Zhoushan as a new Far East bunker hub

May 14, 2020

For decades Singapore has been the gateway to Asia, a major hub offering bunkering as well as other various shipping services. There have been a number of attempts to rival it, particularly when it comes to bunkering, however bunker sales in Singapore remain strong, at around 50 million tons per annum out of the global total of 300 million tons.

Recently, however, certain developments in China and particularly around Zhoushan mean, while unlikely to fully rival Singapore, it may become an attractive bunkering alternative for some.

China as an importer of fuel oil

For a long time China imported fuel oil to help meet its domestic consumption, including bunker sales and as a feed for the secondary refinery units. The consumption as well as the sales tax were applicable on all bunker sales, and given that the majority of fuel oil was imported from Singapore, this was evident in the premium at which bunker fuel was priced in China.

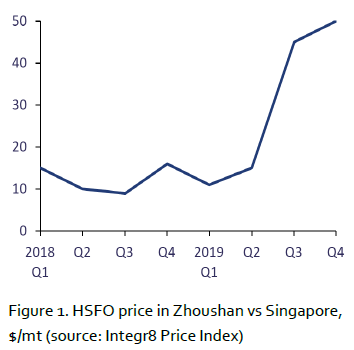

Figure 1 shows the Zhoushan HSFO price premium to Singapore. Zhoushan has the share of around 30% of all bunker deliveries in China.

For the most of 2018 the premium held at around $10-15/mt, widening significantly in 2019 due to a number of factors.

However, this is now changing as the Chinese government has a vision of creating a bunkering and a service hub in the port of Zhoushan.

Certain steps towards achieving this goal have already been made and the market has reacted accordingly.

Creating a bunker and service hub

In an attempt to promote Zhoushan as a bunker and service hub, a free trade zone was established in 2017. This helped reduce the customs clearance time to avoid delays in supplying vessels.

Further to this in July 2018, a country-wide tax incentive was introduced for marine fuel blending using imported feedstocks. Zhoushan benefited the most as, unlike many other Chinese ports, it boasts substantial storage and blending capacity and there is more under construction. Access to storage was one of the key factors which enabled Singapore to develop as a large bunkering hub.

This, however, was still not enough to encourage Chinese refiners and blenders, who had the capacity but no favourable regulatory framework, to produce more marine fuel to cover domestic and potentially foreign demand.

In February 2020 tax rebates started to apply in China for the sale of marine fuels, increasing the regional competitiveness of domestically produced fuels. Major Chinese refiners announced plans to ramp up VLSFO production amounting to over 20 million tons of VLSFO production in 2020, in line with the annual Chinese domestic and bonded bunker demand.

Zhoushan is increasingly becoming the key port for bunker-only calls in China, where they plan to sell 7 million tons of bonded fuel via 11 suppliers in 2020, up from 3.6 million tons in 2018. Such an increase brings Zhoushan closer to Rotterdam and Fujairah by volume.

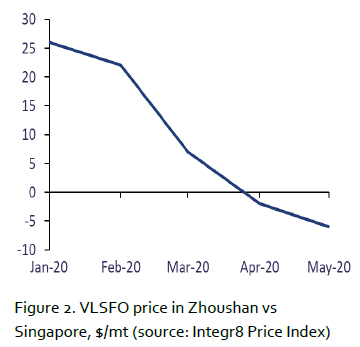

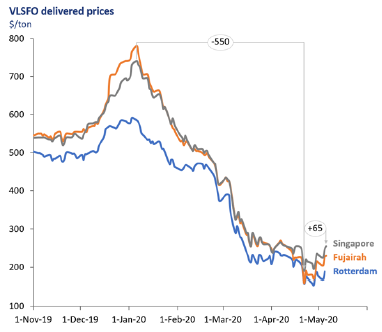

These developments pushed the price of VLSFO in Zhoushan lower (Figure 2), raising its competitiveness against other regional ports, including Singapore.

With the introduction of tax rebates and increased local production, average monthly VLSFO prices in Zhoushan moved from over $20/mt above Singapore early this year to a discount more recently. This trend is likely to continue as 10 million tons of VLSFO quotas for bonded sales have just been released; an extra 5 million tons may be issued later this year, potentially replacing imports.

Zhoushan bunker sales growing

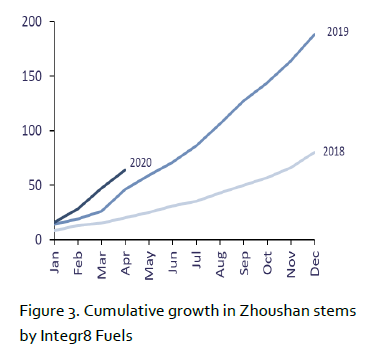

There is already a solid base for the increased Chinese VLSFO production and sales from Zhoushan, supporting the government intention to create a vessel service hub. This is already visible as bunker enquiries and sales are up.

As an example, Figure 3 shows the cumulative growth in the number of stems Integr8 Fuels concluded in Zhoushan.

The Zhoushan growth has also been due to the favourable calling fee policies. With two bunker anchorages, inner and outer, the outer anchorage is free of fees, which makes it similar to Singapore OPL. The inner anchorage charges half of the pilotage fee for bunker-only calls and none if the outer anchorage is unavailable due to bad weather, although other taxes may still apply.

It is understood that the first foreign-flagged vessel was supplied with VLSFO at the Zhoushan outer anchorage in mid-December and many more vessels have followed since.

All these developments increase the attractiveness of Zhoushan as a bunker and vessel services port. There have already been reports of vessels, previously used to bunker elsewhere, deviating to Zhoushan due to the growing price difference. More calls at Zhoushan will help recognise it as a reliable bunker and supply option in the maritime community.

Important decisions and steps have already been made towards reaching the China’s goal of being self-sufficient in bunker fuel production and supply and developing Zhoushan as a key bunkering and service location in the Far East.

Anton Shamray

Senior Research Analyst

P: +44 207 4675 856

E: anton.s@integr8fuels.com

We are off recent price lows, but that doesn’t mean we are in a continually rising market

May 11, 2020

Just over a month ago we put out a note on the collapse in oil prices and the pressures in the market from the significant loss in global oil demand because of ‘lockdowns’ against Covid-19.

Overview

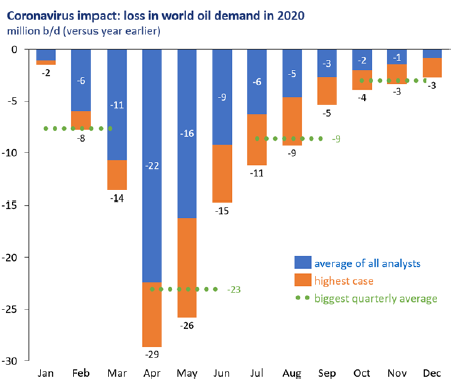

Since then, estimates of demand losses have been even greater, and oil prices took another tumble at end April (only a couple of weeks ago). At the time of the last note the biggest estimates of demand loss were around 20 million b/d for April, more recent estimates are closer to 30 million b/d.

Over the past 2 weeks prices have moved off their lows and general sentiment now seems to be a bit more optimistic. OPEC+ did come to a ‘necessary’ agreement and formally settled on a 9.7 million b/d cut in production starting this month.

However, physical oil prices still remain in very steep contango and have hit such lows there will also be significant production losses from counties outside this agreement. The key focus here will be the US, with the high-profile shale production heavily exposed. US rig counts and spending are down massively, and the net result will be a reduction in output; the question is how much, with different analysts predicting anything between 1.5-3.0 million b/d losses.

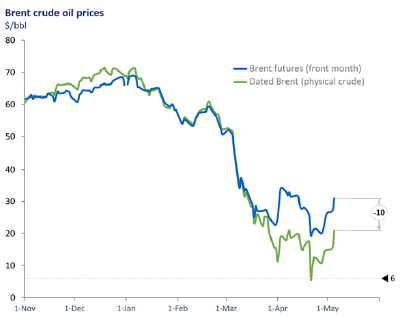

So, we are now entering the next phase in developments, with production coming down and at the same time countries coming out, or planning to come out of lock down; most visibly in growing pressures within the US to ‘open up’. These are clearly more bullish signals than we have seen, and Brent front month futures prices are around $10/bbl above their lows (from $20 to $30).

