East of Suez Fuel Availability Outlook 19 Aug 2024

Bunker demand low in Zhoushan

Prompt VLSFO tight in Japanese locations

VLSFO and LSMGO availability tight in several Indian ports

IMAGE: The Yangshan harbour of Shanghai, China. Getty Images

IMAGE: The Yangshan harbour of Shanghai, China. Getty Images

Singapore and Malaysia

In Singapore, VLSFO deliveries now require lead times of 7–10 days, narrowing slightly from last week’s 4–11 days. HSFO availability is steady with workable delivery windows of 7–12 days, while LSMGO has become more accessible, with lead times easing to 3–6 days from 7–11 days a week ago.

The port’s residual fuel oil inventories have averaged 6% higher so far this month compared to July. The stocks have risen above 25 million bbls despite a steep 28% decline in net fuel imports, Enterprise Singapore data shows. Imports have dropped by 1.60 million bbls, far outpacing the 639,000-bbl fall in exports. Middle distillate stocks, meanwhile, have inched up 2% this month to 9 million bbls.

In Malaysia’s Port Klang, prompt VLSFO and LSMGO deliveries remain readily available, while HSFO continues to be in tight supply.

East Asia

In Zhoushan, VLSFO lead times have lengthened to 6–10 days from 5–8 days last week, despite subdued demand, as suppliers struggle with low inventories and delayed replenishment cargoes.

HSFO is also taking longer to secure, with lead times rising to 4–7 days from 3–5 days. By contrast, LSMGO has become easier to source, with lead times shortening to 2–4 days from last week’s 3–5 days.

Fuel availability across northern China remains mixed. Both VLSFO and LSMGO are well supplied in Dalian and Qingdao, though HSFO is limited in Qingdao. Tianjin, however, is tight across all three grades. In Shanghai, supply pressures persist for VLSFO and HSFO, while LSMGO remains relatively steady.

Further south, market conditions vary by port. Fuzhou is facing shortages of both VLSFO and LSMGO, while Xiamen has ample VLSFO but limited LSMGO. Delivery options remain constrained for both grades at Yangpu and Guangzhou.

In Hong Kong, lead times are stable at around seven days for all fuel types, consistent with recent weeks.

Taiwan continues to report steady conditions as well, with lead times of about two days for VLSFO and LSMGO at Taichung, Hualien, Keelung and Kaohsiung.

In South Korea, VLSFO and HSFO remain readily available amid muted demand, with most suppliers quoting lead times of around five days, slightly down from last week’s 5–6 days. LSMGO deliveries typically require 3–5 days.

Japan continues to face tight prompt VLSFO availability at key ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Mizushima, Nagoya and Yokkaichi. LSMGO stocks are generally sufficient across the country, though prompt orders in Mizushima may still see delays.

B24-VLSFO supply in Tokyo, Chiba, Kawasaki and Yokohama still depends on the enquiry.

HSFO availability is steady in most ports, while Oita is experiencing shortages across VLSFO, LSMGO, and HSFO.

Oceania

In Western Australia, VLSFO and LSMGO are well supplied at Kwinana, Fremantle and Port Kembla, with most suppliers advising lead times of 7–8 days. In New South Wales, LSMGO availability remains steady in Sydney, while securing prompt HSFO deliveries continues to be difficult.

Suppliers in Victoria’s ports of Melbourne and Geelong are well stocked with VLSFO and LSMGO, though HSFO remains limited, particularly for prompt demand.

Further north in Queensland, suppliers in both Brisbane and Gladstone have healthy VLSFO and LSMGO availability with average lead times of around seven days. HSFO, however, continues to be constrained in Brisbane.

In New Zealand, VLSFO supply is stable in Tauranga and Auckland, ensuring consistent availability in both ports.

South Asia

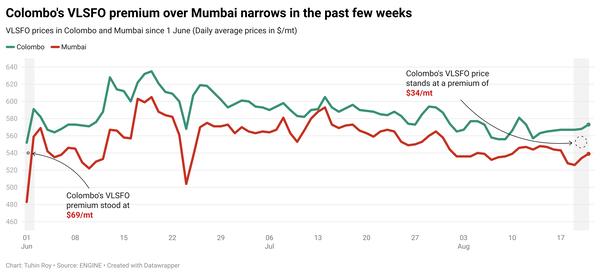

VLSFO availability remains tight across several Indian ports, including Mundra, Kandla, Mumbai, Chennai, Visakhapatnam and Cochin, as it has been in recent weeks. LSMGO supply is also constrained in most locations, with deliveries subject to enquiry. In Tuticorin, one supplier is nearly out of both fuel grades, a situation that has persisted for months.

By contrast, Sri Lanka offers a more stable outlook. A supplier operating in both Colombo and Hambantota reports good availability across all grades, with prompt delivery available.

Middle East

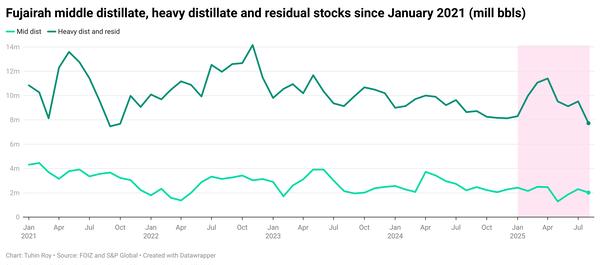

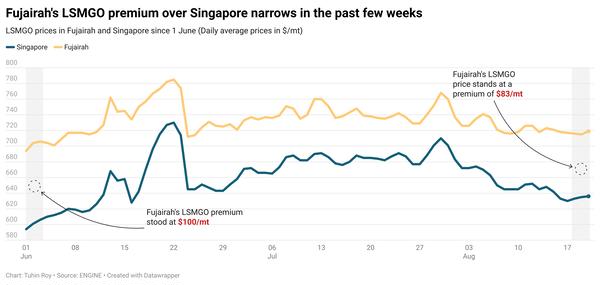

Prompt bunker availability continues to be tight across all fuel grades in Fujairah. Lead times are steady at 5–7 days, though some suppliers can still accommodate prompt orders at premium prices. Similar conditions prevail in the nearby port of Khor Fakkan.

In Iraq's Basrah, VLSFO and LSMGO remain readily available, while HSFO supply is limited. Saudi Arabia's Jeddah is still experiencing restricted availability of both VLSFO and LSMGO. In Egypt’s Port Suez, stocks of all three grades - VLSFO, LSMGO, and HSFO - are nearly exhausted.

Qatar’s Ras Laffan also faces tight supply for VLSFO and LSMGO. Djibouti is grappling with severe shortages, with VLSFO and HSFO nearly depleted and LSMGO also scarce.

By contrast, Oman’s ports - Sohar, Salalah, Muscat and Duqm - continue to offer stable LSMGO supply.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.