East of Suez Market Update 13 Aug 2025

Prices in East of Suez ports have moved down, and supply of VLSFO and LSMGO is good in Iraq’s Basrah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($7/mt), Singapore ($6/mt) and Fujairah ($1/mt)

- LSMGO prices down in Zhoushan ($15/mt), Fujairah ($11/mt) and Singapore ($10/mt)

- HSFO prices down in Fujairah ($8/mt), Zhoushan ($6/mt) and Singapore ($3/mt)

- B24-VLSFO at a $194/mt premium over VLSFO in Singapore

- B24-VLSFO at a $233/mt premium over VLSFO in Fujairah

VLSFO benchmarks across the three major East of Suez ports have fallen over the past day, with Zhoushan recording the sharpest drop. Zhoushan’s VLSFO price is now at a $9/mt premium over Fujairah and at parity with Singapore’s benchmark.

Zhoushan’s LSMGO price has also seen the steepest fall among the three ports, declining by $15/mt in the past day. It remains $30/mt higher than Singapore’s but $41/mt lower than Fujairah’s.

VLSFO lead times in Zhoushan have increased to 5–8 days from 4–6 days last week, as several suppliers grapple with low inventories and delayed replenishment cargoes. In contrast, HSFO and LSMGO delivery times have improved to 3–5 days from 4–6 days earlier.

Bunker deliveries in Zhoushan’s OPL area have been suspended since the weekend, with suppliers uncertain about resumption amid the risk of worsening conditions from Typhoon Podul.

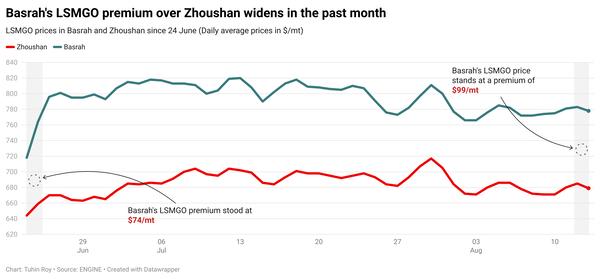

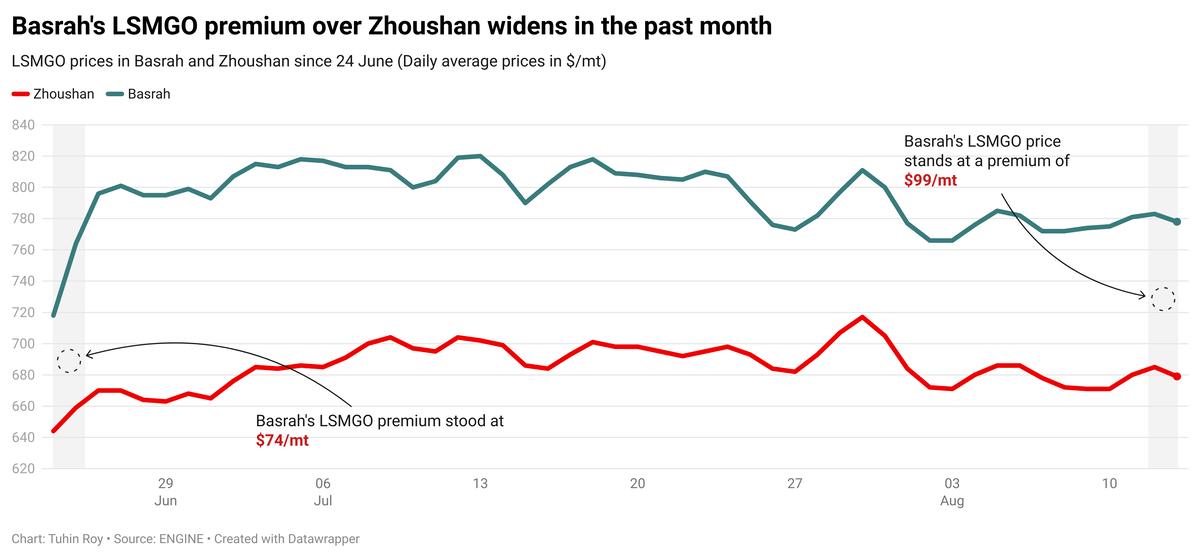

Elsewhere, Iraq’s Basrah continues to price LSMGO significantly higher, commanding a $99/mt premium over Zhoushan. While VLSFO and LSMGO remain readily available in Basrah, HSFO continues to be in short supply.

Brent

The front-month ICE Brent contract has lost by $0.54/bbl on the day, to trade at $66.0/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The latest economic data coming out of the US has provided some upward thrust to Brent’s price today.

The US inflation rate, based on the Consumer Price Index for all urban consumers (CPI-U), increased by 0.2% in July, after rising by 0.3% in June. On an annual basis, the US CPI advanced 2.7% last month.

Market analysts say the CPI figures have strengthened expectations that the US Federal Reserve (Fed) will move to cut interest rates at its September meeting.

“US consumer price index data yesterday [is] buttressing the view that the Federal Reserve will likely cut interest rates at its September meeting,” remarked two analysts from ING Bank.

A rate cut in the US could spur demand growth and make commodities such as oil cheaper for non-dollar holders.

Downward pressure:

Brent’s price has continued to move lower, ahead of Friday’s highly anticipated meeting between US President Donald Trump and Russian counterpart Vladimir Putin.

“The outcome [of Friday’s meeting] could remove some of the sanction risk hanging over the market,” ING Bank’s analysts note.

The two leaders are set to meet in Alaska to discuss potential pathways toward a peace deal in the Russia-Ukraine conflict, now entering its third year.

“Market consensus veered towards expectations that Friday’s summit between US President Donald Trump and Russian President Vladimir Putin will yield a Ukraine ceasefire,” according to VANDA Insights’ founder Vandana Hair.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.