Report reveals Red Sea closure’s impact on VLSFO compliance, and emerging bunker quality trends

June 11, 2024

This is the fourth bi-annual report analysing the bunker fuel landscape

In the latest report from Integr8 Fuels, bunker quality and claims manager Chris Turner advises shipowners and bunker buyers on how they can improve their buying processes and performance. Tapping into the world’s biggest bunker fuel quality sample database, Turner reveals the most pressing quality issues the industry is up against. These include:

- Red Sea closure affecting VLSFO compliance for vessels rerouting around Africa

- Global VLSFO compliance suffers as suppliers stretch barges to cash in on rising HSFO demand, driven by increasing scrubber numbers

- Two-thirds of fuels are still sold with obsolete (pre-2017) specifications. Can the new ISO specs finally shake up old school practices?

- Profit margin-motivated blenders push more HSFOs over ISO limits

- VLSFO sulphur off specs worsening in the ARA and partly driven by high- to low sulphur barge switching

Red Sea closure impact on VLSFO compliance

Geopolitical events often have a knock-on effect on fuel quality, sometimes relating to blending economics, and occasionally, also relating to the impact on barge infrastructure because of rapidly changing demand.

Since October 2023, many more vessels have been rerouting around Africa rather than travelling via the Red Sea, resulting in a significant increase in volume of HSFO demand, with . During the same period, there has been a 30% increase in VLSFO sulphur off specification incidents in ports along the African coast and nearby Spain, which upon closer inspection, show a root cause of affected barges also carrying HSFO.

Integr8 Fuels’ analysis has identified suppliers running a similar model who are unaffected – this likely due to their infrastructure allowing double valve segregation and separate manifolds onboard the barge preventing any cross-over contamination, and/or proper management of grade changeover.

The increase in HSFO demand is also putting pressure on supply models.

Another factor is the significant increase in the number of vessels equipped with scrubbers, resulting in a far higher demand for HSFO than in recent years with data available to Integr8 suggesting approximately 100 million MT of deadweight tonnage being either delivered or retrofitted with scrubbers in 2023. This combined with the price spread which remains very appealing, and scrubber assets travelling further at higher speeds, continues to support the demand going forwards.

Suppliers of course want to meet this increased demand and in doing so place transitional temporary pressure on existing assets or could be forced into a sea change in strategy, both of which may result in the practice of storing both HSFOs and VLSFOs onboard the asset.

This is made apparent by increased sulphur off specification occurrences with the root cause being the switching of grades by certain suppliers, in ports including but not limited to Barcelona, Callao and Hong Kong.

New ISO specs

The International Organization for Standardization’s (ISO) recently launched ISO 8217:2024 standards present a rare opportunity to do away with the industry’s reliance on obsolete fuel specifications. This is no easy task as research from Integr8 shows that two-thirds of residual bunker fuels and three-quarters of distillate bunker fuels are still sold with pre-2017 specifications.

ISO 8217:2024 introduces several important amendments. Notably, it sets minimum viscosity limits across all residual grades, addressing handling issues with low-viscosity fuels. It also identifies specific chemical species linked to operational problems, such as organic chlorides, and incorporates international testing standards. The new specification prepares the industry for the growing use of biofuel blends by establishing new testing parameters for these fuels, such as FAME content and net heat of combustion.

There are however missed opportunities, namely related to de-minimis levels of organic chlorides and cold flow properties.

Suppliers may again attempt to avoid the small print on organic chlorides as they have previously done with Clause 5, which could possibly have been better addressed by incorporating a maximum limit in tables. Cold flow properties must only be reported, not guaranteed, leaving the potential need for buyers to seek additional guarantees outside ISO 8217:2024. This remains a concern as certificates of quality (where such values are reported) often lack reliability when provided at a distant time from delivery.

Despite these challenges, the ISO 8217:2024 specification represents a substantial step forward, providing the necessary framework to address many current fuel quality issues. The uptake of the 2024 specification will depend significantly on ship owners demanding these new standards be incorporated into charterparty agreements. By doing so, owners can drive the transition from outdated specifications to the latest version, paving the way for a more reliable and efficient future in marine fuel standards.

Global HSFO off specs

Global HSFO quality has worsened in the past six months. The number of off-specification HSFO samples has gone up from 3% to 3.4%, and this is significantly higher than for VLSFO (2.1%) and MGO (2.8%).

Profit-motivated blending can go some way to explain the deteriorating HSFO trend. Almost half of HSFO off specs have been blending-related and come as a result of blending close to HSFOs density and viscosity limits, Turner argues. Water content is the second most likely usual off spec suspect and has made up around a third of HSFO off specs.

But fortunately, neither density, viscosity nor most of the water off specs qualify as so-called “critical” or “high risk” off specs. They are not likely to lead to serious engine trouble or debunkerings, which can cost shipowners dearly. These off specs are typically economically motivated. Density and viscosity off specs are more common for HSFO than for VLSFO and LSMGO because they are the blending targets for HSFO, and blenders have an incentive to blend as close to those limits as possible to save money.

