East of Suez Market Update 19 Sep 2025

Prices in East of Suez ports have moved down, and prompt VLSFO supply is tight across several Japanese ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($10/mt), Singapore ($8/mt) and Fujairah ($6/mt)

- LSMGO prices down in Zhoushan ($17/mt), Singapore ($12/mt) and Fujairah ($11/mt)

- HSFO prices down in Singapore ($6/mt), Zhoushan ($4/mt) and Fujairah ($3/mt)

- B24-VLSFO at a $235/mt premium over VLSFO in Singapore

- B24-VLSFO at a $249/mt premium over VLSFO in Fujairah

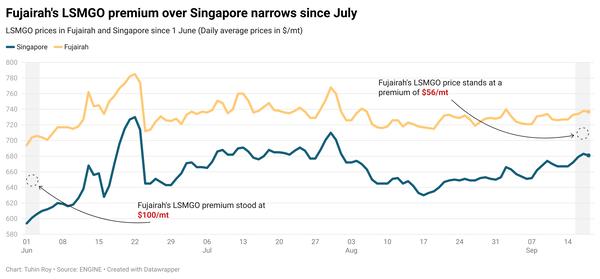

VLSFO benchmarks across the three major Asian bunker ports have fallen within a narrow band of $6–10/mt over the past day. In Singapore, VLSFO is priced at a $22/mt discount to Zhoushan and is trading at near parity with Fujairah.

Availability in Singapore has improved, with recommended lead times now at 7–10 days, compared to last week when supplier delivery times ranged from 8 days to nearly two weeks.

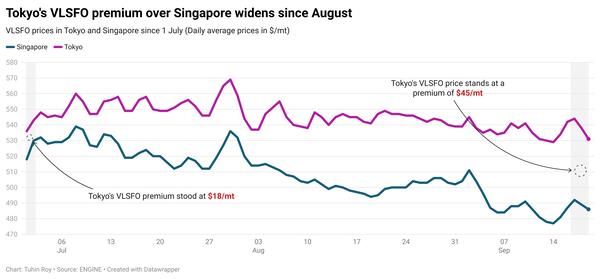

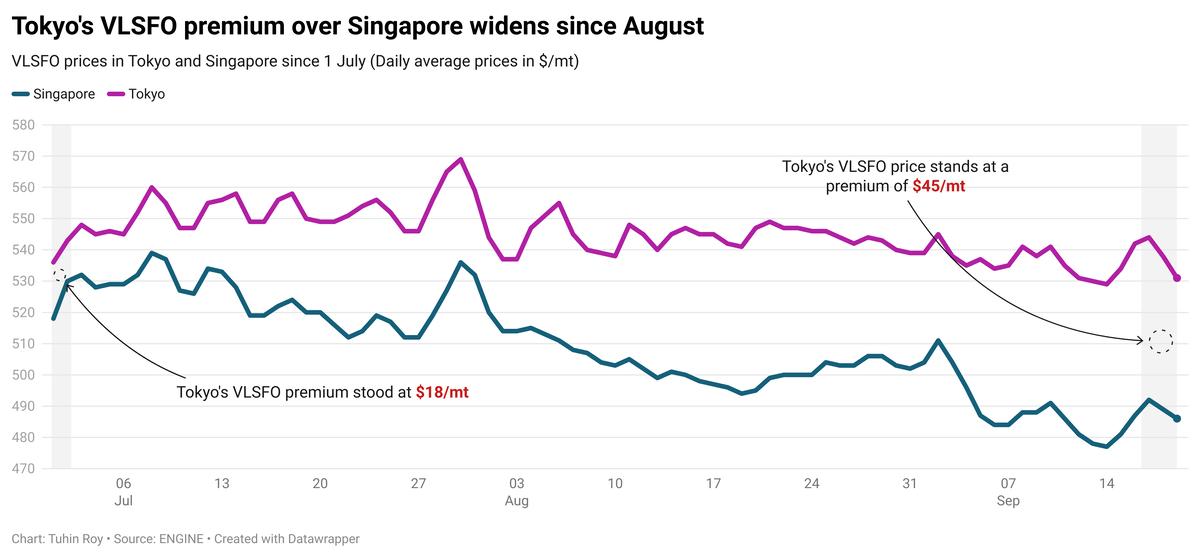

In Japan, Tokyo continues to price VLSFO at elevated levels, carrying a $45/mt premium to Singapore.

VLSFO supply remains tight across key ports including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Mizushima, Nagoya, and Yokkaichi. LSMGO supply is generally sufficient nationwide, though prompt deliveries in Mizushima may still face delays.

B24-VLSFO availability in Tokyo, Chiba, Kawasaki, and Yokohama remains limited to enquiry-based supply. HSFO availability is steady across most Japanese ports, but Oita is experiencing shortages in all three grades — VLSFO, LSMGO, and HSFO.

Brent

The front-month ICE Brent contract has dropped by $0.92/bbl on the day, to trade at $67.13/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has found little support after the US Federal Reserve (Fed) cut interest rates by 25 basis points earlier this week, to a range between 4-4.25%.

The announcement marked the first interest rate cut in 2025. Market analysts expect the US central bank to make more cuts in this year.

“Monetary policy easing cycles have traditionally been positive periods for commodity markets,” remarked ANZ Bank’s senior commodity strategist Daniel Hynes.

Lower US interest rates can spur demand by making dollar-priced oil cheaper for foreign buyers.

Downward pressure:

Downside risks to global oil supply have continued to push prices lower, according to market analysts.

The oil market’s biggest concern right now is a looming glut, expected by year-end and into 2026, as OPEC+ members steadily restore production.

Earlier this month, the Saudi Arabia-led coalition agreed to collectively increase supply by 137,000 b/d in October.

OPEC+ members introduced two voluntary output cuts in 2023 – 1.65 million b/d in April and 2.2 million b/d in November.

The group plans to fully unwind the 2.2 million b/d reduction this month, while the latest decision begins phasing out the April cut.

“A broader narrative of an impending global oil surplus is capping the upside,” said VANDA Insights’ founder and analyst Vandana Hari.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.