These price moves have been mirrored in the bunker market, with VLSFO down by more than $500/ton since the start of the year, but up around $65/ton in the past couple of weeks (in-line with a $10/bbl rise in crude prices).

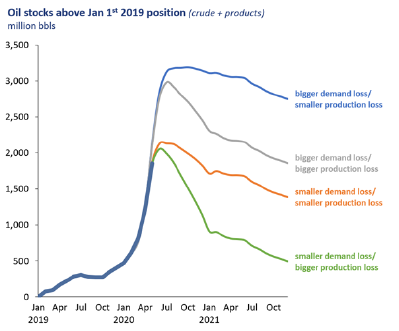

Despite this, it is still far too early to say we are on a definite upwards trend. Oil stocks are still increasing, and this is expected to continue for at least another 1-2 months. The cuts in crude oil production are chasing the losses in oil demand, but are still not big enough to bal-ance the market today and we still have more surplus oil to come. Averaging a number of analysts’ expec-tations, they indicate oil demand was down by around 22 million b/d in April, but the highest ana-lysts were around a 29 mil-lion b/d loss.

All analysts expect the losses to diminish over the year, but the pace varies; the blue columns in the graph represent an average view of monthly losses in demand versus year earlier and the incremental orange columns show the biggest estimated demand losses. Either way, the losses in April/May are bigger than any anticipated production cuts and it is only from around June/July that we are likely to see stock levels start to fall, and then from exceptionally high levels. Consequently, the price contango in the oil market may have eased slightly over the past 10 days, but it is still far bigger than we have seen historically, with physical Brent crude still at extreme levels of $10/bbl below the front month futures price. Both the absolute price and the price contango are key features we must focus on .

It is the extent of the demand loss and then how quickly demand returns, plus how big the production cuts actually are, including OPEC+ adherence and the ‘economic shut-ins’ (not only in the US, but Canada, Norway, Brazil and elsewhere). In addition, market sentiment and expectations will also play a significant role in determining the timing and extent of price recovery.

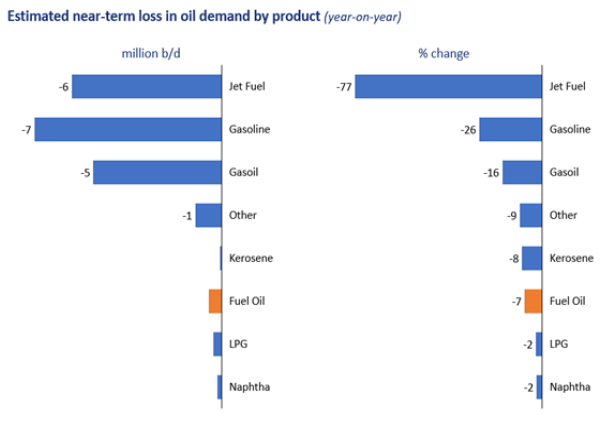

The speed at which we come out of this demand shock is still a big uncertainty. The main impacts on demand have clearly been in the jet fuel, gasoline and diesel/gas oil markets (not so much in fuel oil). Expectations are that gasoline demand will start to recover first, then diesel/gas oil and finally jet, but this may be some way down the line. In terms of OPEC+ production cuts, analysts using AIS ship tracking can get a very good and immediate handle on exports, which will go a long way to identifying adherence.

Finally, one of the more visible and used signs in the market are oil stock levels (crude and products), and although official figures for most countries are too long after the event to cause a price response, in the US there are the API and then the EIA both publishing weekly data. Significantly, these figures are still building, and price moves often reflect whether the gains are bigger or smaller than expectations. Hence oil prices are currently stuttering either side of $30/bbl for front month Brent, with gains in stock levels either bigger or smaller than predicted.

The graph below illustrates four cases to look out to see which track we are likely to be on, ranging from an extended period through 2020, 2021 and into 2022 if the demand losses are ‘bigger’ and the production responses more muted.

At the other end of the spectrum, if demand losses are smaller (this is still around 20 million b/d in April!) and the production impact in the likes of the US is severe, then we could be in a rapid tightening in oil markets and a rapid return to higher prices over the course of the second half of this year. The truth is we are more likely to be some-where between these two extremes, and the current Brent forward curve (which is not a forecast) is tracking closer to the orange line, at around $33/bbl at end 2020 and $38/bbl at end 2021. This would imply VLSFO prices below $300/ton for the next 12 months.

However, as more data, analysis and insights emerge we will have a greater idea of what track we are really on and how long low oil prices are likely to be with us. One thing is that in all cases oil stocks remain well above recent levels at least through to end 2021. Keep watching the stocks numbers, the price and price contango, OPEC+ and US production and finally the true pattern of oil demand.

Steve Christy Strategic Communications Director

P: +44 207 4675 860

E: Steve.C@integr8fuels.com

Can bunkering outside hubs yield better pricing?

April 28, 2020

The short answer is yes, but not always. Continuous price monitoring is key to identifying price dislocations between different ports.

Overview

The world is currently going through a very turbulent time with oil prices recently falling to the multi-decade lows. Bunker fuel expenses, once being the dominant part of the voyage costs, have for now become somewhat less important, particularly in the tanker market, where freight rates skyrocketed and avoiding delays has taken priority.

However, this low bunker price environment and/or high tanker rates are temporary and once the situation goes back to ‘normal’, more attention will again be paid to reducing the bunker bill to increase voyage earnings.

There are a number of ways that can help and one of these is to be open-minded about the bunkering location, which at times may mean refuelling outside of the major hubs if prices dictate so.

Bunker-only calls no longer a feature of hub ports

The bunker market has transformed extensively in the past couple of decades. From a limited number of bunker-only ports (mostly hubs), many more are now open for bunker-only calls.

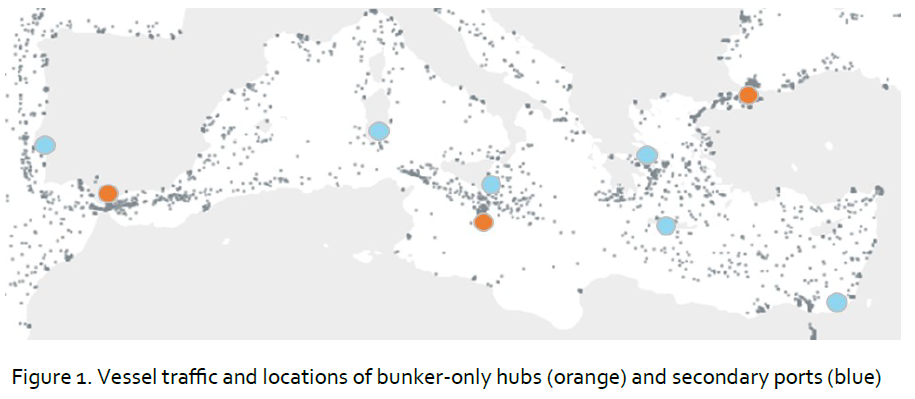

As an example, Figure 1 shows both the hubs and the secondary bunker-only locations in the Mediterranean together with vessel traffic.

As can be seen, in addition to the main hubs bunkers can now be picked up in some smaller ports like Lisbon, Sarroch, Augusta, Piraeus as well as Kali Limenes and off-shore in the South Eastern part of the Mediterranean, pricing for which can be obtained on enquiry. Therefore, it is important to monitor prices not only in the hub ports but also in the smaller locations.

The price, of course, is not the only factor to consider. Quality, availability, weather and other delays together with calling costs can influence the bunker location choice. However, with these factors often being equal or near equal, the port and supplier offering the best price usually gets the stem.

Cheapest price not only in hubs

While bunker hubs often mean a higher number of suppliers, better availability and pricing, this is not always the case, particularly following the transition to VLSFO as the main compliant fuel.