VLSFO sulphur off specs

Sulphur is the biggest off spec concern for VLSFO. Again, this has to do with blending as the 0.50% sulphur limit is the target that blenders have their eyes on. Blending too far from the limit can eat into your profit margins, and we have seen the average sulphur contents in VLSFOs creep up in both the ARA and Singapore in the past six months.

In Singapore, you were 2.5 times more likely get a VLSFO stem with a sulphur content of 0.51-0.53% in the past six months as you were getting one in the preceding six-month period. It is evident that blending is being optimised towards the 0.50%.

But while only 0.3% of VLSFOs test off spec for sulphur in Singapore, the ARA has seen 2% of VLSFOs testing off spec. In the ARA, “we regretfully report that we are almost twice as likely to face a sulphur off specification incident now than in the previous reporting period,” Turner writes.

The report is available to download for free from the Integr8 website at https://integr8fuels.com/fuel-quality-trends-2024/

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Bunker Quality Trends Report 2024

June 11, 2024

In the fourth bi-annual report from Integr8 Fuels, bunker quality and claims manager Chris Turner advises shipowners and bunker buyers on how they can improve their buying processes and performance. Tapping into the world’s biggest bunker fuel quality sample database, Turner reveals the most pressing quality issues the industry is up against.

These include:

- Red Sea closure affecting VLSFO compliance for vessels rerouting around Africa

- Global VLSFO compliance suffers as suppliers stretch barges to cash in on rising HSFO demand, driven by increasing scrubber numbers

- Two-thirds of fuels are still sold with obsolete (pre-2017) specifications. Can the new ISO specs finally shake up old school practices?

- Profit margin-motivated blenders push more HSFOs over ISO limits

- VLSFO sulphur off specs worsening in the ARA and partly driven by high- to low sulphur barge switching

- The supply landscape as it relates to availability, off-specification trends and problematic parameters

- Biofuel quality and distribution

- Geographical variances and “hot spots”

Published June 2024

Dual-fuel vessels owners should consider e-LNG to make the most of emissions compliance

April 11, 2024

Dual-fuel vessel owners should look to liquefied e-methane as a drop-in bunker fuel to make the most out of emission compliance, argue Jonathan Gaylor of Integr8 Fuels and Maximilian Matheis of TURN2X.

We already know that fossil LNG-fuelled vessels will pay less to comply with the EU’s Emissions Trading System (EU ETS) than vessels fuelled with conventional high sulphur fuel oil (HSFO), very low sulphur fuel (VLSFO) and low sulphur marine gasoil (LSMGO) because LNG has a lower carbon factor. Many of these LNG-fuelled vessels will also be compliant with FuelEU Maritime (FEUM) greenhouse gas (GHG) intensity reduction targets until 2030, 2035 and 2040, depending on their engine type and methane slip. Dual-fuel vessels have recently benefitted from low fossil LNG prices, which have rendered it a more attractively priced bunker fuel option to VLSFO, LSMGO (Rotterdam and Singapore) and HSFO (Rotterdam).

Liquefied e-methane, or e-LNG, is almost five times more expensive than fossil LNG, but because you need so little of it per vessel to meet FEUM targets for 2030-2039, it will not add much to the total price of a blend of fossil LNG and e-LNG. Any compliance surplus from extra e-LNG consumption will be added on top of a neutral compliance balance and averaged out across your fleet or pool, or it can be banked for future years.

Incoming LNG Glut

After the LNG bunker market was shaken by Russia’s invasion of Ukraine and skyward prices, it now faces a period of oversupply, low prices and soon a doubling of the global LNG-fuelled fleet. Massive fossil LNG production and export growth from the US and Qatar is set to put LNG in a prime position to continue to trade at discounts to conventional VLSFO and LSMGO prices. Fresh output boosts from Malaysia, Australia and others also form part of a wave of new supply. So, if fossil LNG prices keep at sustained discounts to conventional fuels going forward, these discounts can be used to cover a higher price paid for e-LNG, which can be used to meet more and more stringent GHG reduction targets.

Mass Balancing and Virtual Liquefaction

And you do not necessarily need to blend e-LNG into fossil LNG physically. The LNG industry is increasingly becoming familiar with mass balancing and virtual liquefaction – accounting techniques that remove the need to move physical e-LNG molecules out to every ship and other end-users. A shipowner can order a certain amount of e-LNG in its LNG blend but will actually receive pure fossil LNG in its ship’s fuel tank. The shipowner will pay for, say 1% e-LNG, which will be produced and distributed to another end user that has paid for fossil LNG and would otherwise have consumed only fossil LNG. More e-LNG will be consumed on the balance as a result and costs can be cut in its distribution and liquefaction, which can be done virtually and boost the competitiveness of e-LNG.

Price Edge on Liquid Bunker Fuel Blends

Integr8 Fuels estimates that 2% used cooking oil methyl ester (UCOME) blended with 98% VLSFO is priced around $610/mt with current price levels in the ARA. If you blend e-LNG into the fossil LNG, the e-part will count twice towards FEUM targets towards 2033 because it qualifies as a renewable fuel of non-biological origin (RFNBO) if it has GHG savings of more than 70%. Say you blend in 1% e-LNG with 99% fossil LNG, then that e-LNG component would count as 2% RFNBO and be priced around $480/mt. These prices have been adjusted for calorific contents to make them VLSFO-equivalents in terms of energy. In other words, e-LNG blends are about $130/mt more cost efficient than biofuel blends when you compare energy for energy with 1-2% shares of renewables.

