East of Suez Market Update 20 Aug 2025

Prices in East of Suez ports have moved up, and prompt availability of all grades remains tight in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($6/mt), Fujairah ($5/mt) and Singapore ($3/mt)

- LSMGO prices up in Fujairah ($14/mt), Zhoushan ($8/mt) and Singapore ($6/mt)

- HSFO prices up in Fujairah ($6/mt), Singapore ($2/mt) and Zhoushan ($1/mt)

- B24-VLSFO at a $223/mt premium over VLSFO in Singapore

- B24-VLSFO at a $240/mt premium over VLSFO in Fujairah

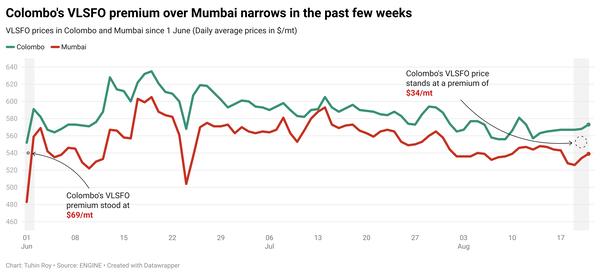

VLSFO prices across the three main Asian bunker hubs have increased slightly, rising by $3–6/mt over the past day. In Fujairah, the grade's price is at discounts of $21/mt and $8/mt to Zhoushan and Singapore, respectively.

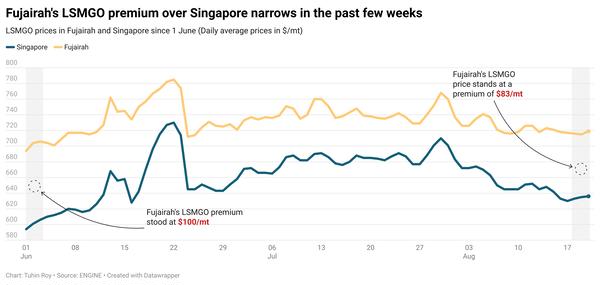

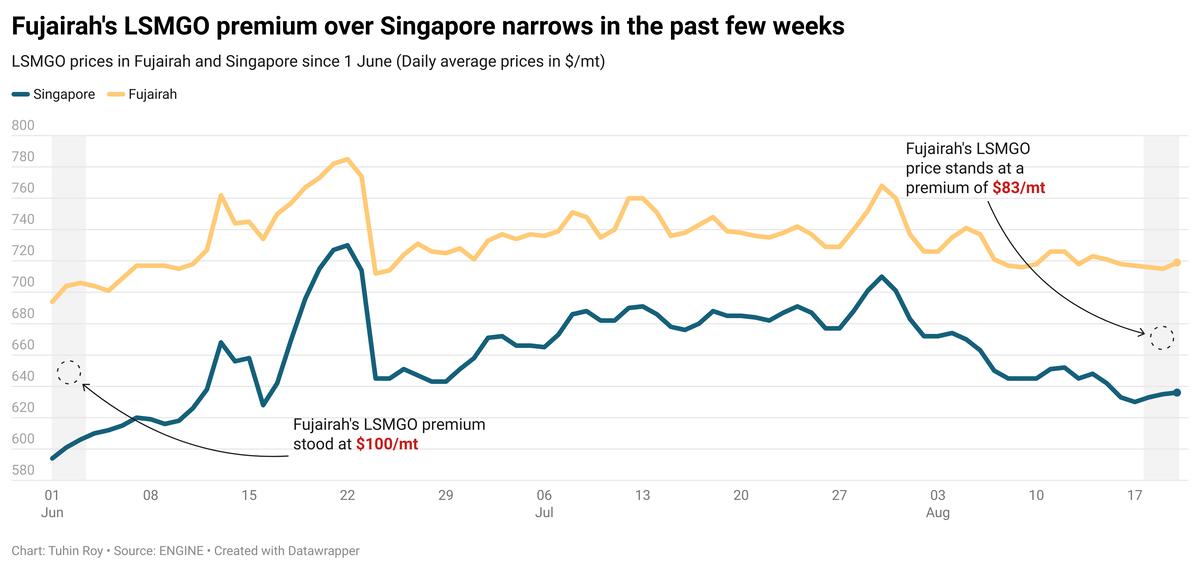

Fujairah’s LSMGO price has recorded the sharpest increase among the three major East of Suez ports, climbing by $14/mt in the past day. Its LSMGO premiums over Singapore and Zhoushan now stand at $83/mt and $59/mt, respectively.

Prompt bunker availability in Fujairah remains tight across all fuel grades. Lead times are steady at 5–7 days, though some suppliers can still arrange prompt deliveries at premium prices. Similar supply conditions are reported in the nearby port of Khor Fakkan.

In Singapore, VLSFO deliveries currently require 7–10 days, slightly down from up to 11 days last week. HSFO availability is stable, with lead times of 7–12 days. LSMGO supply has improved, with lead times easing to 3–6 days from 7–11 days a week ago.

Brent

The front-month ICE Brent contract has gained by $0.69/bbl on the day, to trade at $66.58/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has gained following a larger-than-expected draw in US crude stocks.

US crude oil inventories have decreased by 2.4 million bbls in the week ending 15 August, according to estimates from the American Petroleum Institute (API) cited by Trading Economics.

Market analysts had projected a smaller drop of 1.2 million bbls in the week.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Downward pressure:

Easing geopolitical risks have put some downward pressure on Brent this week, after US President Donald Trump stated that a ceasefire deal between Russia and Ukraine could be reached soon.

The news has erased concerns of stricter sanctions against Russia, according to market analysts.

“President Trump continues to try using diplomatic avenues to reach a ceasefire agreement between Russia and Ukraine, easing risks of sanctions on Russia which would impact supply,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Notably, no concrete resolution on the Ukraine conflict was reached at last week’s Alaska summit between Trump and Russian counterpart Vladimir Putin.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.