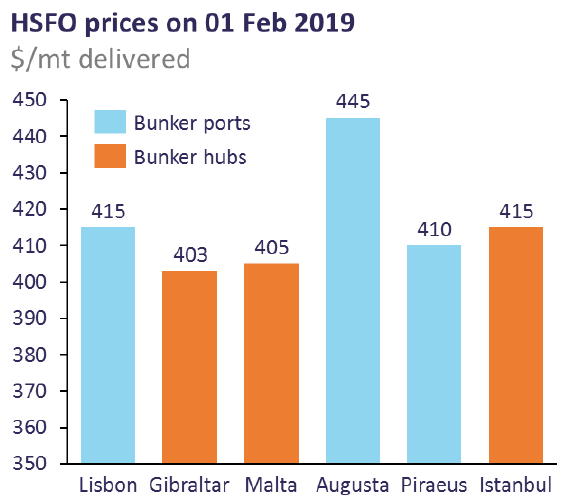

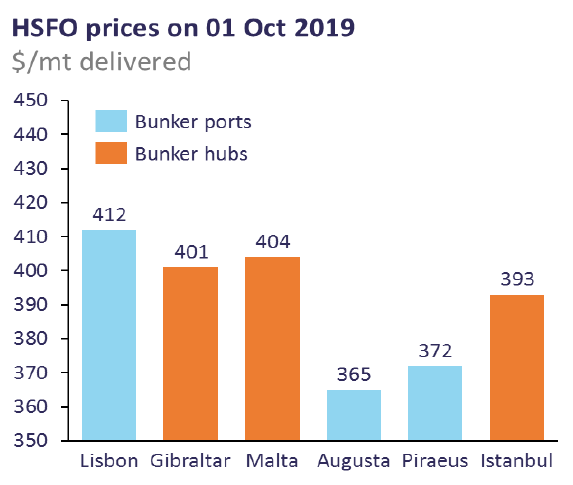

The chart above shows an example of what the ‘normal’ bunker pricing would look like. Just over a year ago, in February 2019, a buyer or an operator of a vessel needing bunkers passing through the Mediterranean would habitually enquire in Gibraltar or Malta and typically get the best price compared with the alternatives.

Then the market started changing prior to the IMO2020 transition so the usual pricing relationships between ports were broken. HSFO in some hubs started to sell at hefty premiums to the secondary ports. The bottom chart on Figure 2 shows the $40/mt premium Malta attracted over neighbouring Augusta in early October 2019, potentially resulting in a $20,000 overpayment on a 500mt stem.

From 01 January 2020, with the market fully transitioning to VLSFO as the main compliant fuel, price distortions spiked. For a period of time and due to the very limited availability, Singapore VLSFO was pricing way above anywhere in the region and even above LSMGO. While the bunker market has largely settled, certain pricing dislocations have remained.

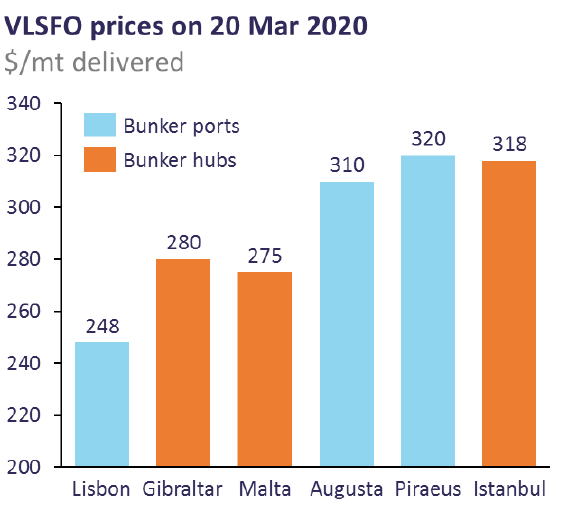

Figure 3 shows a couple of recent VLSFO price dislocation cases and the emergence of Lisbon as a viable and often well-priced alternative, which has so far in April on average traded at a $20/mt discount to Gibraltar.

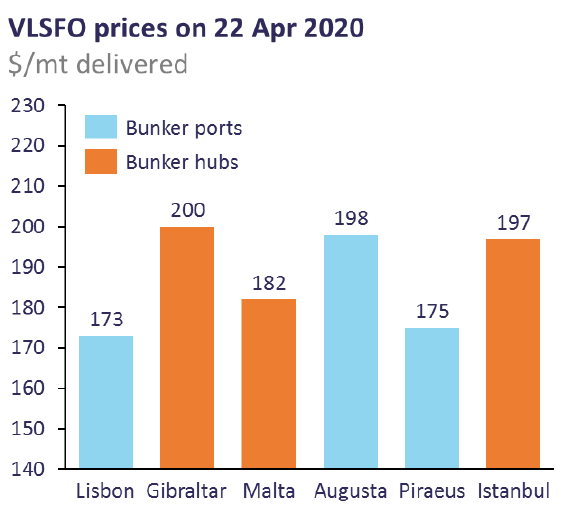

Excluding Lisbon, on 20 March 2020 it was ‘business as usual’ with both Gibraltar and Malta priced at a discount to other ports. However just over a month on, VLSFO prices dropped across the board following the drop in oil prices, although VLSFO in Gibraltar remained relatively strong.

It is estimated that booking a 500mt stem in Gibraltar vs Malta or Lisbon on 22 Apr 2020 would have resulted in at least $10,000 in overpayment. Besides this, Piraeus would have also become a viable option for vessels sailing from the North East of the Mediterranean.

Overall, it is worth noting that bunker prices fluctuate on a daily basis and bunker ports (including hubs) may frequently move from ‘expensive’ to ‘cheap’. Such price movements as well as delays, fuel quality, and changes in port call costs should be closely monitored in order to select the most optimal bunker port, achieve bunker bill savings and increase voyage revenues.

Anton Shamray

Senior Research Analyst

P: +44 207 4675 856

E: anton.s@integr8fuels.com

Advance bunker planning an answer to tighter HSFO availability

April 6, 2020

In the run-up to IMO2020 doubts existed whether there would be enough VLSFO available to meet demand, while HSFO was thought to remain in abundance. The reality however is very different, with the corona virus putting a cap on bunker demand, the growing oversupply of VLSFO and a relative HSFO tightness and availability concerns have become the new reality.

As the scrubber fleet continued to grow, reports of HSFO non-availability started to appear. With certain regions and ports currently not offering HSFO, owners and operators of scrubber tonnage may experience difficulty procuring HSFO and need to shift to more advance bunker planning.

Scrubber vessels, HSFO supply and demand

In the main shipping sectors, including tanker, bulk, gas, container and cruise, the share of scrubber vessels is relatively low by number, at 4%, and slightly higher by deadweight, at 10% – meaning fewer stems but larger volumes per stem. Due to this, many suppliers prefer not to stock HSFO for now.

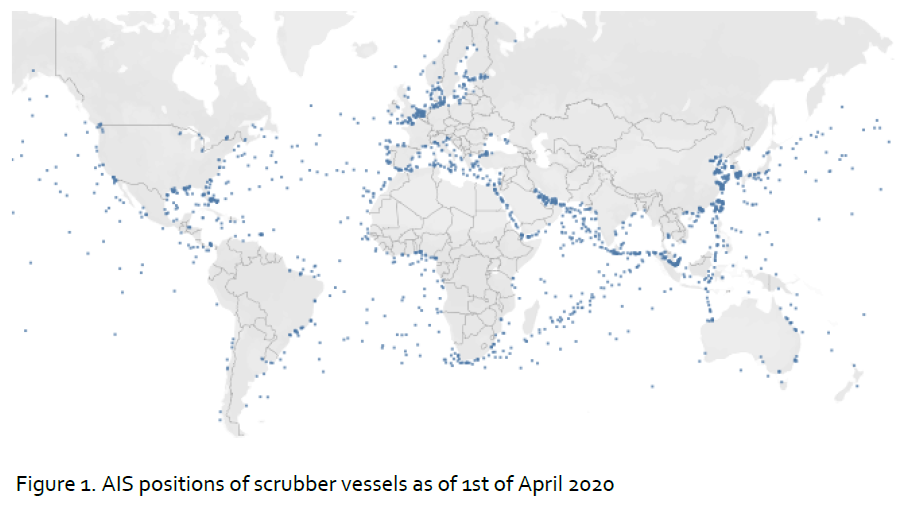

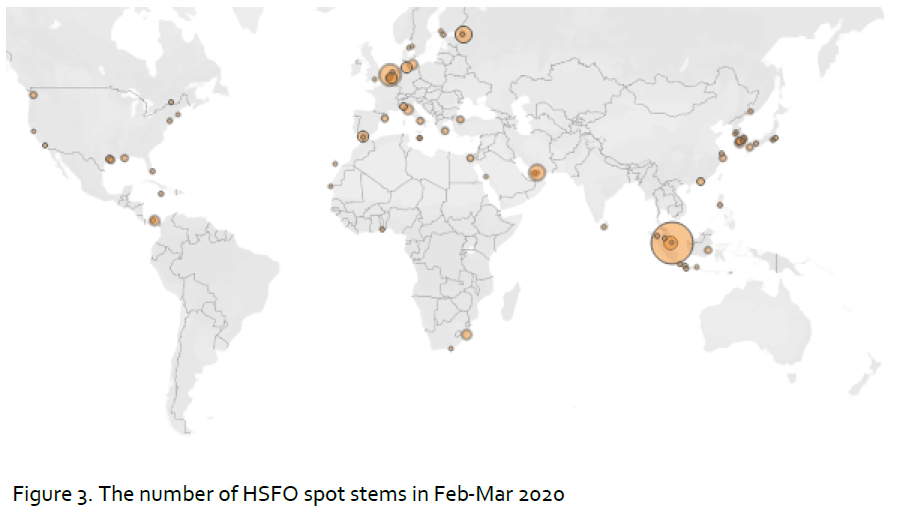

However, as seen on Figure 1 scrubber vessel operations are spread globally and, while a share of HSFO demand is linked to term contracts, the majority of scrubber vessels procure bunker fuel on the spot market.