Taking the RFNBO argument a bit further, running just one vessel on 100% e-LNG can cover the FEUM compliance of 44 other similar vessels running on VLSFO between 2025-2029, according to a recent report by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping. This is because the e-LNG vessel generates a massive compliance surplus that can be averaged out across a fleet of conventionally fuelled vessels or a pool of vessels. Your compliance surplus can therefore be sold to other shipowners through pooling with them. It can also allow you to lower your EU ETS exposure and help improve your Carbon Intensity Indicator (CII).

FEUM Here to Stay

When we consider not just e-LNG on its own, but in blends with attractively priced fossil LNG, it becomes a more attractive proposition to dual-fuel vessel owners. This will lead to further investments into this space and continue to reduce costs. It is important to note that FEUM is a long-term regulation that can enable shipowners to be confident about signing the long-term agreements that are necessary for e-LNG projects to get through the final investment decision stage. Since these projects will have strong commercial underpinnings, they are more robust. As an e-LNG supplier or project developer, you need long term contracts to underwrite power purchasing agreements for these types of fuels. FEUM creates predictability through being an offtake enabler. This long-term focus does not generally align with the nature of the bunker market – which tends to favour spot deals – but FEUM is poised to help bridge that gap.

How It’s Made

E-LNG is an electricity-based fuel where green hydrogen is one of its two major components. The process of splitting water into hydrogen and oxygen through electrolysis is dependent on renewable electricity generation, so access to competitively priced electricity is key. E-methane is e-LNG in gas form and has no upstream emissions because it is synthesised at plants that combine green hydrogen from renewable electricity with biogenic CO2. The green hydrogen allows renewable electricity to be stored off the grid and without a need for batteries. This green hydrogen is subsequently reacted with captured biogenic CO2 and liquefied into e-LNG.

All of these processes are comparatively CAPEX- and OPEX-intense, but e-methane start-up TURN2X is actively working on lowering the levelised costs for e-LNG to become an even more competitive drop-in fuel. A shared characteristic of all electricity based

fuels (i.e. e-LNG, e-ammonia and e-methanol) are the conversion losses, especially within the electrolysis. The conversion loss from methanation – which TURN2X uses to produce e-methane – is significantly smaller. Further increasing the efficiency of electrolysis will therefore become an important lever to reduce the energy conversion losses going forward.

The Case For E-LNG

It is almost impossible to electrify largescale ocean-going ships and there is not yet technological readiness for hydrogen fuelled vessels – which is why we need to move one step further with the molecules toward hydrogen derivatives such as e-LNG.

TURN2X recently launched its first commercial e-methane plant in Spain’s Miajadas. The location was chosen for its abundant solar energy potential, and because the electricity grid in this region in Spain is already suffering from congestion at certain times during the day, it has become harder for renewable electricity projects to come online. The company is creating an off-grid opportunity to bring in renewables projects while finding another way of transporting it out of Spain – and sees the pan-European gas grid as the largest battery that we currently have.

Munich-based TURN2X is now looking to the maritime sector for long-term contract customers, and because FEUM does not have an end date, it can help underpin growing renewables demand in decades to come. This can, in turn, enable TURN2X to develop even more competitive and scalable solar PV projects on-site for affordable green electricity and further reduce the price of critical CAPEX components such as the electrolyser stacks and the proprietary methanation technology. Maritime is one outlet for TURN2X, which has teamed up with Integr8 Fuels to reach a wide network of fossil LNG-fuelled vessels with e-LNG. Existing bunker infrastructure used to deliver fossil LNG can just as well be used to deliver e-LNG.

Jonathan Gaylor

Integr8 Fuels

jonathan.g@integr8fuels.com

Maximilian Matheis

TURN2X

max@turn2x.com

For more information about Integr8’s energy procurement offering, visit our bunker trading services page.

Integr8 Fuels Expands into Australasia with New Perth Office

March 7, 2024

Chris Seidel, Integr8 Fuels Australia’s Business Manager

Integr8 Fuels, a global leader in bunker trading and fuel management services, today announced the launch of a new trading desk in Perth, Australia. This strategic expansion positions Integr8 to better serve its international clientele by broadening supply chain capabilities and delivering expertise suited to the Australasian bunkering sector. The international marine fuels procurement company also aims to capitalise on new domestic business opportunities in Australia, by catering to the burgeoning renewables segment and offshore oil & gas projects.

“Our expansion into Australasia is a natural progression reflecting our commitment to providing clients with tailored support and localised market intelligence,” said Yusuff Shah, Australasia Trading Lead for Integr8 Fuels. “With our on-the-ground presence in Perth, we can better understand the unique challenges and opportunities this region presents.”

Chris Seidel, Integr8 Fuels Australia’s Business Manager for its Perth office, is eager to contribute to the company’s mission of shaping the future of marine fuels and supporting the country’s decarbonisation journey. Leveraging his extensive Australian offshore oil and gas services experience spanning over 30 years, Chris looks to develop and nurture client and supplier relationships in the region.

