East of Suez Market Update 17 Sept 2025

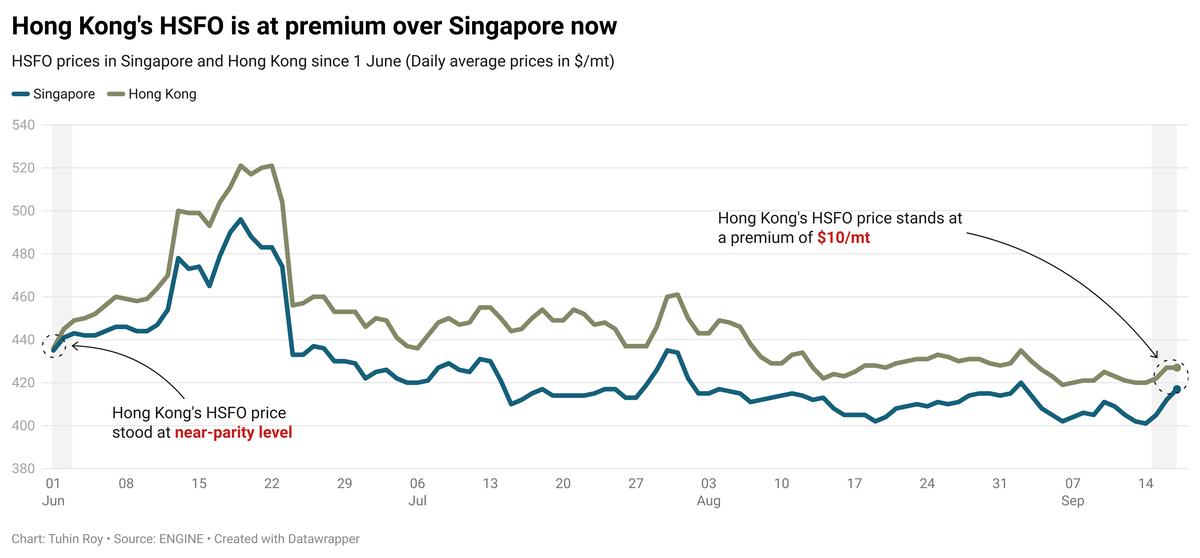

Prices in East of Suez ports have moved up, and availability of all grades is good in Hong Kong.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($24/mt), Singapore ($10/mt) and Fujairah ($6/mt)

- LSMGO prices up in Zhoushan ($9/mt), Singapore ($7/mt) and Fujairah ($6/mt)

- HSFO prices up in Singapore ($9/mt), Zhoushan ($5/mt) and Fujairah ($2/mt)

- B24-VLSFO at a $252/mt premium over VLSFO in Singapore

VLSFO benchmarks across the three main Asian bunker ports have risen sharply by $6–24/mt in the past day. Singapore’s VLSFO price is at a $27/mt discount to Zhoushan and holds a marginal $4/mt premium over Fujairah.

Among the three ports, Singapore recorded the steepest increase in HSFO prices of $9/mt. The rise was supported by two higher-priced stems fixed in the port. Singapore’s HSFO now trades at a $31/mt premium over Fujairah but remains at a $20/mt discount to Zhoushan.

HSFO availability in Singapore is steady, with lead times unchanged at 8–12 days.

VLSFO availability in Singapore has improved, with recommended lead times at 7–10 days, compared with last week’s wider range of 8 days to nearly two weeks. LSMGO supply has also strengthened, with delivery windows narrowing to 4–8 days from 5–10 days previously.

Meanwhile, Hong Kong continues to price HSFO at a $10/mt premium over Singapore, with lead times steady at around seven days for all grades.

Brent

The front-month ICE Brent contract has gained by $0.95/bbl on the day, to trade at $68.03/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has moved higher after the American Petroleum Institute (API) reported a drop in US crude stocks.

US crude oil inventories dropped by 3.42 million bbls in the week ending 12 September, according to API estimates cited by Trading Economics.

The API data was “in contrast to the average market expectations of a build of 1.07m barrels [1.07 million bbls],” remarked two analysts from ING Bank.

A drop in US crude stocks typically indicates higher demand in the world’s largest oil-consuming nation and can lend support to oil prices.

Geopolitical flare-ups have also continued to support Brent today. Overnight, Israel launched an attack on Yemen’s port city of Hodeida, the Associated Press (AP) reported.

The strike “threatens to escalate the conflict in the region and endanger crude oil supplies,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

A sharp rise in Brent’s price has been capped as the market shifts its focus to the US Federal Reserve’s (Fed) meeting, which concludes later today.

The meeting is seen as highly pivotal, with the US central bank expected to decide whether to maintain current interest rates or implement a cut, according to market analysts.

Higher interest rates in the US can dampen demand growth and make dollar-denominated commodities like oil more expensive for holders of other currencies.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.