The mismatch between the global operation of the scrubber fleet and the

ports with HSFO supply has created difficulties for the owners and operators of scrubber tonnage when it comes to HSFO procurement.

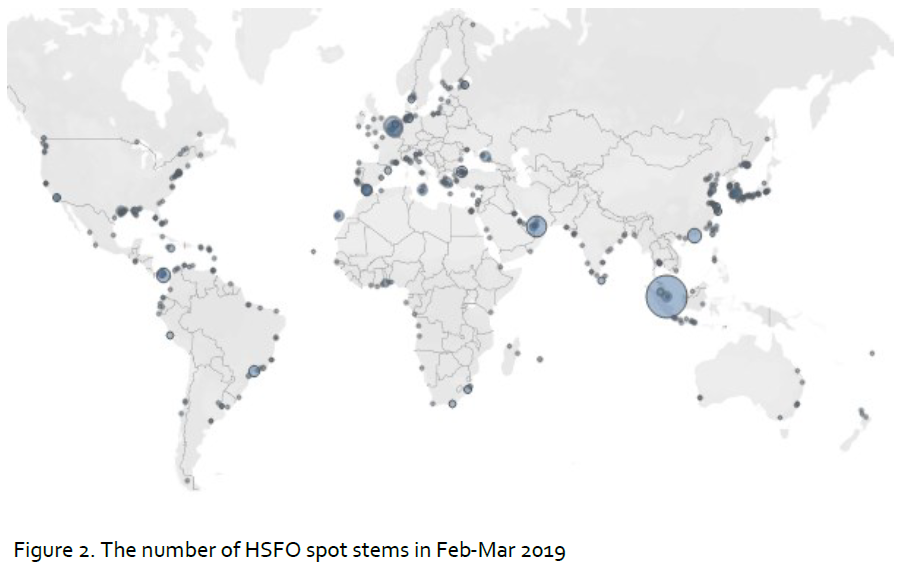

Figure 2 shows the global number of HSFO spot stems in Feb-Mar 2019, which cover most ports, hubs and regions.

Looking at the past couple of months (Figure 3), the picture is very different

with South America, West Africa, Black Sea, India, Australia and New Zealand are among the regions with little or no HSFO availability.

Even with HSFO available in major hubs, the number of suppliers have

decreased sharply. In some locations out of many suppliers present, only one or two carry HSFO stock and delivery slots can often get booked quickly.

At the moment, one half of the scrubber orderbook has been installed. Assuming most of the remaining orderbook is put into service (and currently it is hard to see many new orders placed), it will likely still not be enough to change the position of HSFO in the global bunker market so the expectation is for continuing difficulties with sourcing HSFO, at least in the near future.

Therefore, owners and operators of the scrubber fitted tonnage should plan

HSFO bunkering well in advance where possible and we recommend the following based on the recent HSFO buying experience:

• Availability and competitive pricing are more likely for enquiries with

lead times of 7 or more days

• Enquiring for HSFO not only in hubs but also smaller ports, which could

at times be more competitive on pricing and have better availability

• As the VLSFO/HSFO delivered spread has narrowed and on certain

occasions gone close to single digit figures, it is worth checking both VLSFO and HSFO prices adjusting for the difference in calorific value and

additional scrubber consumption when deciding which grade to buy.

Overall, current HSFO availability and pricing have clearly proved many

forecasts wrong. In this situation owners and operators of scrubber tonnage

can clearly benefit from more advance planning and access to transparent pricing and availability information.

Anton Shamray

Senior Research Analyst

P: +207 4675 856

E: Anton.s@integr8fuels.com

Where are we and do we know where we are going?

April 1, 2020

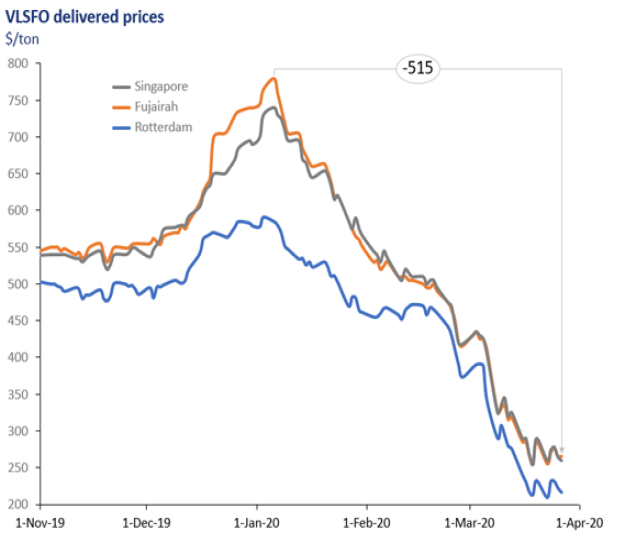

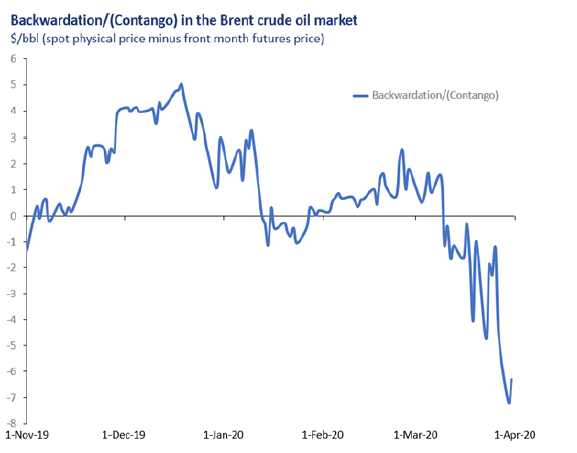

There is a little more clarity in oil market pricing, but still huge uncertainty on where things are going. It was just a few weeks ago when news of the coronavirus started to hit and OPEC put forward a proposal to cut production by around 1.5 million b/d, but only if there was the support of the OPEC+ group (principally Russia). The agreement didn’t happen, Saudi opened the taps and oil prices collapsed. With hindsight the proposed 1.5 million b/d cut was ‘a drop in the ocean’, with analysts now indicating that global oil demand could be an unprecedented 20 million b/d lower in April 2020 than in April 2019, and also some 4-6 million b/d down for this year as a whole. So, near-term oil supply is up by around 2-3 million b/d and demand down by around 15-20 million b/d. Markets tend to tell you almost everything and we have seen a near 70% collapse in crude prices since the start of the year to hit 18-year lows. At the same time the crude market has switched from backwardation to steep contango, bringing storage into play.

So, what about bunker prices. We are no different in terms of being driven by absolute prices in the oil market and VLSFO in Singapore and Fujairah is around $500/ton lower than at the start of the year (minus 66%). Prices in Rotterdam are below those in Singapore and Fujairah and so the absolute drop has not been as great, at around $370/ton, but in percentage terms it is more-or-less the same at 63% lower.

Understandably, there have been even greater pressures in the jet and gasoline markets, where demand destruction is at extreme levels. It has been well documented on how airlines are suffering, and this is clearly seen by the demand for jet fuel, which is down by a massive 77%.

