East of Suez Market Update 1 Oct 2025

Prices in East of Suez ports have moved in mixed directions, and securing prompt deliveries can be difficult in Fujairah.

IMAGE: Harbour craft in front of an oil tanker in Fujairah. Port of Fujairah

IMAGE: Harbour craft in front of an oil tanker in Fujairah. Port of Fujairah

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($12/mt), Fujairah ($6/mt) and Singapore ($5/mt)

- LSMGO prices down in Zhoushan ($15/mt), Singapore ($13/mt) and Fujairah ($7/mt)

- HSFO prices up in Fujairah ($8/mt), unchanged in Zhoushan, and down in Singapore ($9/mt)

- B24-VLSFO at a $233/mt premium over VLSFO in Singapore

Fujairah’s VLSFO price has declined in the past day, while its HSFO price has increased, narrowing the port’s Hi5 spread by $14/mt to $68/mt.

The increase in Fujairah’s HSFO price has brought the port to parity with Singapore, from a $17/mt discount. The UAE port’s benchmark remains at a discount of $25/mt to Zhoushan.

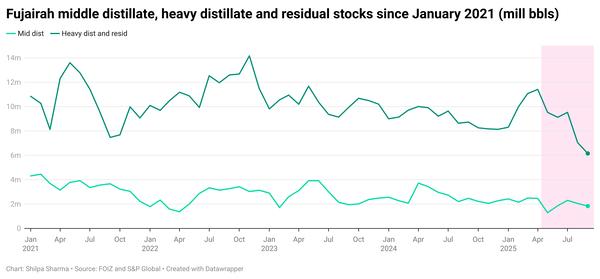

Prompt bunker supply remains tight in Fujairah across all grades, with recommended lead times of 5–7 days. Some suppliers can handle urgent requests, but these typically come at a premium. Most suppliers in Fujairah are not fixing bigger stems due to tight supply, a source said.

Operations across China are expected to stay subdued during the Golden Week holidays (1–8 October), as most suppliers will only fulfill pre-booked stems.

Though VLSFO prices across the three major Asian bunker hubs have declined in the past day, China's Zhoushan recorded the steepest fall. Bunker demand in Zhoushan remains weak.

Brent

The front-month ICE Brent contract has slumped for the third straight day, this time $1.57/bbl lower on the day, to trade at $67.37/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The American Petroleum Institute (API) has estimated a 3.7-million-bbl draw in US crude stocks on the week, which could mark its third straight weekly drop. The official US Energy Information Administration's weekly data is due to be released today.

China "continues to stockpile crude oil," the International Energy Agency noted in September. Coupled with recent improvements in industrial output, this could theoretically indicate that China's oil appetite will remain firm in the near-term, lending some support to Brent.

JPMorgan does not see any signs of global oil demand “slowing down structurally” in the near future, Natasha Kaneva, head of global commodities research at the private bank said in a podcast.

Domestic airline activity in China, broader Asia, Europe and the Middle East as well as port activities in the US remains strong, which is “very, very supportive for the demand numbers”, Kaneva added.

Downward pressure:

OPEC+ members could boost production by 500,000 b/d over the next three months, Bloomberg has reported citing a delegate.

Reuters has also reported that the group could hike output by 500,000 b/d in November, citing three sources.

The OPEC Secretariat has quashed such reports, calling it “inaccurate and misleading” and has urged media restraint to avoid “fuelling unnecessary speculation” in the market.

But if confirmed, such an increase will “increase the scale of the surplus through the fourth quarter of this year and next year,” ING’s head of commodity strategy, Warren Patterson noted.

OPEC+'s expected rise in production output in November, Iraq's resumption of Kurdish oil flows and rising non-OPEC+ production have fuelled fears of a global oil glut, keeping the price under pressure.

By Shilpa Sharma and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.