Chris commented “The dynamic evolution of the Australasian bunker market reflects mounting interest in the exploration of alternative energy solutions and our commitment lies in supporting clients as they navigate the opportunities and challenges that this momentous transition offers. Fundamental to this will be building and reinforcing partnerships with trusted, hands-on local suppliers.”

Opportunities in Australasia

Australia is experiencing renewed interest in offshore oil and gas exploration, and strong government support for solar, wind, and other renewables has encouraged the expansion of sustainable energy projects.

In addition, decarbonisation implemented by the Australian government are expected to incentivise the adoption of biofuels and other alternative energy sources. Integr8 Fuels previously reported a rising demand for Liquified Natural Gas (LNG), which, as a lower carbon alternative to traditional marine fuels, presents a significant opportunity for bunkering services in the region.

A key focus for Integr8’s new posting will be to forge partnerships with suppliers who have been vetted by the International Sustainability and Carbon Certification (ISCC) scheme. The ISCC is a global certification system that sets standards for sustainable production, sourcing, and trade of all kinds of bio-based feedstocks and biofuels, in line with the EU’s Renewable Energy Directive.

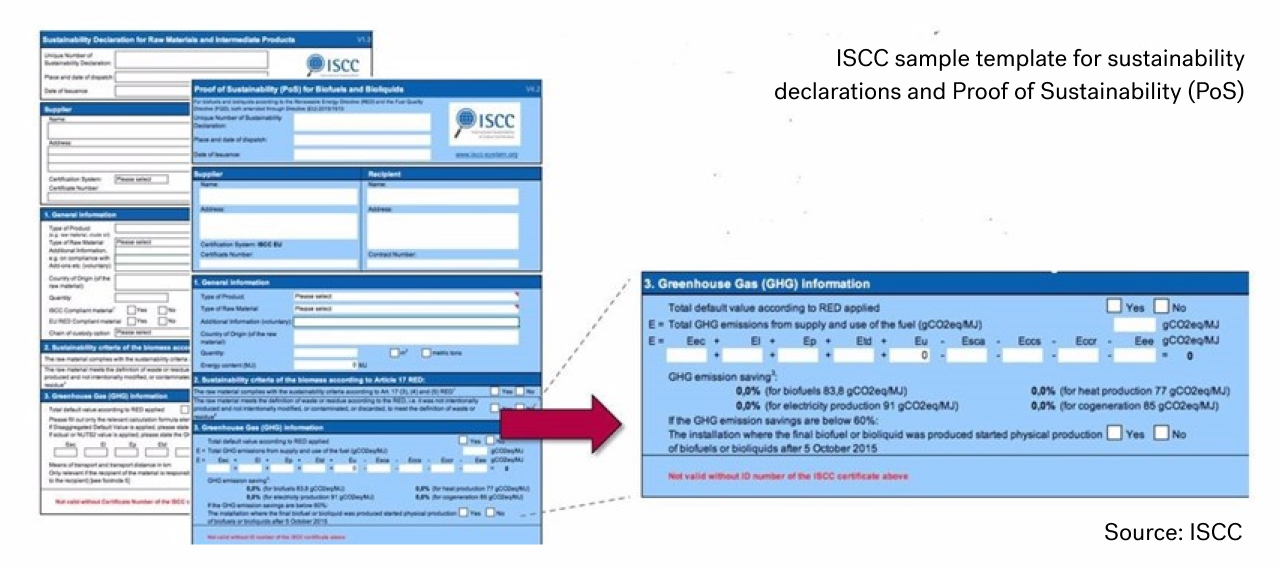

In order for shipowners to reduce their emissions exposure towards environmental regulations like the EU Emissions Trading System (EU ETS) and FuelEU Maritime, they can produce a Proof of Sustainability (PoS) document to confirm the sustainability of the bio-based components of their fuel. Integr8 is certified to pass on PoS from supplier to customer, ensuring compliance for global clients with ships operating within the EU.

Contacts:

Yusuff Shah, Australasia Trading Lead: yusuff@integr8fuels.com

Christopher Seidel, Business Manager: chris.s@integr8fuels.com

Integr8 Fuels invites stakeholders to embrace the new world of bunkering, at MEBC 2024

February 2, 2024

Integr8 Fuels will again participate in this year’s Middle East Bunkering Convention (MEBC), taking place in Dubai on 05-07 February 24.

Bunker Quality & Claims Manager, Chris Turner, will deliver a presentation on the new world of bunkering, exploring how stakeholders will have to evolve to deal with the commercial and technical challenges driven by decarbonisation and fuel quality. It is a matter of survival of the fittest; those who embrace change and those who do not.

Chris will also join an expert panel for Session 1. As geopolitical headwinds continue to impact the shipping industry, speakers in this opening session will consider how vessel trading patterns are being adapted in response to the current volatile economic climate, on a global scale and regionally. Is ‘deglobalisation’ set to become a future trend and how might this affect various vessel segments and bunkering?

Speakers will examine the current commercial pressures on bunker companies, including fuel prices, the availability of credit, bunker licensing, and fuel quality challenges. As margins have narrowed over the past year, this session will consider whether more industry consolidation is on the horizon. Are bunker companies having to become ‘leaner and fitter’ to stay ahead and how are they approaching issues such as staff recruitment and retention?