In volume terms, the loss in gasoline demand is even greater than jet, but with the gasoline market almost four times bigger, the percentage drop is around 26%; still hugely significant. The demand impact in the bunker market has been relatively limited, with fuel oil consumption down by an estimated 7%.

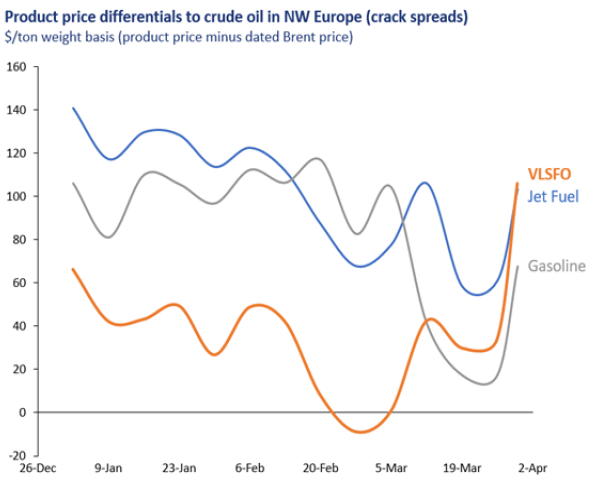

The collapse in oil prices is clearly the headline news, but relationships across the barrel have altered significantly. Before this happened, on a weight basis in NW Europe, jet fuel was around $120-140/ton above Brent, gasoline $90-110/ton and VLSFO $30-50/ton higher than Brent. The loss of jet and gasoline demand meant the crack spreads for these products have tended to fall further than other products.

However, over the past couple of days we have seen physical crude oil prices fall even further and faster than products and, as shown in the graph, crack spreads have widened. At the same time the relative price of VLSFO has risen and is now priced similar to jet and above gasoline.

For refiners the question is not about absolute prices, but the difference between crude and product prices and what this means for their refinery margins. In such a violent market there are always leads and lags that affect the margin on a day-to-day basis, but the current downwards pressures on physical crude oil prices are so extreme, and on paper margins have soared. However, the reality out there will be very different for different refiners and for those with positive margins they will continue to process, whether the demand is there or not. We are in a vicious cycle; there is too much crude and to generate buyers it has to be sold (or stored) at a profit.

There are already stories of some refiners severely cutting runs. Some of the most vulnerable are likely to be land-locked, without endless storage or the ability clear products. For the rest it will be different for different refiners, depending on the type, infrastructure and connectivity of the refinery. But if refinery margins stay positive and storage economics work and there is somewhere to put the products, then those refiners that can will continue to run; we will just see huge builds in products stocks.

The consequence of the hike in oil supply and the downfall in demand is these massive builds in oil stocks. This is yet to show in weekly stocks reports, but it is coming, and the oil price structure already reflects

this.

Backwardation has been replaced by steep contango in the crude market, and for Brent the difference between physical and front month futures prices is now $7/bbl, with the contango running at around $17/bbl over the next 6 months This means storage economics are now very favourable (traders will still make money storing crude on a VLCC and paying $140,000/day for it). It is just that supply goes into storage rather than into consumption.

Clearly the longer we go down this road, the bigger the stock-build will be and so take longer to unwind. So how do things change? We either see a sharp rebound in demand or a major cutback in supply, or a combination of both. On the demand side, current expectations (which can obviously change) are that things will ease from May onwards, but that demand will still be well below 2019 levels for most of this year, plus there is also the issue of recession; so no quick fix here. This then points to any potential cutback in supply, which in the near/medium term would seem to need Russia to come back to the table and approve an OPEC+ agreement. If this is the case, then the cutback will have to be much bigger than the 1.5 million b/d proposed last time round. Global politics may yet come up with something else, but what we don’t know. Alternatively, could we see the industrial collapse of oil production at a field, company or even country level? Without any of these, stocks will continue to build, oil prices are going to remain low and could fall even further.

At the time of writing President Trump indicated that Saudi Arabia and Russia will announce an agreement to cut production by 10 million b/d (or more), to which the price responded positively and then fell back a bit; we just have to see if such an agreement is formally announced and adhered to. If not, then global politics may yet come up with something else, but what we don’t know. Without any of these, oil stocks will continue to build, oil prices are going to remain low and could fall even further. Then it may be the fall in oil supply will come from the industrial collapse of oil production at a field, company or even country level. The pressure is clearly on an agreement to cut production in the near term; let’s see what happens.

Steve Christy

Strategic Communications Director

P: +44 207 4675 860

E: Steve.C@integr8fuels.com

VLSFO pricing conditions for less distillate blending and higher viscosity

March 30, 2020

The recent drop in VLSFO viscosity has been a talked about topic. It is the result of more distillate making its way into the VLSFO blending pool. Having analysed over 15,000 VLSFO test results, viscosity was found to have dropped by over 35% between November 2019 and March 2020, from 160cst to 100cst.

Lower VLSFO viscosity has been linked with a number of potential issues, from purification difficulties to stability and ignition problems. This is particularly applicable to the <30cst viscosity product, whose has been growing.

The reason for more distillate going into the VLSFO blending pool is pricing, where at times VLSFO was sold at a premium to MGO — a phenomenon few could envisage prior to the IMO 2020 switch.

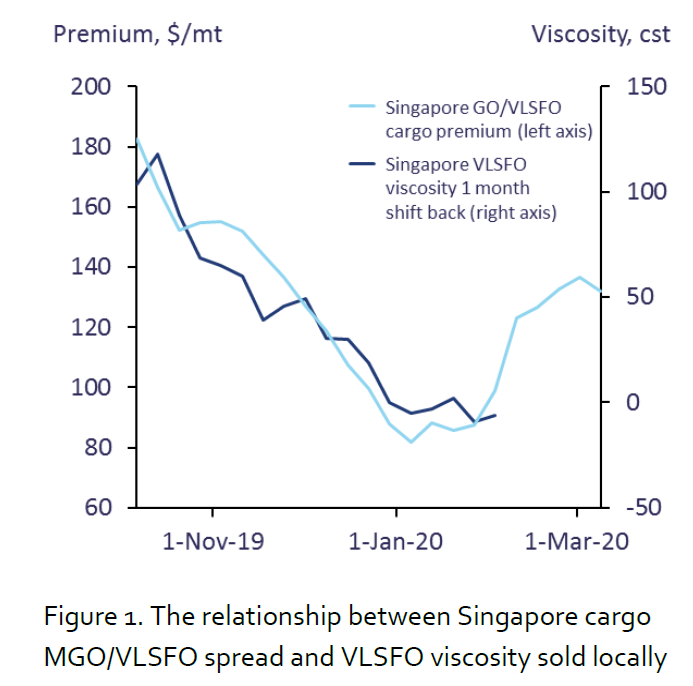

Using Singapore as an example, Figure 1 shows how the cargo pricing spread between VLSFO and MGO affected the viscosity levels of VLSFO sold locally.

The line for viscosity has been shifted one month back as in reality there is always a similar lag between the pricing reaction and the fuels being produced, making it to the bunker market and getting tested before put to use.

It is clearly seen that both viscosity and the pricing spread movements are very similar. In recent weeks the MGO premium to VLSFO cargo in Singapore flipped from negative back to the more expected positive and this is likely to put a cap on the amount of distillate going into VLSFO blending.

The expectation is that more non-distillate blending components will start being blended to produce VLSFO pushing viscosity higher and potentially resulting in a different mix of VLSFO quality issues.

Anton Shamray

Senior Research Analyst

P: +207 4675 856

E: Anton.s@integr8fuels.com

Should the industry worry about decreasing VLSFO viscosity?

March 18, 2020

VLSFO quality remains a headline IMO2020 topic. As suppliers are getting

more experienced at producing VLSFO blends, the proportion of off-spec tests has been declining, although certain quality concerns remain. One of these is the reduction in viscosity, which is due to more distillate blending. This has resulted in vessels being required to adjust age old practices in order to handle and consume the fuel and moreover requires a change in tact when procuring bunkers. The choice of fuel is often limited, however checking quality before buying is as important as ever in order to minimise the risk of claims.

