East of Suez Fuel Availability Outlook 30 Sep 2025

Bunker demand low in Zhoushan

Prompt bunker supply tight in Fujairah

VLSFO and LSMGO availability good across Taiwanese ports

IMAGE: Heavy cranes at Ningbo-Zhoushan port. Getty Images

IMAGE: Heavy cranes at Ningbo-Zhoushan port. Getty Images

Singapore and Malaysia

Securing prompt bunker deliveries can be difficult in Singapore this week. Lead times of 7-10 days are recommended for VLSFO and 8-10 days for HSFO, largely unchanged from last week. Lead times for LSMGO have increased to 4-8 days from 3-6 days last week.

Residual fuel oil stocks in Singapore have averaged 1% lower so far this month than in August, according to data from Enterprise Singapore. The port has recorded a 21% fall in net fuel oil imports this month. Imports have fallen by 1.68 million bbls, while exports have decreased by 903,000 bbls. Most of this month’s fuel oil imports have come from the UAE (15%), Russia (12%) and Malaysia (8%), according to data from cargo tracker Vortexa.

In contrast, middle distillate stocks at the port have averaged 3% higher so far this month.

At Malaysia’s Port Klang, VLSFO and LSMGO are readily available, with prompt supply possible for smaller parcels. Supply of HSFO remains tight.

East Asia

Bunker demand in Zhoushan remains weak, with recommended lead times of around 10 days for all grades. Fuel availability is said to be normal, but demand is expected to stay low this week across most Chinese ports due to the holiday season.

Operations across China are expected to stay subdued during the Golden Week holidays (1–8 October), as most suppliers will only fulfill pre-booked stems. New bookings will not be accepted for deliveries before 10 October, according to a source.

While conducive weather conditions are forecast in Zhoushan this week, strong winds and moderate rains are expected in Qingdao between 2-5 October, according to China’s National Meteorological Center.

In Hong Kong, securing prompt supply can be difficult. Lead times of around seven days are advised for all grades to ensure good coverage from suppliers.

Taiwan’s Central Weather Administration lifted its warning for Typhoon Ragasa last week, and weather conditions are forecast to remain conducive for bunkering across most Taiwanese ports this week.

Bunker supply is stable in Taiwan. VLSFO and LSMGO deliveries can typically be arranged within two days in Keelung and Hualien, while up to four days are required for deliveries in Taichung and Kaohsiung.

Bunker fuel availability is currently tight in South Korea. HSFO and LSMGO require lead times of 9-10 days for delivery at both western and southern ports, while VLSFO supply remains subject to enquiries.

Prompt supply of VLSFO remains tight across Japan’s key ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Mizushima, Nagoya and Yokkaichi. LSMGO is generally well supplied nationwide, though deliveries in Mizushima and Oita may still face delays.

B24-VLSFO is available only on an enquiry basis at Tokyo, Chiba, Kawasaki and Yokohama. HSFO supply is stable at most ports, but Oita is facing shortages of all three grades — VLSFO, LSMGO and HSFO.

Oceania

In Western Australia, bunker supply is stable. VLSFO and LSMGO grades require lead times of around seven days for deliveries at Kwinana and Fremantle. Deliveries are typically made by barge from a single supplier, while LSMGO can also be supplied by truck.

Overall, in Australia, a seven-day lead time is recommended, although most suppliers can make deliveries within 3–4 days due to generally good availability.

South Asia

Prompt bunker supply has tightened in the Sri Lankan ports of Colombo and Hambantota. Lead times of about 10 days are recommended for all grades in both the ports, a supplier said.

Middle East

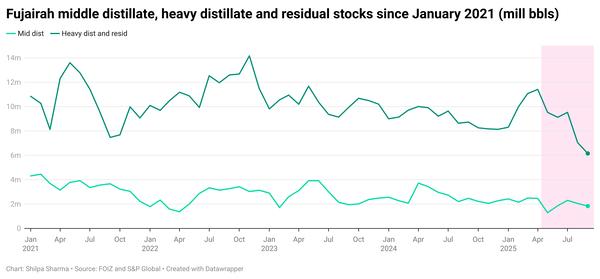

Prompt bunker supply remains tight in Fujairah across all grades, with recommended lead times of 5–7 days. Some suppliers can handle urgent requests, but these typically come at a premium. Most suppliers in Fujairah are not fixing bigger stems due to tight supply, a source said.

In Iraq’s Basrah, VLSFO and LSMGO are readily available, though HSFO supply remains constrained.

Saudi Arabia’s Jeddah continues to face limited availability of VLSFO. Supply of LSMGO has improved since last week, with prompt deliveries possible now.

Egypt’s Port Suez is facing severe shortages of VLSFO, LSMGO and HSFO, with stocks nearly depleted.

Qatar’s Ras Laffan is also struggling with tight availability of VLSFO and LSMGO grades.

Bunker availability remains tight in Djibouti, with VLSFO and HSFO almost exhausted and LSMGO in short supply.

Supply of LSMGO is currently tight in Oman’s Duqm port.

By Shilpa Sharma

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.