To learn more or to catch up with Chris at the event, hosted by Petrospot Limited, email marketing@integr8fuels.com.

Integr8 achieves ISCC EU certification to trade sustainable biofuels and help shipowners prove compliance.

December 19, 2023

Integr8 achieves ISCC EU certification to trade sustainable biofuels and help shipowners prove compliance with environmental regulations.

Integr8 Fuels has today announced they have been awarded certification from the International Sustainability and Carbon Certification (ISCC) scheme for the trading of biofuels. The news comes in advance of a raft of regulations from the EU designed to reduce greenhouse gas (GHG) emissions from shipping, which are due to come into effect in 2024 and 2025.

In order for shipowners to reduce their emissions exposure towards environmental regulations like the EU Emissions Trading System (EU ETS) and FuelEU Maritime, they will need to show that the low carbon fuels they consume are sustainable and meet the criteria defined in the EU’s Renewable Energy Directive (RED II).

As conventional ship engines can run on biofuels, they can have an edge over alternatives like LNG, which requires specialised engines. For biofuel suppliers, however, this market power comes with great responsibility. Biofuel suppliers and operators will have to provide a Proof of Sustainability (PoS) or similar documentation to verify the sustainability of feedstock and energy inputs.

ISCC is a global certification system that sets standards for sustainable production, sourcing and trade of all kinds of bio-based feedstocks and biofuels. A PoS follows a fuel batch throughout its whole supply chain with GHG estimates.

Integr8’s Bunker Quality and Claims Manager, Chris Turner, asserts why certification and documentation of this nature will be paramount in the evolving alternative fuels regime.

“Shipowners are turning to alternative fuels with significantly lower emissions than fossil fuels to trim the greenhouse gas emissions from their vessels. Alternative fuel suppliers must show that the bio-components in their fuels are sustainable and provide proof of that to their customers.

With ISCC EU certification, we are demonstrating our capability and commitment to trading biofuels that have been produced by ethical and sustainable practices, and importantly, we can provide the Proof of Sustainability that clients need to verify this with regulators. It provides an additional layer of trust and reassurance for our customers.

Without this documentation, then the biofuels, which are generally bought at premiums to conventional fuels, would not be counted in any emissions saving, counting the same as mineral fuels.”

Ultimately, the benefit of requiring documentation is twofold:

“Not only will certification ensure we are making meaningful strides towards decarbonising the industry, but it will also bring enhanced transparency and accountability to a historically opaque sector. I am hopeful that we will emerge a better and more professional industry as a result,” Chris explains.

Integr8’s ISCC EU certificate will enable the international bunker trading firm to pass on PoS for liquid and gaseous biofuels, including fatty acid methyl ester (FAME), hydrotreated vegetable oil (HVO) and liquefied biomethane (LBM).

Press Contact: Angela Freeth

Email: angela.f@integr8fuels.com

Tel: +44 (0) 207 467 5877

To see how we can assist you with your fuel procurement requirements, visit our Contact Us page.

Shipping navigates towards transparency amidst rise in alternative fuels

November 20, 2023

The shipping sector has come under increased scrutiny due to its environmental impact and lack of transparency in recent years. But it may “finally shift from the opacity (and endemic mistrust) of the past to a more professional, transparent and traceable future,” Integr8 Fuels bunker quality and claims manager Chris Turner writes in the company’s latest bunker quality report.

Need for change

Shipowners are turning to alternative fuels with significantly lower emissions than fossil fuels to reduce the greenhouse gas (GHG) emissions of their vessels. As technology advances, ships may eventually run on fuels with zero-emission potential such as ammonia or methanol.

For now though, biofuels and liquefied natural gas (LNG) are the most promising conventional fuel alternatives to meet upcoming emission intensity-reduction targets in the European Union’s FuelEU Maritime regulation and the International Maritime Organisations’ (IMO) revised GHG strategy. As conventional diesel engines do not require any modifications to run on biofuels, they have a competitive edge over LNG. For biofuel suppliers, however, this power comes with great responsibility.

Encouraging a culture of responsibility

With the EU’s Emissions Trading System including shipping from next year, and with FuelEU Maritime coming into effect from 2025, shipowners will have to report their fleets’ verified emissions to, from and between EU ports. Turner explains that alternative fuel suppliers must show that the bio-components in their fuels are sustainable and provide proof of that to their customers.

“If this is not possible then the alternative fuels, which are generally bought at premiums to conventional fuels, would not be counted in any emissions saving, counting the same as mineral fuels,” he says.

As a result, alternative fuel bunker buyers – especially biofuel consumers – will pay close attention to the feedstocks and well-to-wake emissions associated with these fuels. This is likely to compel suppliers to maintain and encourage transparency and traceability through their product supply chain.

“Of course, not all suppliers will embrace alternative fuels or mandatory mass flow meters (as recently announced in Rotterdam, Antwerp and Brugge ports),” Turner argues, “but those who do will quickly realise their tried and tested practices will be challenged by the end users who will demand they demonstrate and certify sustainability.”

Navigating towards transparency

Documentation will be paramount in the evolving alternative fuels regime, Turner argues.