Lower off-specs but watch viscosity and associated issues

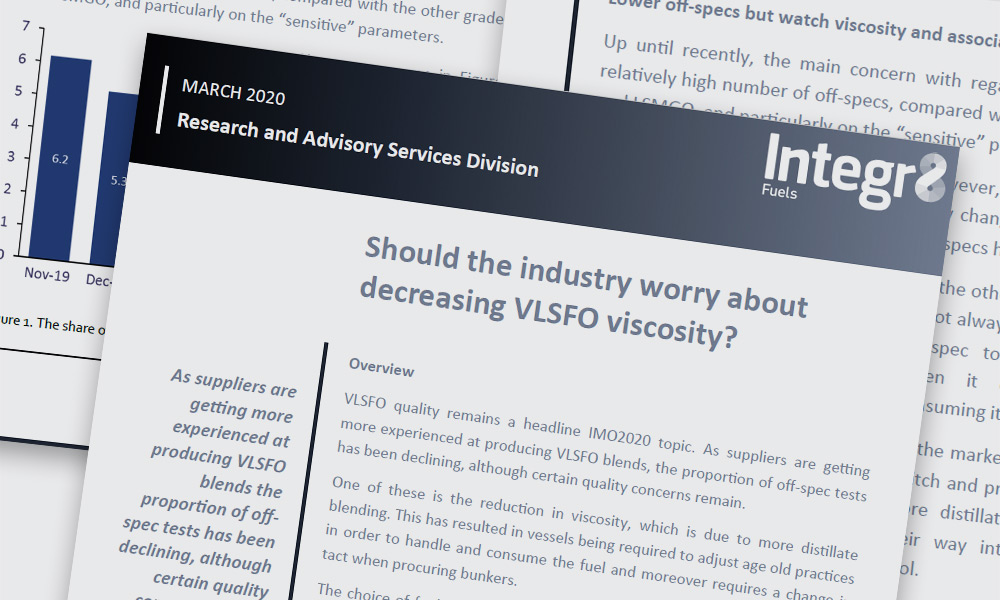

Up until recently, the main concern with regard to VLSFO quality was the

relatively high number of off-specs, compared with the other grades like HSFO and LSMGO, and particularly on the “sensitive” parameters. However, as seen in Figure 1, this is now changing and the share of VLSFO

off-specs has been declining.

On the other hand, it was found that it is not always necessary for a fuel to be off-spec to result in quality issues when it comes to storing and consuming it.As the market adjusts to the IMO2020 switch and pricing made it favourable, more distillates have recently made their way into the VLSFO blending pool. As suppliers are getting more experienced at producing VLSFO blends the proportion of offspec tests has been declining, although certain quality concerns remain.

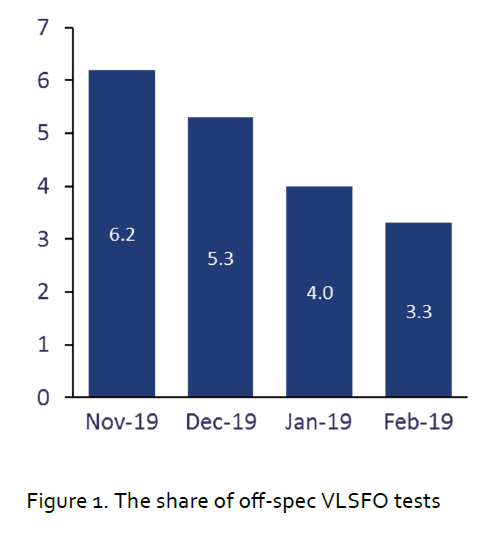

Figure 2 below shows the increase in the share of distillate based VLSFO blends and the associated reduction in viscosity.

Indeed, viscosity dropped globally from around 160cst in early November to around 100cst by March, a drop of over 35%. At the same time the share

of distillate based VLSFO went up from around 20-25% to 35-40%. The viscosity drop has affected most bunker hubs. For example, viscosity in ARA dropped 30cst by March to 100cst and there was a bigger decrease in Singapore, from 170cst down to 90cst, with an even bigger reduction in

Malta, from 150cst to 50cst.

The trend of lowering viscosity in combination with other factors is a cause for concern. Viscosity, density, pour point, aluminium and silicon (ALSI), and sediment potential (TSP) require careful assessment when purchasing and consuming the fuel.

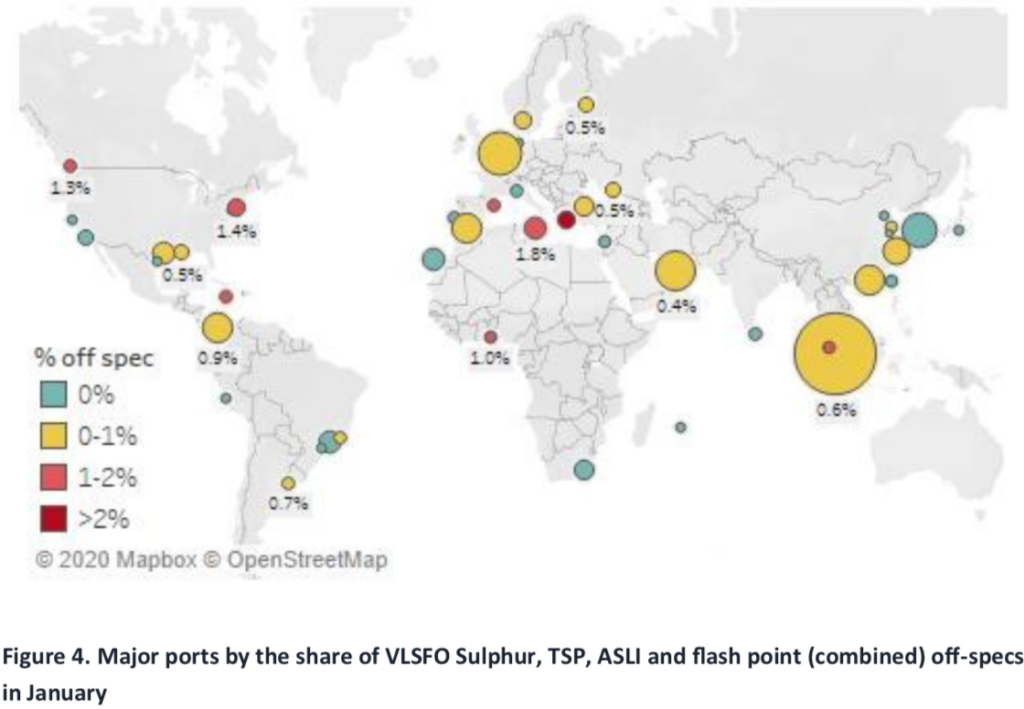

While the majority of ports recorded very few off-spec fuels in January, several locations were particularly affected.

Viscosity and Pour Point

In the past the effective purification of HSFO required a temperature of 98 deg. C for any fuel over 180cst. Given that many VLSFO fuels are now well below this viscosity level, the purifier temperature is adjusted lower to achieve 20-24cst viscosity in the purifier (for example 58 deg. C for a 30cst fuel).

However, the new VLSFOs are more paraffinic (waxy) and with a higher pour point than HSFO. Under reduced purifier temperatures such fuels may tend to produce wax sludge, which could cause serious handling difficulties; it could also potentially affect the efficiency of removing particles such as aluminium and silicon to safe levels.

It is also essential to inject VLSFO into the engine at the correct injection viscosity. For very low viscosity VLSFO the temperature to achieve the correct injection viscosity may well be on, around, or in extreme cases below pour point (at which the fuel no longer flows) and the wax appearance temperature. For example, in order to inject a 5cst and +12 pour point VLSFO.

The trend of lowering viscosity in combination with other factors is cause

for concern it has to be heated or cooled to 18 deg. C, which is only 6 deg. C above pour point (recommended min. 10 deg. C above pour point). In trying to rectify this by increasing the injection temperature the corresponding fuel viscosity would fall, in effect leaving an impossibly small window to operate in outside of which poor combustion, deposit formation and loss of energy may occur even though the fuel is fully compliant with the contractual specification.

Therefore, some owners may prefer buying VLSFO with minimum 30cst viscosity for RMD/E/G/K grades where pour point is limited to 30 deg. C maximum. Alternatively, if the fuel available is less than 30cst viscosity, it is recommended to be sold against the RMA 10 or RMB 30 spec for which there is a much tighter 6 deg. C (0 deg. C for the winter spec) limit on pour point.

Density and Viscosity

High density in combination with low viscosity remains a cause for concern for VLSFOs, similar to HSFO due to the possibility of poor or delayed ignition and combustion which can result in engine damage. This is also reflected in high CCAI readings in such fuels. It is important to remember that the 2005 ISO specification does not offer CCAI protection.

