East of Suez Market Update 15 Aug 2025

Bunker prices in East of Suez ports have moved in mixed directions, and prompt VLSFO availability remains tight in Zhoushan.

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($10/mt), and unchanged in Fujairah and Singapore

- LSMGO prices up in Singapore ($2/mt), unchanged in Fujairah, and down in Zhoushan ($2/mt)

- HSFO prices unchanged in Zhoushan, and down in Singapore ($2/mt) and Fujairah ($1/mt)

- B24-VLSFO at a $160/mt premium over VLSFO in Singapore

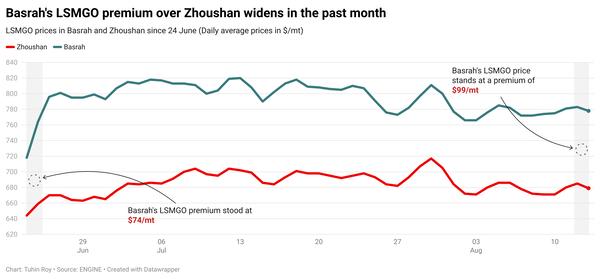

Barring Zhoushan, VLSFO benchmarks have recorded no significant changes in Singapore and Fujairah in the past day. Zhoushan’s VLSFO price has gained by $10/mt, widening its premium over Fujairah and Singapore to $23/mt and $13/mt, respectively.

VLSFO lead times in Zhoushan have increased to 5–8 days from 4–6 days in the previous week, largely because of low inventory levels, according to a trader. In contrast, HSFO and LSMGO delivery times have improved to 3–5 days from the earlier range of 4–6 days.

HSFO’s price has held steady in Zhoushan, while inching lower in the other two major Asian bunker hubs. Zhoushan’s HSFO premiums over Fujairah and Singapore now stand at $37/mt and $14/mt, respectively.

Northern China’s Dalian and Qingdao can both offer VLSFO and LSMGO for prompt delivers. Qingdao has limited HSFO supply, while Tianjin faces tight availability across all three fuel grades.

Brent

The front-month ICE Brent contract has moved $0.31/bbl higher on the day, to trade at $66.19/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Brent crude’s price has gained after Ukrainian drones hit a Russian oil refinery located in Volgograd.

The falling drone debris caused an oil spill at the refinery, which subsequently caught fire, Volgograd region’s governor Andrey Bocharov said.

The oil refinery is owned by Russia’s biggest energy firm Lukoil, according to a Bloomberg report. It has a refining capacity of 300,000 b/d, said VANDA Insights’ founder Vandana Hari.

“Crude oil prices edged higher, recouping some of the losses recorded earlier this week as traders take stock of the geopolitical landscape,” remarked ANZ Bank’s senior commodity analyst Daniel Hynes.

Downward pressure:

Brent’s price has felt some downward pressure amid uncertainty ahead of today’s highly anticipated meeting between US and Russian Presidents Donald Trump and Vladimir Putin.

If successful, the meeting could secure a US-brokered ceasefire between Moscow and Kyiv – a goal the US President has pursued since the start of his second term – and potentially lead to the lifting of global sanctions on Russian energy.

“Hopes are high that Friday’s meeting between Presidents Putin and Trump might remove much of the sanction risk hanging over the market,” two analysts from ING Bank said.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.