Where are we and do we know where we are going?

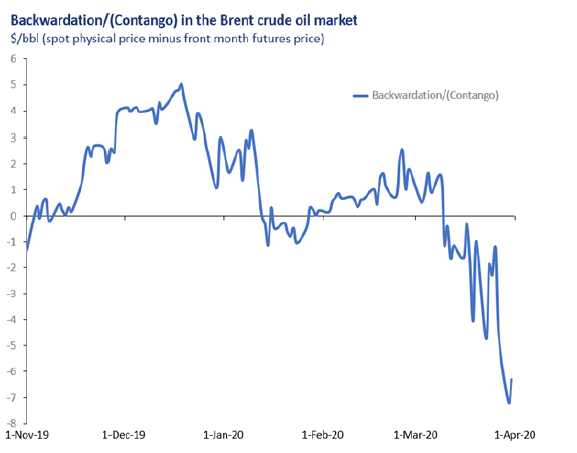

There is a little more clarity in oil market pricing, but still huge uncertainty on where things are going. It was just a few weeks ago when news of the coronavirus started to hit and OPEC put forward a proposal to cut production by around 1.5 million b/d, but only if there was the support of the OPEC+ group (principally Russia). The agreement didn’t happen, Saudi opened the taps and oil prices collapsed. With hindsight the proposed 1.5 million b/d cut was ‘a drop in the ocean’, with analysts now indicating that global oil demand could be an unprecedented 20 million b/d lower in April 2020 than in April 2019, and also some 4-6 million b/d down for this year as a whole. So, near-term oil supply is up by around 2-3 million b/d and demand down by around 15-20 million b/d. Markets tend to tell you almost everything and we have seen a near 70% collapse in crude prices since the start of the year to hit 18-year lows. At the same time the crude market has switched from backwardation to steep contango, bringing storage into play.

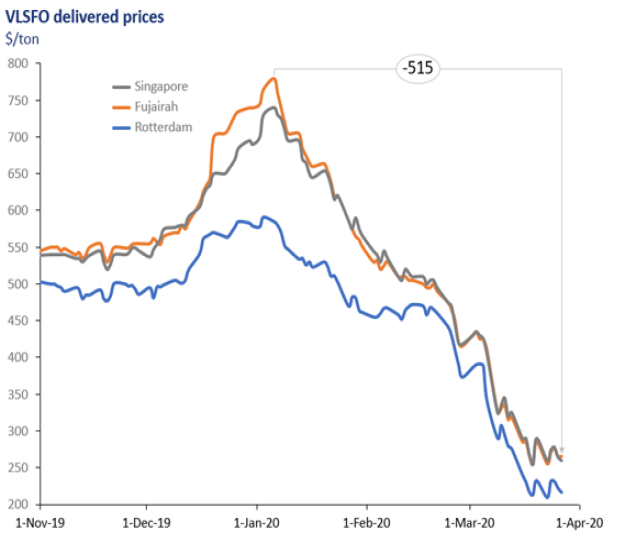

So, what about bunker prices. We are no different in terms of being driven by absolute prices in the oil market and VLSFO in Singapore and Fujairah is around $500/ton lower than at the start of the year (minus 66%). Prices in Rotterdam are below those in Singapore and Fujairah and so the absolute drop has not been as great, at around $370/ton, but in percentage terms it is more-or-less the same at 63% lower.

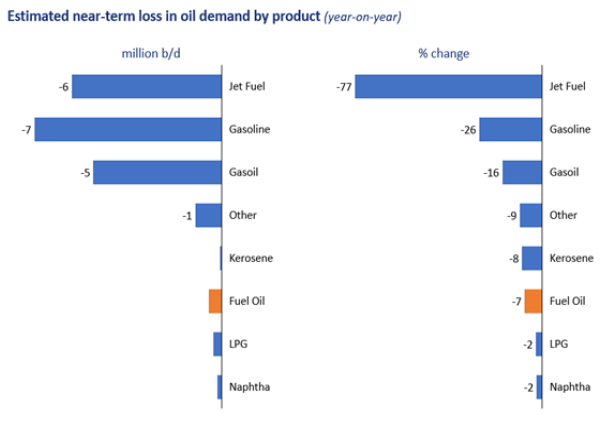

Understandably, there have been even greater pressures in the jet and gasoline markets, where demand destruction is at extreme levels. It has been well documented on how airlines are suffering, and this is clearly seen by the demand for jet fuel, which is down by a massive 77%.