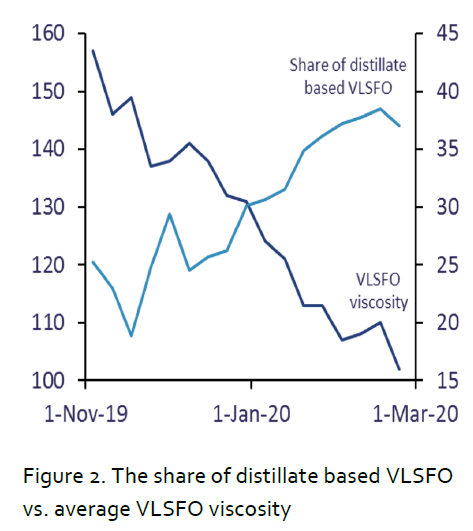

Analysing over 15,000 VLSFO test results it was found that TSP (the ability

of the fuel to deposit sediment) appears to trend up with a decrease in viscosity (Figure 3). This may be due to distillate blending and where different VLSFO components (paraffinic, naphthenic, aromatic) are

mixed together in a blend.

Moreover, given that the hot filtration test is performed at 100 deg. C the

effects of lower purification temperature (due to fuel’s low viscosity)

on the purifier with regard to wax formation may not be fully identified.

Overall, VLSFO quality seems to be improving with fewer samples tested offspec, however checking quality before buying is as important as ever. The ISO spec sets the upper limit for most parameters and it was found that even with all parameters on-spec, some VLSFOs may be more problematic than others. This is not normally the case with HSFO where most parameters vary in a much narrower range and average viscosity, despite dropping slightly recently, is still around 300cst.

When it comes to bunker procurement, Integr8 Fuels provides its customers

with full information not only on the price but also on quality, availability and delays. By analysing global trends and changes in quality, Integr8 Fuels are well positioned to help procure quality fuels and minimise the risk of claims.

Anton Shamray

Senior Research Analyst

P: +207 4675 856

E: Anton.s@integr8fuels.com

VLSFO prices now more settled, but still plenty to look at when buying bunkers

February 18, 2020

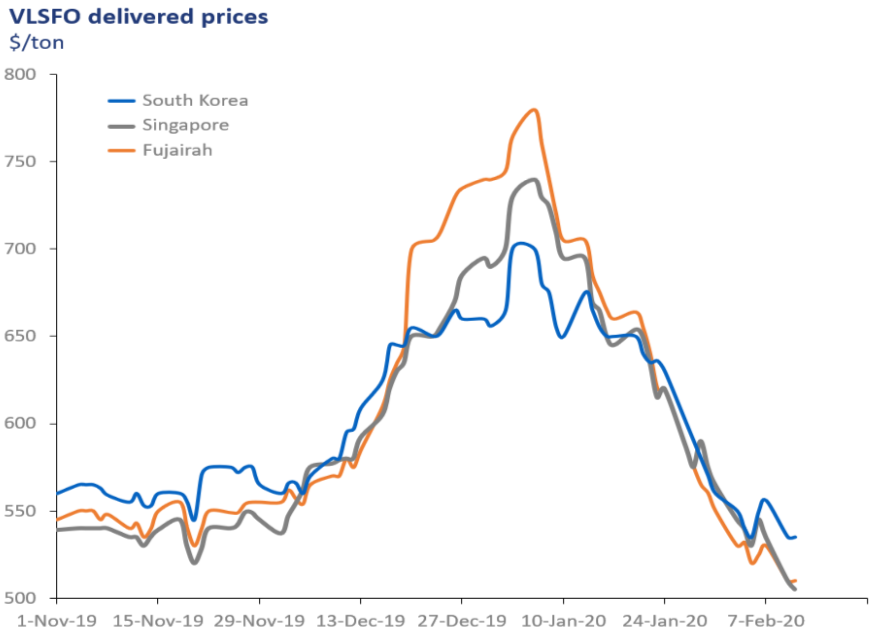

The absolute price of bunkers has fallen sharply since the start of the year, largely inline with the fall in crude. The easing of Middle East tensions, higher oil stocks, and now, far more significantly, the impact and uncertainty surrounding the Coronavirus have meant oil prices have dropped. Correspondingly, representative VLSFO prices East of Suez are down from around $750/ton in early January towards $500/ton currently, a drop of some 25-35%.

However, as a bunker buyer we have no control over the absolute oil price; what we

do have some control of is when and where we make our purchases.

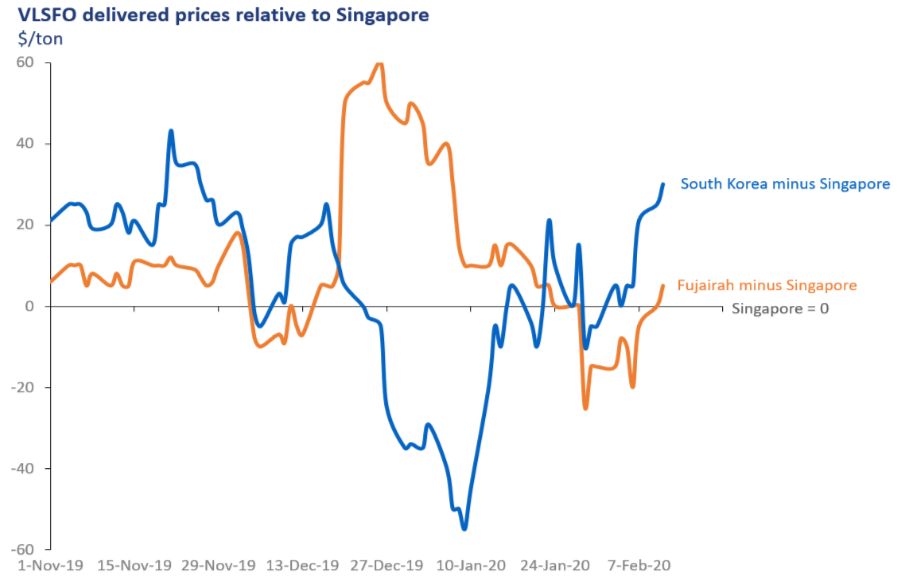

The switch to VLSFO has highlighted the extreme moves in pricing that can take place;

at one stage in early January Singapore VLSFO prices were $60/ton less than in

Fujairah and soon after South Korean prices were $60/ton below Singapore. There

were clearly huge potential savings in bunkering ‘at the right port’, and although

these extremes have eased there are still significant opportunities to save money in

the bunker market.

The huge distortions in VLSFO pricing between different ports at the start of the year were associated with the introduction of IMO 2020 and ran through to the 3rd week of January. Although relative prices then appeared to settle down, more dramatic moves again hit the market in mid February, when South Korean prices moved to $30/ton above Singapore and Fujairah prices moved from being well below Singapore to now above Singapore.

Just looking at these 3 ports over the past 3 months, what it does show is that the

most ’advantageous’ pricing has shifted from Singapore to Fujairah, back to

Singapore, then to South Korea, back to Fujairah and now again to Singapore.

Notwithstanding issues around availability and quality, and all other possible

bunkering locations, in this case there is easily a $20/ton bunker saving to be had,

even in today’s ‘more settled’ markets. On a VLCC this is equivalent to close to

$1,000/day, on a Capesize bulk carrier $500/day, and on a 9,000 teu containership a

$20/ton saving on bunkers equates to more than $1,600/day.

We are possibly beyond the most extreme volatility in relative VLSFO pricing.

However, there is still a lot to monitor in the bunker market, and significant financial

savings to be had from high quality market knowledge and analysis alongside forward

bunker planning.

Steve Christy

Strategic Communications Director

P: +44 (0) 207 467 5860

E: steve.c@integr8fuels.com

VLSFO: better quality but watch for critical parameters

February 12, 2020

It has been over a month since the IMO2020 regulation came into force and there are mixed views on how the transition has gone so far. Some participants claim the switch has gone smoothly, while others highlight the constant quality issues with the VLSFO blends.

