VLSFO prices now more settled, but still plenty to look at when buying bunkers

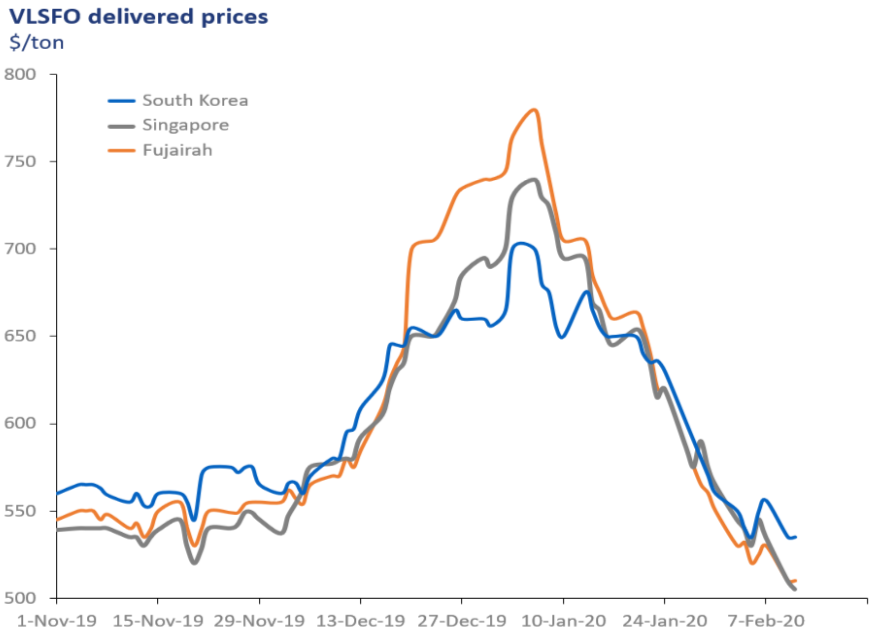

The absolute price of bunkers has fallen sharply since the start of the year, largely inline with the fall in crude. The easing of Middle East tensions, higher oil stocks, and now, far more significantly, the impact and uncertainty surrounding the Coronavirus have meant oil prices have dropped. Correspondingly, representative VLSFO prices East of Suez are down from around $750/ton in early January towards $500/ton currently, a drop of some 25-35%.

However, as a bunker buyer we have no control over the absolute oil price; what we

do have some control of is when and where we make our purchases.

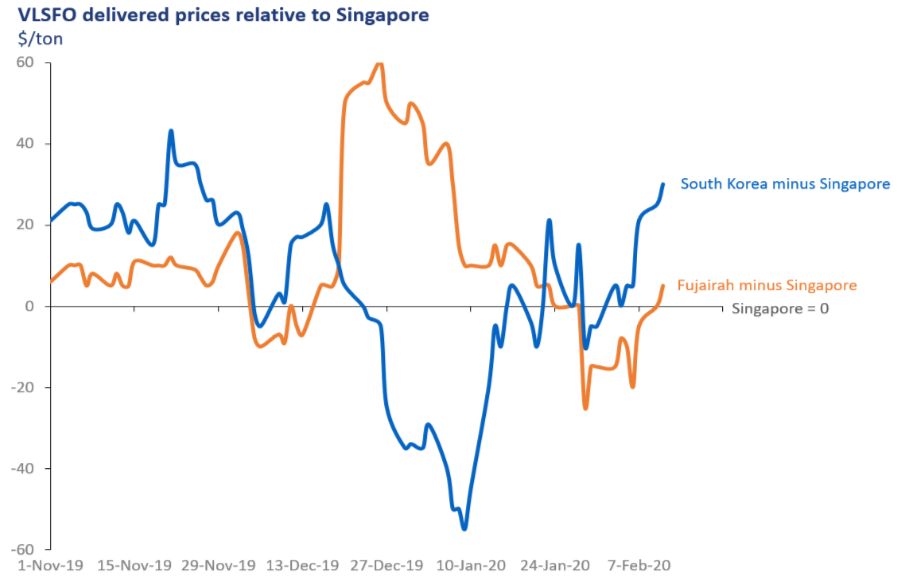

The switch to VLSFO has highlighted the extreme moves in pricing that can take place;

at one stage in early January Singapore VLSFO prices were $60/ton less than in

Fujairah and soon after South Korean prices were $60/ton below Singapore. There

were clearly huge potential savings in bunkering ‘at the right port’, and although

these extremes have eased there are still significant opportunities to save money in

the bunker market.

The huge distortions in VLSFO pricing between different ports at the start of the year were associated with the introduction of IMO 2020 and ran through to the 3rd week of January. Although relative prices then appeared to settle down, more dramatic moves again hit the market in mid February, when South Korean prices moved to $30/ton above Singapore and Fujairah prices moved from being well below Singapore to now above Singapore.

Just looking at these 3 ports over the past 3 months, what it does show is that the

most ’advantageous’ pricing has shifted from Singapore to Fujairah, back to

Singapore, then to South Korea, back to Fujairah and now again to Singapore.

Notwithstanding issues around availability and quality, and all other possible

bunkering locations, in this case there is easily a $20/ton bunker saving to be had,

even in today’s ‘more settled’ markets. On a VLCC this is equivalent to close to

$1,000/day, on a Capesize bulk carrier $500/day, and on a 9,000 teu containership a

$20/ton saving on bunkers equates to more than $1,600/day.

We are possibly beyond the most extreme volatility in relative VLSFO pricing.

However, there is still a lot to monitor in the bunker market, and significant financial

savings to be had from high quality market knowledge and analysis alongside forward

bunker planning.

Steve Christy

Strategic Communications Director

P: +44 (0) 207 467 5860

E: steve.c@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.