The Bunker Delivery Note (BDN) issued by the marine fuel supplier must include the alternative fuel product and grade. For biofuels, bunker suppliers and operators will have to provide PoS or similar documentation to verify the sustainability of feedstock and energy inputs. The International Sustainability & Carbon Certification (ISCC) is globally recognised as an approved sustainability certificate.

ISCC is a global certification system that sets standards for sustainable production, sourcing and trade of all kinds of bio-based feedstocks and biofuels. A PoS will be passed on throughout the whole supply chain – from initial producer to end consumer. It evaluates the sourcing of raw materials, supply chain management, land use, GHG emissions and social aspects of various companies’ activities.

This could all lead to a “changing of the guard” in the bunker industry, Turner suggests. Stakeholders “from barge deck hand to buyer, and beyond” will need to be retrained to avoid ambiguity on the BDN for the verifier, according to Turner.

Unlike IMO 2020, which was an overnight shift to mostly low-sulphur fuels, the gradual shift to alternative fuels will give suppliers time to realign their efforts to meet evolving industry standards for transparency and sustainability.

Turner discusses this subject, and assesses trends related to biofuels and all conventional grades of marine fuels in the free Bunker Quality Trends Report (Q3-2023).

Press Contact: Angela Freeth

Email: Angela.f@integr8fuels.com

Tel: +44 207 467 5877

Integr8 Fuels launches Brazil office to service an increasingly dynamic South American market

October 26, 2023

Integr8 Fuels has this week opened a new office in Rio de Janeiro, Brazil. Integr8, which previously serviced South America from its US offices, says now is an ideal time to establish a local trading desk as the market is becoming increasingly dynamic following the sale of state-owned refineries in recent years.

Until two years ago, Petrobras owned the largest and almost all other local refineries in Brazil. It was the only physical bunker fuel oil supplier in the country, alongside other players that supplied the market exclusively with Marine Gas Oil (MGO).

The market has since evolved, and a year ago the first non-Petrobras bunker fuel oil delivery was made. Several physical bunker suppliers have made recent entries and brought fresh dynamism, more pricing opportunities and greater delivery flexibility to Brazil’s bunker market.

A more diverse field of fuel producers and bunker suppliers has unlocked new opportunities that buyers in the know stand to benefit from. The types of fuels available has expanded to include most of the top fuel oil and gasoil grades, and a selection of lower-carbon products. These supply chain developments are expected to help Brazilian ports compete with long-established bunkering ports worldwide.

Integr8 Fuels’ new trading desk is led by Lucas Oliveira, a Brazilian industrial engineer with a background in marine sales, trading, fuels distribution, new business development, and the commercial aviation market. With an MBA degree in Oil and Gas Management from Fundação Getulio Vargas and representing the 4th generation in his family to work in shipping, Lucas is excited to witness the latest developments in the sector.

“We are pleased to be closer to our clients in South America, offering on the ground support as they navigate a more complex and vibrant supply chain. With Integr8’s local and international market intelligence and expertise alongside them, clients will be well-supported to make the best of these new opportunities. And as the landscape continues to evolve, we’ll be strengthening both new and existing supplier relationships.” Lucas said.

In addition to providing access to all the main fuel grades, Integr8 continues to establish itself in the alternative fuels space.

“We’re geared up to assist clients in the move to lower carbon options and are strengthening our network coverage of lower carbon fuels such as biofuels and LNG.” Lucas added.

Interested parties are invited to reach out to Lucas directly.

Contact Lucas Costa de Oliveira:

Email: lucas.c@integr8fuels.com

Mobile: +55 (21) 9 7183 1991

Address: Rio de Janeiro/RJ – Brasil, Rua Visconde de Inhaúma, 37 Sala 801 – Centro

Robust regulation and licensing key to ensuring ARA’s mass flow meter mandate is a success

October 24, 2023

The initiative is a positive step towards much needed transparency, but scepticism remains without clarification of enforcement protocols.

On 19 October, the Port of Rotterdam and Antwerp-Bruges Port Authority officially confirmed that Mass Flow Metres (MFM) will become compulsory in Rotterdam, Antwerp and Brugge ports from January 2026. International bunker trading company Integr8 Fuels welcomed the announcement but emphasised that robust regulatory and enforcement protocols will prove critical in order to build confidence in the system.

A report from IBIA and BIMCO in May 22 showed that while strong support exists for licencing schemes, mass flow metering, and the transparency this brings between suppliers and receivers, only 80% of those surveyed trusted a correctly installed, certified, and used MFM.

Chris Turner, Bunker Quality & Claims Manager for Integr8 explained “The announcement is great news, but we must also commit to a transparent model strictly aligned to ISO 22192, with the ability to appropriately enforce and sanction. Without this, even with Mass Flow Meters being mandatory in these ports, endemic mistrust will remain, and the opaque nature of supply will persist in the eyes of many.”

Singapore – The Gold Standard

Singapore’s MFM roll-out could serve as a model for the ARA, Chris points out. The best practices achieved in Singapore was a result of an industry-wide initiative and has been underpinned by government support and regulatory enforcement.

