East of Suez Market Update 2 Oct 2025

Most prices in East of Suez ports have moved up, while VLSFO and LSMGO remain readily available at Malaysia’s Port Klang.

IMAGE: Dense rows of vessels on the waters of Singapore. Getty Images

IMAGE: Dense rows of vessels on the waters of Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($7/mt), unchanged in Singapore, and down in Zhoushan ($4/mt)

- LSMGO prices up in Singapore ($4/mt), Fujairah ($3/mt) and Zhoushan ($1/mt)

- HSFO prices up in Fujairah ($5/mt) and Zhoushan ($2/mt), and down in Singapore ($4/mt)

- B24-VLSFO at a $252/mt premium over VLSFO in Singapore

- B24-VLSFO at a $255/mt premium over VLSFO in Fujairah

LSMGO prices across the three major Asian bunker hubs have moved within a narrow range, rising by $1-4/mt over the past day. In Singapore, securing very prompt deliveries of the grade can be difficult, with recommended lead times now at 4–8 days, up from 3–6 days last week.

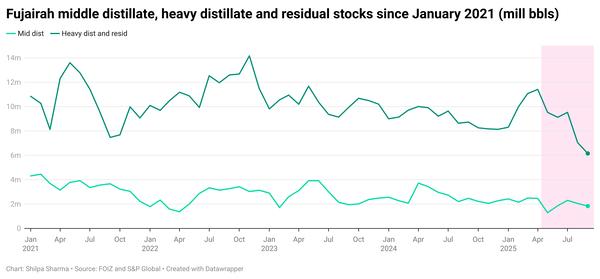

As for Fujairah, prompt bunker supply for all grades remains tight, with lead times of 5-7 days recommended.

The port's HSFO price has seen a slight increase over the past session, aided by a higher-priced HSFO stem fixed at the port. Meanwhile, a sharper rise in the port's VLSFO price has slightly widened its Hi5 spread to $70/mt.

Over at Malaysia’s Port Klang, VLSFO and LSMGO are readily available, with prompt supply possible for smaller parcels.

Brent

The front-month ICE Brent contract has extended its losing streak and inched lower by $0.36/bbl on the day, to trade at $65.44/bbl at 17.00 GMT (09.00 GMT).

Upward pressure:

The US dollar has come under pressure after the US government shutdown, sliding to a two-week low in trade yesterday.

When the US dollar weakens against other currencies, it becomes cheaper for foreign buyers to purchase oil. This can encourage more purchases and put upward pressure on Brent.

“…because oil is a global market and we’re seeing better-than-expected demand in China, global inventories that are tight, and continuing geopolitical risks, the supply side is not headed towards a glut, and we have a market that at the very best is in balance or is headed to a supply deficit in the coming months,” Phil Flynn, a senior analyst at Price Futures Group said, suggesting possible tailwinds for Brent in the near-term.

Downward pressure:

An unexpected build in US commercial crude inventories has added further downward pressure on Brent.

Official data from the US Energy Information Administration (EIA) showed stocks rising by 1.8 million bbls to around 417 million bbls, compared with industry body American Petroleum Institute’s forecast of a 3.7-million-bbl draw.

Concerns over a looming oversupply continue to dampen market sentiment.

Multiple media reports cited sources that OPEC+ could lift production by 500,000 b/d – either in November or spread over the next three months.

The OPEC Secretariat has refuted those specific reports, but Iraq has now confirmed its own plans to increase output.

Iraq plans to raise domestic oil production from 4.4 million b/d to 5.5 million b/d by the end of 2025, Iraq’s oil minister, Hayyan Abdul Ghani, told Kurdish broadcaster Rudaw. The announcement follows the resumption of crude flows from Kurdistan oil fields to Turkey, which at full capacity could add around 400,000 b/d back to the market.

By Shilpa Sharma and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.