Biofuel Bunker Snapshot: Sharp oil price declines drag bio-bunker prices down

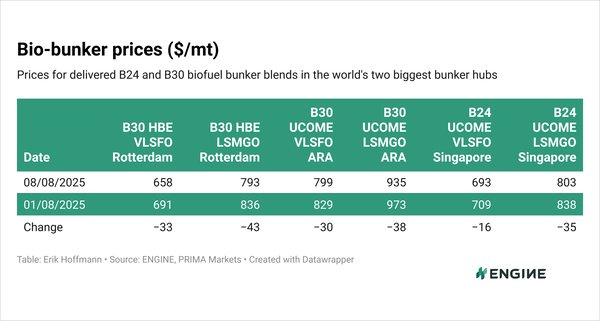

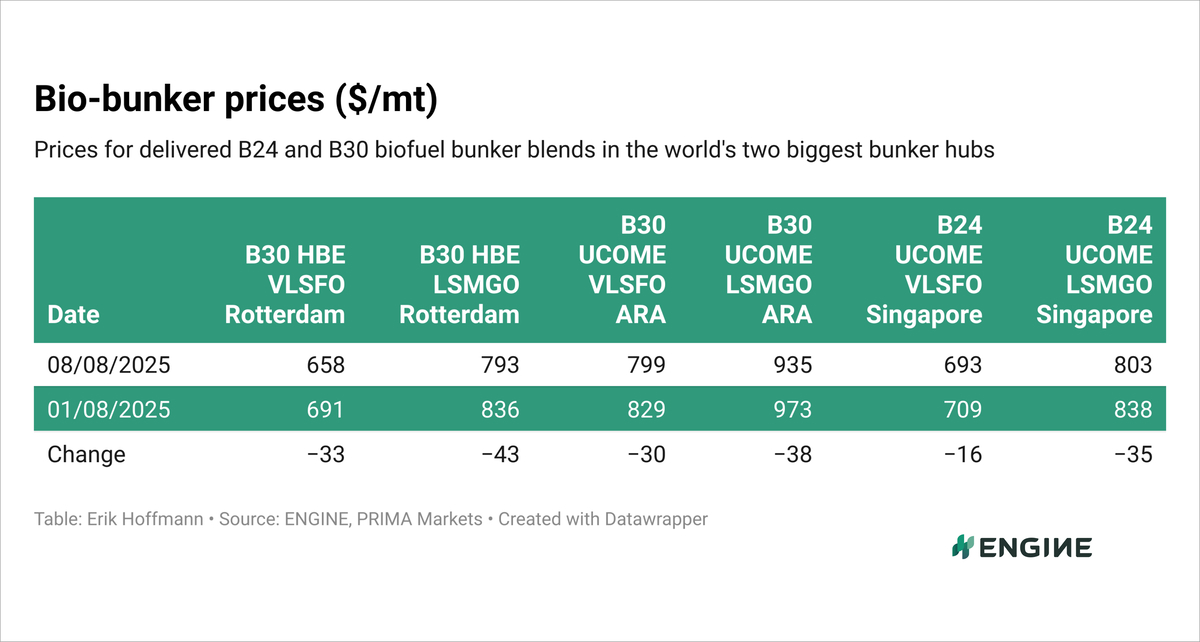

Massive B24 and B30 price drops across regions

Declining VLSFO and LSMGO prices the culprits

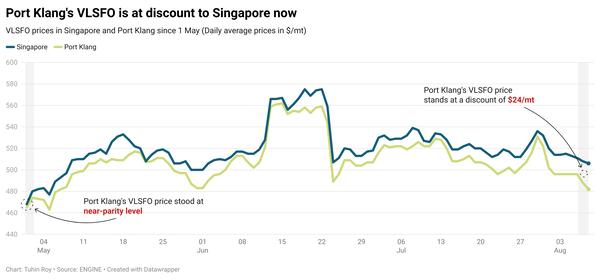

Singapore’s bio-bunker prices lowest in the world

Rotterdam

Rotterdam’s HBE-rebated B30-VLSFO and B30-LSMGO have taken a beating in the past week. Hammered down by sharp drops in pure VLSFO and LSMGO prices, they have dropped to their lowest levels in six weeks.

Prima Market’s POMEME CIF ARA barge benchmark has dropped by $13/mt on the week, to $1,455/mt, and is also at a six-week low. The HBE rebate for B30 marine biofuels has gained $4/mt to put additional downward pressure on B30 bunker prices.

ARA UCOME B30-VLSFO and B30-LSMGO prices have not fared much better, weighed down by a $9/mt decline in Prima’s UCOME FOB ARA barge price, and the pure VLSFO and LSMGO drops mentioned above.

Gibraltar’s B30-VLSFO UCOME price is at a $77/mt premium over Rotterdam’s, and Lisbon's at a $154/mt premium.

Singapore

B24-VLSFO and B24-LSMGO UCOME prices have both moved down in Singapore, but B30-LSMGO much more so under pressure from a $50/mt drop in the pure LSMGO price. Pure VLSFO has fallen by a still significant $25/mt on the week.

Prima’s UCOME FOB China cargo benchmark has risen by $15/mt on the week, to $1,155/mt, and cushioned the B30-VLSFO and B30-LSMGO price falls. UCOME FOB China has been at three-week highs this week.

The freight rate for UCOME shipped from China to Singapore has edged $0.25/mt lower to $17.00/mt, and not done much to move the B24 prices.

Converted to B30, Singapore’s B30-VLSFO UCOME price is at discounts of $39/mt to Rotterdam’s HBE-rebated B30-VLSFO and $58/mt below the ARA’s UCOME price. And it is $28/mt below Fujairah’s UCOME price.

So prices are looking competitive in Singapore compared to the ARA at the moment, although these prices have not been adjusted for the impacts of EU emission regulations.

Other bio-bunker news

In the latest The Week in Alt Fuels newsletter, we look at biofuel research from the European Biodiesel Board (EBB) and ask where the EU’s biofuels come from. With slowing imports and not much more FAME production forecast in the EU, will impending demand squeeze supply?

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.