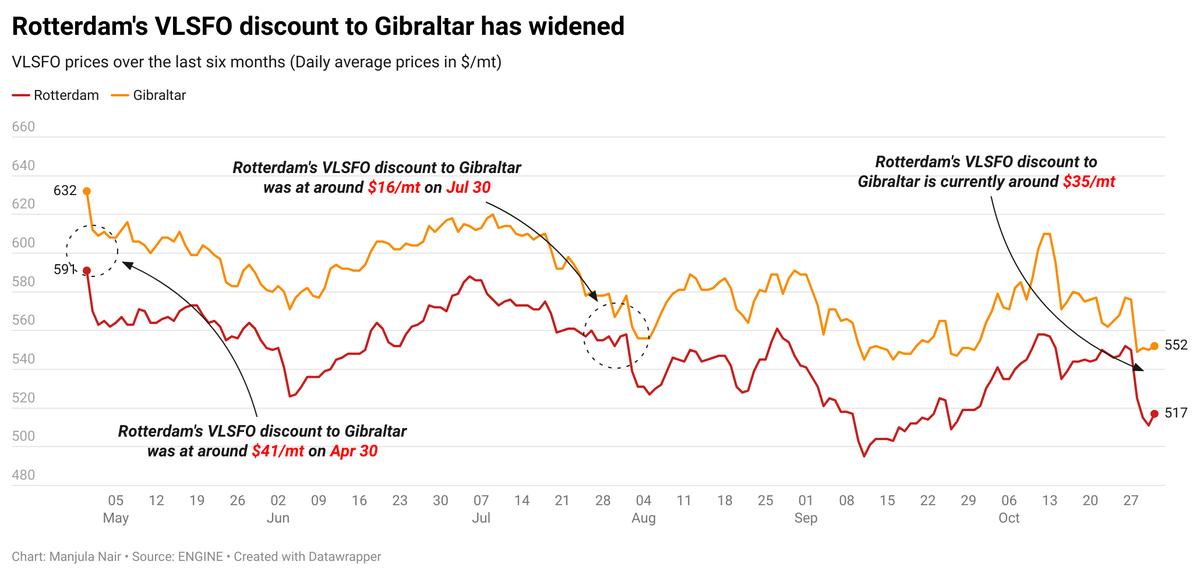

Rotterdam's VLSFO price gain has outpaced Gibraltar's in the past day. This has narrowed Rotterdam's VLSFO discount to Gibraltar to around $35/mt now.

The Gibraltar Port Authority has issued a heavy rain and thunderstorm warning today. Adverse weather in the port may cause bunkering delays and stretch lead times, a trader told ENGINE. The thunderstorm warning is in effect until 23.59 CET (22.59 GMT) today. Bunker availability is normal in Gibraltar, with prompt delivery dates available across all three bunker grades. Lead times of 3–5 days are advised, a trader said.

Across the strait, Ceuta is experiencing cloudy weather today, but bunkering is proceeding normally. A supplier is delayed by around five hours in the anchorage area today, said shipping agent Jose Salama & Co. Eight vessels are due to arrive for bunkers in Ceuta today, down from nine yesterday, the shipping agent added.

Brent

The front-month ICE Brent contract has gained $0.91/bbl on the day, to trade at $72.65/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price moved higher after the US Energy Information Administration (EIA) reported a draw in US crude stocks. Commercial crude oil inventories in the country dropped by 515,000 bbls to touch 426 million bbls for the week ending 25 October, the EIA reported.

A drop in US crude stocks indicates growth in oil demand, which can put upward pressure on Brent’s price. Sentiment in the crude oil market was supported by an “expected drawdown in US inventories,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

On the supply front, attention is likely to shift back to OPEC, which is scheduled to gradually unwind output cuts from December. Brent could get a boost as oil market analysts expect the Saudi Arabia-led group to maintain crude oil production levels and put a floor under oil.

“The focus remains on the OPEC+ production numbers and outlook and the group’s response to recent price weakness,” two analysts from ING Bank said.

Downward pressure:

Brent gains have been capped marginally amid ongoing negotiations over a ceasefire deal for the Gaza Strip. Israeli Prime Minister Benjamin Netanyahu has revealed plans to resolve the conflict in Lebanon, according to media reports.

“The plan, if agreed, would lead to a 60-day suspension of [Israel-Lebanon] hostilities while mediators craft a lasting peace deal to remove Hezbollah from the border region and bolster US peacekeepers there,” Hynes said.

Meanwhile, the market has regained confidence from Iran’s delayed response to Israel’s latest round of airstrikes. The news has eased some supply-related concerns and put downward pressure on Brent.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.