East of Suez Market Update 21 Aug 2025

Most prices in East of Suez ports have inched up, and availability of VLSFO and LSMGO remains tight in several Indian ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($4/mt) and Singapore ($2/mt), and unchanged in Fujairah

- LSMGO prices up in Fujairah ($10/mt), Singapore ($8/mt) and Zhoushan ($4/mt)

- HSFO prices up in Fujairah ($4/mt) and Singapore ($3/mt), and unchanged in Zhoushan

- B24-VLSFO at a $225/mt premium over VLSFO in Singapore

- B24-VLSFO at a $252/mt premium over VLSFO in Fujairah

VLSFO benchmarks across the three major East Asian ports have stayed largely rangebound over the past day, with no significant changes. In Zhoushan, VLSFO is trading at premiums of $25/mt to Fujairah and $15/mt to Singapore.

Lead times for VLSFO in Zhoushan have extended to 6–10 days, up from 5–8 days last week, even amid subdued demand, as suppliers face low inventories and delayed replenishment cargoes, according to a source.

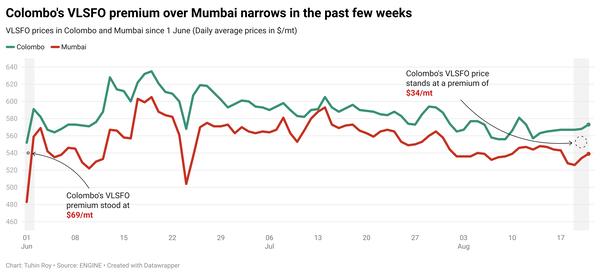

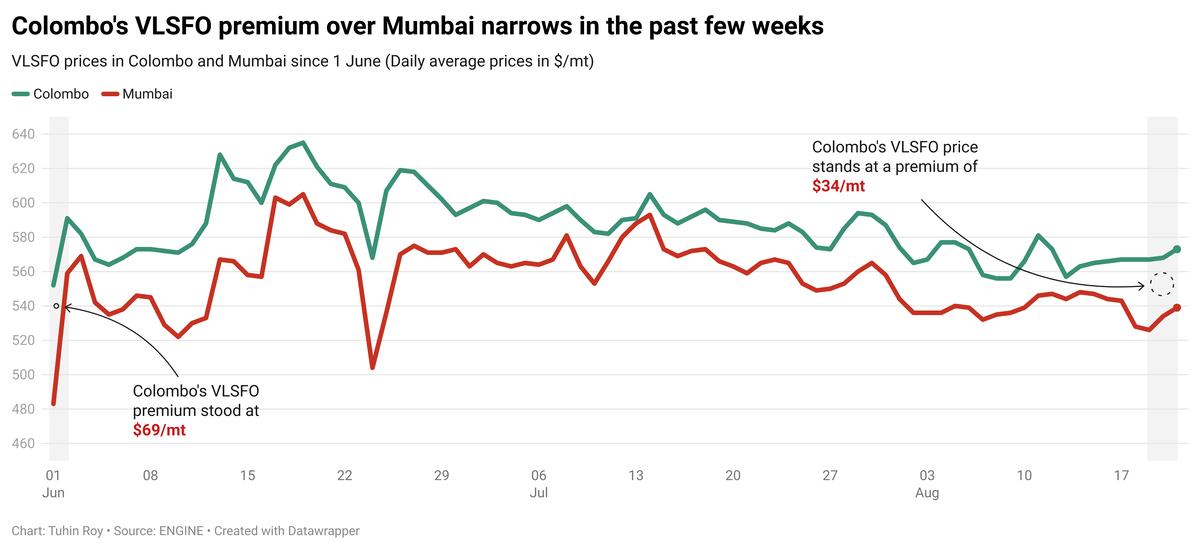

In South Asia, Sri Lanka’s Colombo continues to price VLSFO higher than India’s Mumbai, with a premium of $34/mt.

Tight VLSFO availability persists across several Indian ports, including Mundra, Kandla, Mumbai, Chennai, Visakhapatnam, and Cochin, consistent with recent weeks. LSMGO supply is also restricted at most ports, with deliveries available only upon enquiry. At Tuticorin, one supplier is nearly out of both VLSFO and LSMGO, a shortage that has lasted for months.

In contrast, Sri Lanka presents a more stable picture. A supplier in Colombo and Hambantota reports good availability of all fuel grades, with prompt delivery options.

Brent

The front-month ICE Brent contract has gained by $0.84/bbl on the day, to trade at $67.42/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has moved higher amid signs of strong demand in the world’s largest oil consumer – the US.

Commercial US crude oil inventories have dropped by 6 million bbls to touch 421 million bbls for the week ending 15 August, according to data from the US Energy Information Administration’s (EIA).

“Crude oil prices rebounded as signs of strong demand in the US boosted sentiment,” remarked ANZ Bank’s senior commodity strategist Daniel Hynes.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Downward pressure:

Oil market traders remain cautious, keeping a close watch on peace talks aimed at ending Russia’s war in Ukraine.

Earlier this week, officials from the US and NATO met to discuss security measures for Ukraine to help forge a peace agreement, Bloomberg reports. This news has added some downward pressure on Brent’s price.

A US-mediated ceasefire deal between the two eastern European nations may open the door to lifting energy sanctions on Moscow, according to market analysts.

“Any peace deal is likely to lead to fewer restrictions on Russian crude oil,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.