East of Suez Market Update 14 Aug 2025

Prices in East of Suez ports have remained broadly steady, and prompt availability remains tight across all grades in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($6/mt), Singapore and Fujairah ($2/mt)

- LSMGO prices up in Fujairah, Zhoushan ($4/mt) and Singapore ($1/mt)

- HSFO prices up in Zhoushan ($4/mt) and Singapore ($2/mt), and unchanged in Fujairah

- B24-VLSFO at a $203/mt premium over VLSFO in Singapore

- B24-VLSFO at a $241/mt premium over VLSFO in Fujairah

VLSFO benchmarks in the three major Asian bunker ports have remained broadly stable over the past day, with no significant changes. Fujairah’s VLSFO discounts to Zhoushan and Singapore are $13/mt and $10/mt, respectively.

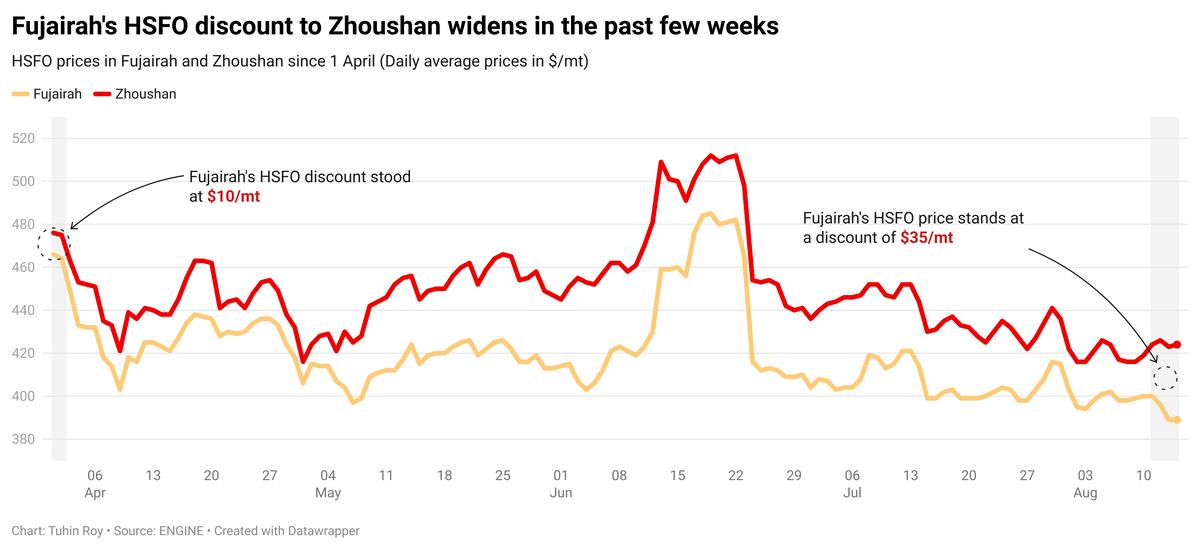

HSFO prices in the three East of Suez ports have also held steady, with Fujairah’s HSFO discounts to Zhoushan and Singapore at $35/mt and $22/mt, respectively.

Fujairah continues to experience tight prompt bunker availability across all fuel grades, despite subdued demand. Lead times remain at 5–7 days, although some suppliers can still accommodate prompt orders—usually at premium rates. Similar conditions are reported at the nearby Khor Fakkan port.

In Saudi Arabia’s Jeddah, VLSFO and LSMGO availability remains limited, while at Egypt’s Suez port, stocks of VLSFO, LSMGO, and HSFO are nearly depleted.

Brent

The front-month ICE Brent contract has lost by $0.12/bbl on the day, to trade at $65.88/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The US inflation rate, based on the Consumer Price Index for all urban consumers (CPI-U), increased by 0.2% in July, after rising by 0.3% in June. On an annual basis, the US CPI advanced 2.7% last month.

This news has provided some support to Brent’s price as it has boosted market expectations of an interest rate cut at the US Federal Reserve’s (Fed) upcoming meeting in September, according to analysts.

The next month is shaping up to be the “long-anticipated” rate cut, remarked SPI Asset Management's managing partner, Stephen Innes.

A rate cut in the US could spur demand growth and make commodities such as oil cheaper for non-dollar holders.

Downward pressure:

Brent crude’s price has declined further after yesterday’s bearish demand forecasts for the global oil market.

Market sentiment has turned negative following releases from the International Energy Agency (IEA) and Energy Information Administration (EIA).

The IEA forecasts that global oil demand will grow by 680,000 b/d this year and 700,000 b/d in 2026, about 200,000 b/d lower than its previous estimate.

Global oil demand growth has been “repeatedly downgraded” since the start of this year, by a combined 350,000 b/d, according to the IEA.

“The IEA monthly oil market report was largely bearish, with the agency expecting large inventory builds towards the end of this year and through 2026,” two analysts from ING Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.