In volume terms, the loss in gasoline demand is even greater than jet, but with the gasoline market almost four times bigger, the percentage drop is around 26%; still hugely significant. The demand impact in the bunker market has been relatively limited, with fuel oil consumption down by an estimated 7%.

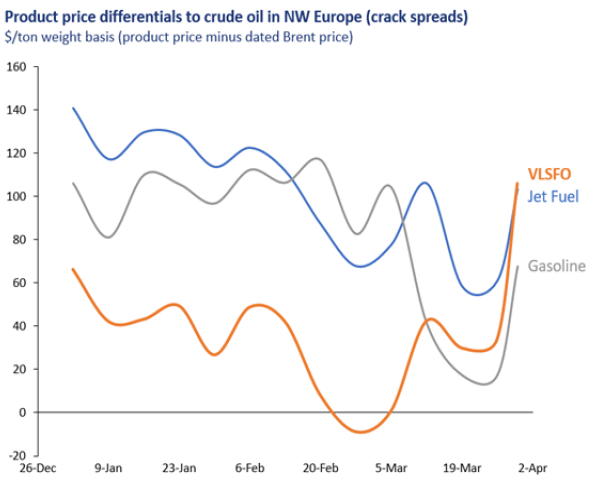

The collapse in oil prices is clearly the headline news, but relationships across the barrel have altered significantly. Before this happened, on a weight basis in NW Europe, jet fuel was around $120-140/ton above Brent, gasoline $90-110/ton and VLSFO $30-50/ton higher than Brent. The loss of jet and gasoline demand meant the crack spreads for these products have tended to fall further than other products.

However, over the past couple of days we have seen physical crude oil prices fall even further and faster than products and, as shown in the graph, crack spreads have widened. At the same time the relative price of VLSFO has risen and is now priced similar to jet and above gasoline.

For refiners the question is not about absolute prices, but the difference between crude and product prices and what this means for their refinery margins. In such a violent market there are always leads and lags that affect the margin on a day-to-day basis, but the current downwards pressures on physical crude oil prices are so extreme, and on paper margins have soared. However, the reality out there will be very different for different refiners and for those with positive margins they will continue to process, whether the demand is there or not. We are in a vicious cycle; there is too much crude and to generate buyers it has to be sold (or stored) at a profit.

There are already stories of some refiners severely cutting runs. Some of the most vulnerable are likely to be land-locked, without endless storage or the ability clear products. For the rest it will be different for different refiners, depending on the type, infrastructure and connectivity of the refinery. But if refinery margins stay positive and storage economics work and there is somewhere to put the products, then those refiners that can will continue to run; we will just see huge builds in products stocks.

The consequence of the hike in oil supply and the downfall in demand is these massive builds in oil stocks. This is yet to show in weekly stocks reports, but it is coming, and the oil price structure already reflects

this.

Backwardation has been replaced by steep contango in the crude market, and for Brent the difference between physical and front month futures prices is now $7/bbl, with the contango running at around $17/bbl over the next 6 months This means storage economics are now very favourable (traders will still make money storing crude on a VLCC and paying $140,000/day for it). It is just that supply goes into storage rather than into consumption.

Clearly the longer we go down this road, the bigger the stock-build will be and so take longer to unwind. So how do things change? We either see a sharp rebound in demand or a major cutback in supply, or a combination of both. On the demand side, current expectations (which can obviously change) are that things will ease from May onwards, but that demand will still be well below 2019 levels for most of this year, plus there is also the issue of recession; so no quick fix here. This then points to any potential cutback in supply, which in the near/medium term would seem to need Russia to come back to the table and approve an OPEC+ agreement. If this is the case, then the cutback will have to be much bigger than the 1.5 million b/d proposed last time round. Global politics may yet come up with something else, but what we don’t know. Alternatively, could we see the industrial collapse of oil production at a field, company or even country level? Without any of these, stocks will continue to build, oil prices are going to remain low and could fall even further.

At the time of writing President Trump indicated that Saudi Arabia and Russia will announce an agreement to cut production by 10 million b/d (or more), to which the price responded positively and then fell back a bit; we just have to see if such an agreement is formally announced and adhered to. If not, then global politics may yet come up with something else, but what we don’t know. Without any of these, oil stocks will continue to build, oil prices are going to remain low and could fall even further. Then it may be the fall in oil supply will come from the industrial collapse of oil production at a field, company or even country level. The pressure is clearly on an agreement to cut production in the near term; let’s see what happens.

Steve Christy

Strategic Communications Director

P: +44 207 4675 860

E: Steve.C@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.