East of Suez Market Update 18 Sep 2025

Prices in East of Suez ports have moved in mixed directions, and LSMGO availability is good in several Omani ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($4/mt) and Singapore ($3/mt), and unchanged in Zhoushan

- LSMGO prices up in Zhoushan ($9/mt), Singapore and Fujairah ($6/mt)

- HSFO prices up in Fujairah ($4/mt), unchanged in Zhoushan, and down in Singapore ($1/mt)

- B24-VLSFO at a $236/mt premium over VLSFO in Singapore

VLSFO prices have remained largely rangebound across the three main Asian bunker hubs, with no major fluctuations. Fujairah's VLSFO price is at a discount of $27/mt to Zhoushan and $3/mt to Singapore.

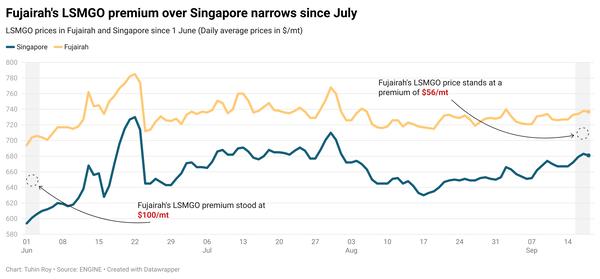

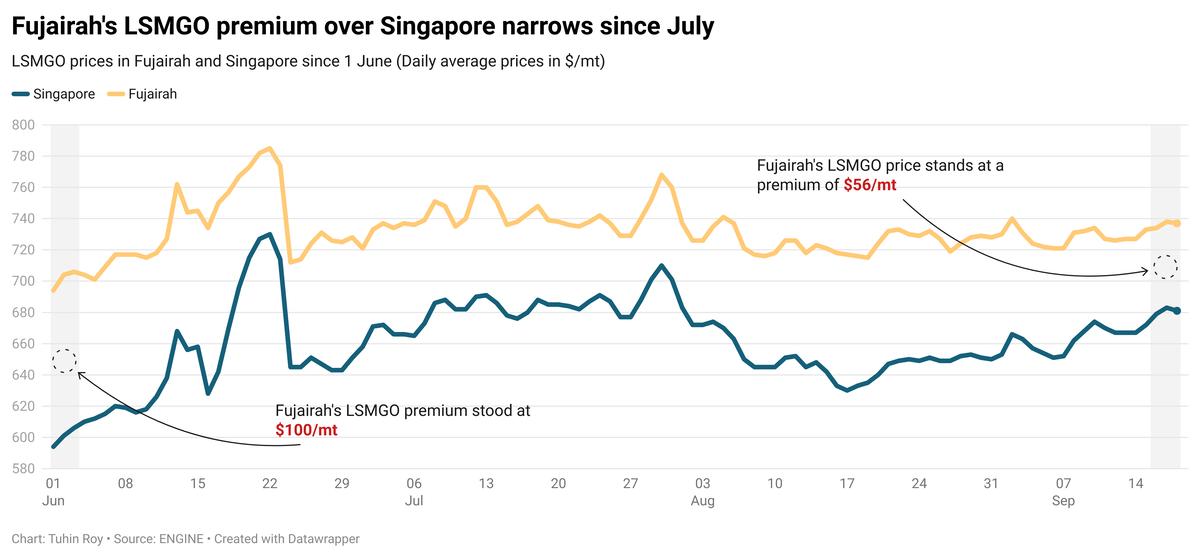

LSMGO prices in the three ports have inched higher within a narrow band of $6–9/mt, with Zhoushan recording the sharpest increase. Fujairah’s LSMGO is at premiums of $56/mt and $47/mt over Singapore and Zhoushan, respectively.

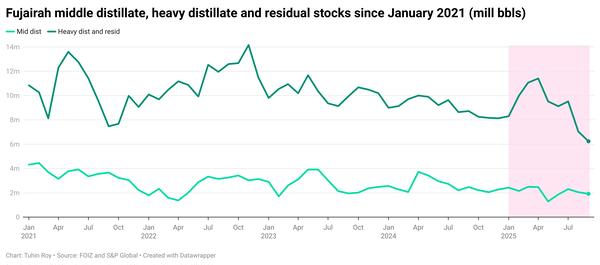

Prompt bunker availability in Fujairah remains tight across all grades, with lead times recommended at 5–7 days.

By contrast, Oman’s ports — including Sohar, Salalah, Muscat and Duqm — continue to offer stable LSMGO supply. In Singapore, LSMGO availability has also improved, with the delivery window shortening to 4–8 days from 5–10 days last week.

Brent

The front-month ICE Brent contract has gained by $0.02/bbl on the day, to trade at $68.05/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

A big inventory draw in the US and interest rate cut by the US Federal Reserve have put upward pressure on Brent’s price today.

Commercial US crude oil inventories have declined by 9.3 million bbls to touch 415 million bbls for the week ending 12 September, according to data from the US Energy Information Administration (EIA).

“The drop [in US crude stocks] comes as exports almost doubled from the week before, while imports fell,” remarked two analysts from ING Bank.

A drop in US crude stocks typically signals higher demand and can lend support to Brent's price.

Additionally, the US Federal Open Market Committee (FOMC) cut its key interest rate by 25 basis points yesterday, to a range between 4.00-4.25%.

The move was “widely expected,” ING Bank’s analysts said. This marks the first interest rate cut in 2025. Lower US interest rates can spur demand by making dollar-priced oil cheaper for foreign buyers.

Downward pressure:

Brent’s price has felt some downward pressure as market participants remain focused on the supply glut expected by the end of this year.

Notably, the International Energy Agency (IEA) has projected the global oil market to remain oversupplied, with supply growth outpacing global oil demand in both 2025 and 2026.

The IEA now expects global oil supply to grow by 2.7 million b/d to average 105.8 million b/d in 2025 and rise by another 2.1 million b/d to average about 107.9 million b/d in 2026.

The energy agency sees “muted demand growth,” due to limited consumption in emerging economies and declining demand in industrialised nations, according to ING Bank’s analysts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.