Singapore’s approach has been to strive for best practice and deal with poor performance. Its MFM system reduces the chance of manipulation through the following measures:

• A robust Maritime and Port Authority of Singapore approval process

• Application of the SS 524:2021 quality management standard

• Sampling at the vessel manifold

• Traceable calibration

• Consistent documentation

Supported by robust enforcement, the model encourages dispute reporting and performance reviews, with demerit points and possible loss of licenses as penalties for non-compliance.

Licensing Benefits – Improved Compliance

Integr8 data shows that in the last 180 days there were significantly fewer quantity claims in Singapore than the global average (0.9% of Singapore volume vs 1.6% globally).

Chris continued: “Let’s not forget, many of the alternative fuels will be even more expensive, exacerbating potential hidden losses. With carbon taxes and emission trading schemes approaching, it’s even more important for fuel users to have reliable data and the use of MFMs contribute to that.”

Not only do MFMs significantly reduce the likelihood of hidden loses, but the numbers continue to support licenced MFMs when it comes to VLSFO sulphur compliance. Data available to Integr8 shows that Singapore’s system appears to go a long way in lowering the chance of sulphur over 0.50% being reported (a x6 reduction compared to ARA), and allegations of sulphur breaching the carriage ban (also a x6 reduction compared to ARA).

All this suggests that if a commitment is taken to drive the quality systems to the right level, MFMs and licencing can have a significant benefit to disputes, hidden losses and quality issues, including critical MARPOL non-compliance.

“We have a super chance to make a lasting difference in the supply landscape, let’s seize it.” Chris concluded.

Contact Chris Turner:

Email: chris.t@integr8fuels.com

Dubai Tel: +971 4424 0700

Dubai Address: 2901 Silver Tower, Cluster I P.O. Box 214434, Jumeirah Lake Towers, Dubai

Integr8 sees spot LNG bunker demand pick up in evolving market

October 19, 2023

Integr8 Fuels’ LNG desk has recently traded several LNG stems as a volatile market encourages buyers to seek spot deals to manage their price risk.

LNG bunkering is typically more complex than bunkering of conventional fuels. It requires a very good understanding of the operational, commercial and contractual aspects of LNG deliveries, and Integr8 has been helping several clients through the purchasing process.

