Europe & Africa Market Update 13 May 2024

Bunker benchmarks in most European and African ports have gained over the weekend, and availability of all bunker grades is normal in Gibraltar.

PHOTO: Antwerp is one of Europe's biggest ports. Port of Antwerp

PHOTO: Antwerp is one of Europe's biggest ports. Port of Antwerp

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO prices up Durban ($8/mt) and Gibraltar ($4/mt), and down in Rotterdam ($1/mt)

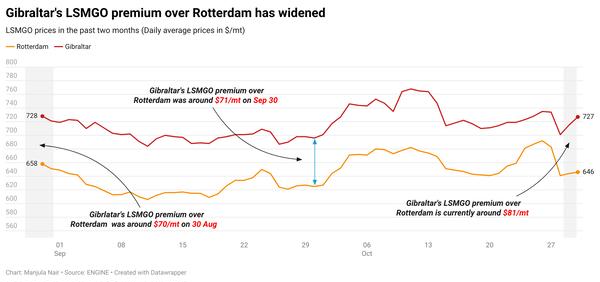

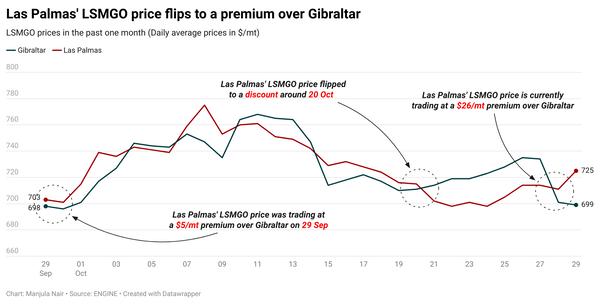

- LSMGO prices up in Durban ($26/mt), Rotterdam ($2/mt) and Gibraltar ($1/mt)

- HSFO prices up in Rotterdam ($17/mt) and Gibraltar ($2/mt)

Rotterdam’s HSFO price has gained steeply over the weekend, outpacing Gibraltar’s moderate price rise. The price moves have narrowed Rotterdam’s HSFO discount to Gibraltar's by $15/mt to $42/mt now.

Unlike its HSFO price, the port’s VLSFO price has moved counter to the wider market direction and dipped slightly over the weekend. The price movements have narrowed Rotterdam’s Hi5 spread from $88/mt on Friday to $70/mt now. Availability of HSFO and VLSFO is normal in Rotterdam and the wider ARA hub. Traders recommend lead times of 3-5 days for HSFO and 4-5 days for VLSFO.

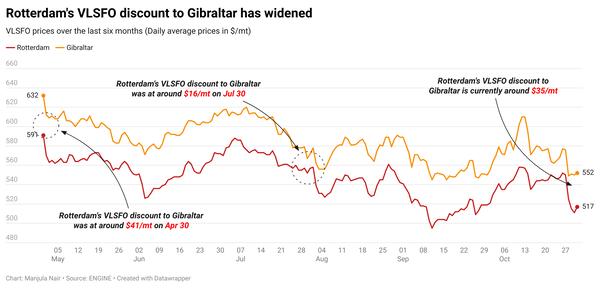

Several stems were booked in Gibraltar over the weekend. Of these, a higher-priced VLSFO stem fixed on Saturday in Gibraltar for prompt delivery has pushed the benchmark higher. This has widened Gibraltar’s VLSFO premium over Rotterdam's VLSFO by $5/mt to $41/mt now. Availability is normal for all three bunker fuel grades in the port, with lead times of 3-5 days advised.

Rough weather could disrupt bunkering in the Gibraltar Strait ports tomorrow amid a forecast of wind gusts of 22 knots. Two vessels are waiting for bunkers in Gibraltar today, down from three on Friday, according to a source.

Brent

The front-month ICE Brent contract lost $1.07/bbl on the day from Friday, to trade at $83.10/bbl at 09.00 GMT.

Upward pressure:

Brent futures found some support as geopolitical tensions in the Middle East remained elevated over the weekend. Hopes of a ceasefire agreement between Israel and Hamas have diminished as Israel continued its ground attack in Gaza over the past two days.

“Israel continued to move more Palestinians out of Rafah while expanding its assault on the densely populated city in southern Gaza through the weekend,” VANDA Insights’ founder and analyst Vandana Hari said.

Brent’s prices gained after Iraq’s oil minister Hayan Abdul Ghani reaffirmed on Sunday the country’s commitment to voluntary oil production cuts agreed within the OPEC+ group of oil producers, Reuters reported.

“Expectations of further constraints on OPEC output were also [price] supportive,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

The group is due to meet in June to discuss supply policies for the rest of this year.

Downward pressure:

Brent’s price dipped after remarks from the US Federal Reserve's (Fed) officials diminished hopes of interest rate cuts anytime soon this year.

Speaking at the Louisiana Bankers Association conference, Dallas Fed President Lorie Logan said upside risks to inflation in the US remains high, Reuters reported.

She further emphasised on uncertainty whether current monetary policy measures are sufficient to steer inflation towards the central bank's target of 2%.

"Oil markets shrugged off the impact of the Middle East conflicts and shifted attention to the world economic outlook again," New Zealand-based market analyst Tina Teng said.

The impact of higher-for-longer interest rates in the US includes a decline in oil demand, as it increases cost of dollar-denominated commodities like oil.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.