As we moved through the later part of December and now fully into 0.5% sulphur compliance, so VLSFO prices have risen sharply, not only in absolute terms (up 25- 35% since early December) but also higher relative to crude oil. The pricing of VLSFO reflects all the issues around the market, including demand and availability (or lack of it). One fallout is that reported prices for VLSFO are now extremely close to MGO, with the difference now typically less than $20/ton, compared with VLSFO ‘discounts’ anywhere from $40/ton to $120/ton just one month ago.

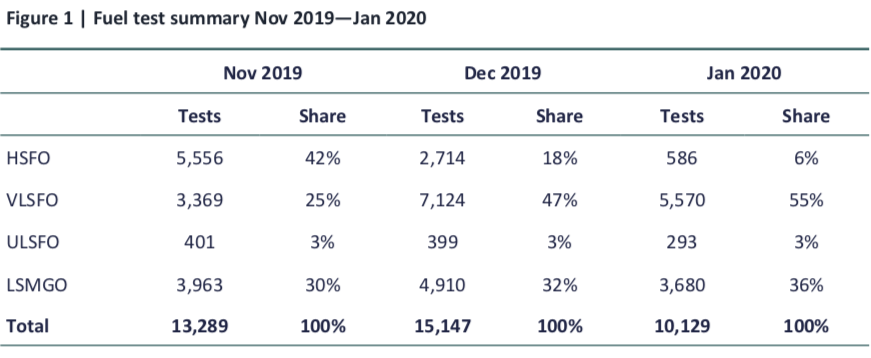

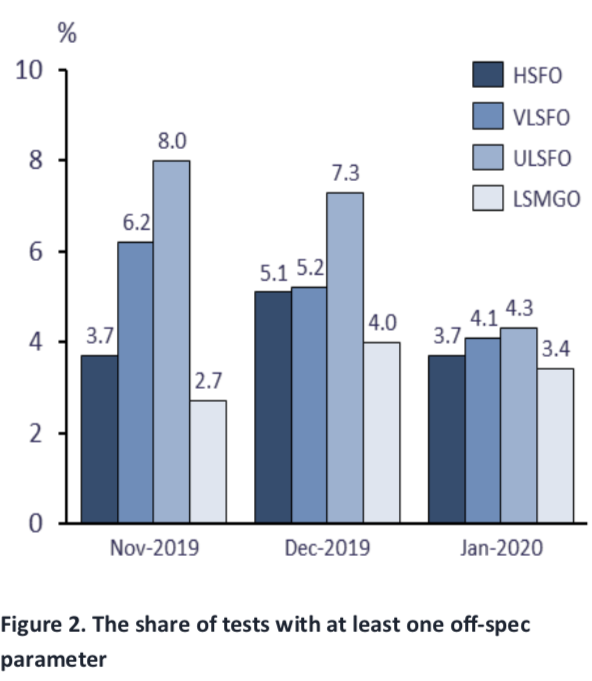

Integr8 Fuels’ analysis of global fuel quality data covering November 2019 to January 2020 shows the improvement in the overall fuel quality of VLSFO. However, there are concerns about the continuing decrease in viscosity and the increasing likelihood of more sedimentation and stability issues.

Despite VLSFO having only marginally more off-specs than HSFO, it is the critical quality parameters that are often recorded off-spec in VLSFO, potentially causing technical problems on board vessels.

While the majority of ports recorded very few off-spec fuels in January, several locations were particularly affected.

Fuel quality analysis

For the analysis, Integr8 Fuel’s live global fuel quality database was used. It receives over 400 results daily and has accumulated over 38,000 ISO8217 test results since November 2019, which have allowed for a detailed insight into fuel quality and associated issues.

It is worth mentioning, that there are limitations in the scope of ISO8217 testing, but this remains the main marine bunker fuel quality test and as such can help understand why there are such mixed views about VLSFO on the market.

Figure 1 summarises the tests the analysis is based on, and shows a representation of how quickly HSFO has been losing its market share to VLSFO and LSMGO. VLSFO now constitutes the majority of the bunker fuel supplied, followed by LSMGO, HSFO and ULSFO.

While switching to LSMGO is rarely associated with problems, particularly in modern vessels, switching to VLSFO has definitely highlighted a number of issues.

Naturally, quality issues are associated with a higher number of blends on the market, where at least one parameter is found off-spec.

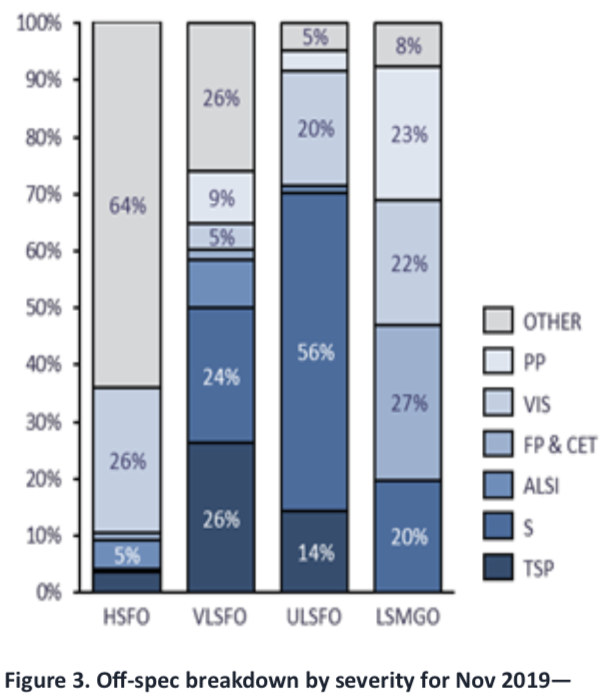

However, Figure 2 shows that the number of off-spec VLSFO tests was only marginally higher than HSFO (and lower than ULSFO) in January and has been declining over the past three months.

This gives an impression that VLSFO is becoming less problematic, contrary to the news on the market.

In further analysis, January off-specs were broken down by parameter and the severity of each parameter being off-spec.

This is summarised in Figure 3 with critical parameters coloured in red, less critical in yellow and least critical in green. Critical VLSFO parameters like sulphur, TSP, ALSI and flash point jointly share around 60% of all VLSFO off-specs, compared with around 20% for HSFO.

It is worth mentioning that on off-spec critical parameters VLSFO is very similar to ULSFO, which is blended to an even tighter sulphur limit.

Indeed the consequences of these parameters being off-spec are much more serious, including damage to machinery, filter blockages, the inability to burn bunkers or even de-bunkering—all these are more likely to result in claims and end up in the news headlines.

On the other hand, off-spec (within reason) pour point, water content, density or viscosity can be dealt with on-board and are less likely to lead to a major problem, which has often been the case with HSFO.

On the port level, the majority of locations presented very few VLSFO issues. However, several ports in January were particularly prone to off-specs on critical parameters (Figure 4), including several ports in the Mediterranean, North America and the Caribbean.

As the VLSFO quality situation is dynamic, it is very important to stay up-to-date with the changes in the market. Integr8 Fuel’s global fuel quality database allows us to monitor in near real-tme the changes in fuel quality and be proactive in our buying strategies in order to procure the best quality fuels for our customers.

Anton Shamray

Senior Research Analyst

P: +207 4675 856

E: Anton.s@integr8fuels.com

VLSFO prices are now very close to MGO

January 7, 2020

In our last research note in December we pointed out that the differential between quoted prices for MGO and VLSFO in Singapore had fallen from $75/ton to only $10/ ton over a couple of months. This squeeze in the MGO/VLSFO differential is now commonplace in all the main bunkering centres.

As we moved through the later part of December and now fully into 0.5% sulphur compliance, so VLSFO prices have risen sharply, not only in absolute terms (up 25- 35% since early December) but also higher relative to crude oil. The pricing of VLSFO reflects all the issues around the market, including demand and availability (or lack of it). One fallout is that reported prices for VLSFO are now extremely close to MGO, with the difference now typically less than $20/ton, compared with VLSFO ‘discounts’ anywhere from $40/ton to $120/ton just one month ago.

This means we have moved from a market where, on price, VLSFO was a clear and obvious fuel choice in the run-up to IMO 2020, to a market now where MGO may be the best option, especially considering generally higher energy content and no heating requirements.

Clearly, there are major issues in availabilities, delays and pricing highlighted by these developments, and possible technical issues between using different grades, but again this stresses the need for information and analysis in what is now a very differ- ent and complex bunker world.

Steve Christy

Strategic Communications Director

P: +2074675860

E: SteveChristy@navig8group.com