East of Suez Market Update 30 Sep 2025

Most prices in East of Suez ports have fallen, and bunker demand remains weak in Zhoushan.

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($18/mt), Fujairah ($5/mt) and Singapore ($4/mt)

- LSMGO prices down in Fujairah ($15/mt), Zhoushan and Singapore ($9/mt)

- HSFO prices up in Fujairah ($3/mt), and down in Zhoushan ($9/mt) and Singapore ($8/mt)

- B24-VLSFO at a $241/mt premium over VLSFO in Singapore

- B24-VLSFO at a $239/mt premium over VLSFO in Fujairah

VLSFO prices across the three major Asian bunker hubs have declined in the past day, with Zhoushan seeing the steepest fall. The sharp drop in Zhoushan’s VLSFO price has narrowed its premium over Singapore by $14/mt to $17/mt, and over Fujairah by $13/mt to $19/mt.

Bunker demand in Zhoushan remains weak, with recommended lead times of around 10 days for all grades. Fuel availability is said to be normal, but demand is expected to stay low this week across most Chinese ports due to the holiday season.

Operations across China are expected to stay subdued during the Golden Week holidays (1–8 October), as most suppliers will only fulfill pre-booked stems. New bookings will be accepted for deliveries after 10 October, according to a source.

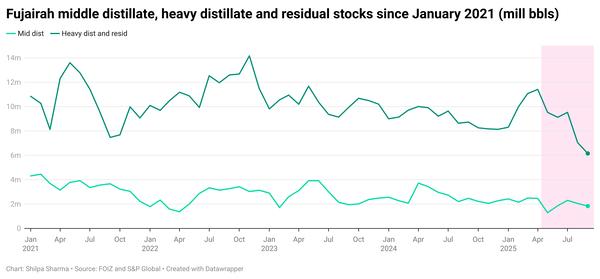

In Fujairah, the VLSFO price has decreased some in the past day, while the HSFO price has inched up. These price moves have narrowed the port’s Hi5 spread by $8/mt to $82/mt now.

Brent

The front-month ICE Brent contract has declined even further by $2.07/bbl on the day, to trade at $67.37/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The purchasing managers' index (PMI) for China's manufacturing sector has climbed to 49.8 in September, from 49.4 in August, China’s state-media Xinhua reported, citing official data.

"The figure showed that in September, production activities in the manufacturing sector accelerated, with the overall business climate continuing to improve," Huo Lihui, chief statistician with China’s National Bureau of Statistics, told Xinhua.

Higher industrial output typically requires more oil for power generation, refining and transport. An improvement in China’s output could suggest that its domestic oil demand is unlikely to ease in the near term, adding upward pressure on Brent.

Downward pressure:

Eight OPEC+ members will meet online on 5 October and potentially decide to increase the group’s combined output by at least 137,000 b/d in November, according to Reuters.

Iraq’s Kurdistan region has resumed crude exports to Turkey. This can potentially restore up to 400,000 b/d of supply that had been offline for more than two years and add more volume to global supplies.

The International Energy Agency (IEA) expects non-OPEC+ production to rise this year, with the US, Brazil, Canada, Guyana and Argentina projected to add around 1.4 million b/d in 2025.

This rise in production will add even more barrels to the global oil market and push Brent’s price even lower.

“We expect the market to move into a large surplus in the fourth quarter and remain in surplus through 2026. As a result, we expected oil prices to come under significant pressure over the course of next year,” ING’s head of commodity strategy, Warren Patterson has noted.

By Shilpa Sharma and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.