Volatility spurs spot trading

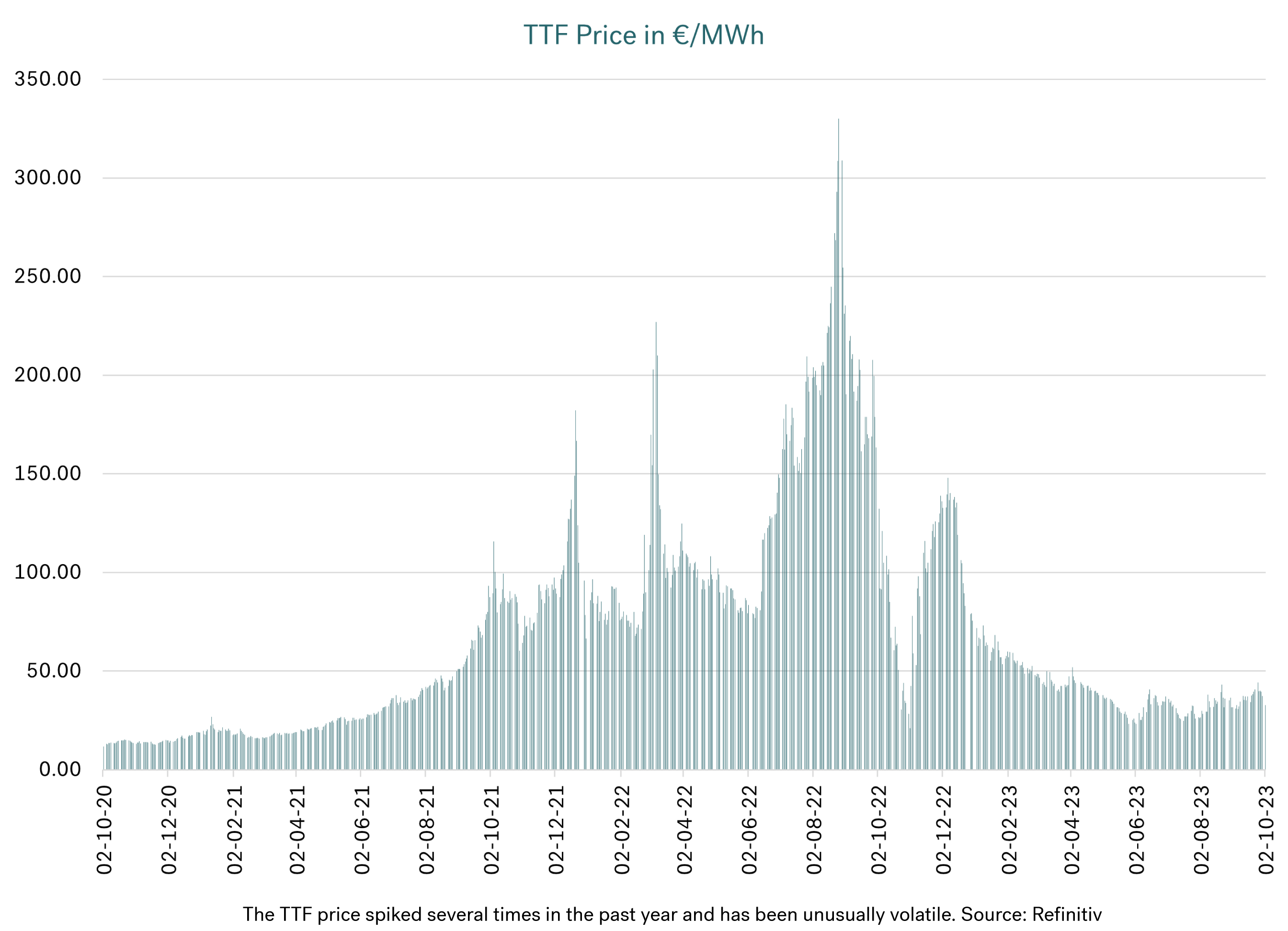

When strike action was announced by workers at two Chevron LNG plants in Australia, it sent shockwaves through the LNG market in September. While these plants primarily produce LNG for exports to Asian markets, the impact on prices was global and Europe’s benchmark TTF price surged on the news. The market feared global supply disruptions in an interconnected LNG supply chain. And this shows just how sensitive the global supply-demand balance has been to supply disruptions after Russia invaded Ukraine.

Volatile LNG prices are here to stay for the time being, but are expected to come down and stabilise at a lower level after 2025, argues Integr8 Fuels business manager Jonathan Gaylor. “We forget that before Russia’s war with Ukraine, LNG prices were competitive against conventional marine fuels and rather stable,” he says.

LNG was priced below €500/mt in Rotterdam’s bunker market until December 2021, when it had risen gradually for about a year. When Russia invaded Ukraine in late February, it started gathering pace and rose rapidly to new highs. A year later, the price had quintupled and peaked at over €2,500/mt. It had gone from a discount to VLSFO to a three-fold premium, and this discouraged owners of dual-fuel vessels from bunkering LNG. Their fuel flexibility came on display and the market saw widespread gas-to-oil switching.

Rotterdam’s LNG price has since come off sharply. It has dipped below LSMGO and traded at parity with VLSFO. Buyers have subsequently readjusted to take advantage of the renewed pricing opportunities, and oil-to-gas switching has become more prevalent again.

LNG and conventional low-sulphur marine fuels alternate between being at a discount to one another. This discourages terming up supply in contracts and has increasingly turned buyers towards the spot market to manage their price risks and costs on a more predictable near-term basis.

A highly volatile and competitive market presents new opportunities for traders to get involved, particularly as the global LNG-capable fleet is set to more than double from just over 400 vessels now to more than 800 by 2028, according to data from classification society DNV.

Container vessels used to make up the vast majority of vessels bunkering LNG. We have recently seen more dual-fuel tramp vessels bunkering. These typically require greater flexibility in timing and location, especially for tankers. Oil and chemical tankers now make up the biggest LNG-capable vessel type, with 116 vessels in operation and another 85 on order, according to DNV data.

Price references vary between suppliers and geographies. It is quite common to link LNG stem pricing to established wholesale oil and gas benchmarks like TTF, JKM, Henry Hub and Brent to cover some exposure to price swings.

There are longer-term Brent or fuel oil price linkage options for LNG, but they will typically come at a premium for buyers. By locking in the delta on a linked price of a certain percentage, LNG prices will have a partial ceiling based on conventional fuels and buyers can pay down the premiums they paid for investments in dual-fuel engines. The rate of payback on dual-fuel vessels is expected to pick up after 2026 as global LNG supply is set to be boosted by huge new volumes from Qatar and the US, according to multiple industry forecasts.

Challenges remain

LNG stems still require longer time to fix and deliver than conventional ones and this is also probably how things will play out in the foreseeable future. In many cases, compatibility studies between delivering and receiving vessels need to be performed to ensure safe and smooth deliveries.

Integr8 has the knowledge and network to identify competitive suppliers and advice buyers on how best to streamline the bunkering process. Having an overview of and ready access to supply intelligence can certainly help to make the bunker planning and delivery process more efficient for buyers.

Outlook

- Gas prices could easily rise on increased heating demand this winter, but will then likely come down again post winter. Especially if this winter proves that there is sufficient supply in Europe and industrial demand remains subdued.

- The global LNG-fuelled fleet is projected to grow faster than the LNG bunker fleet is expanding. This could lead to undersupply of bunker vessels in 2025-2026, when bunker demand is on track to rise above supply capacity and LNG prices become competitive. It could pose challenges to tramp trading vessels looking for timely LNG spot bunker deliveries.

- Looking further ahead, global gas supply is set to rise with production gains in Qatar and the US. Qatar is in the process of a major expansion of its North Field and two new LNG export terminals. A surge in exports is expected to boost US gas investments and production capacity to new highs over the next decade, with Europe as a key outlet.

Contact the Integr8 Fuels LNG bunker desk:

Email: LNG@integr8fuels.com

Tel: +44 20 7943 5408

Address: Zig Zag Building, 70 Victoria St, London SW1E 6SQ, UK