East of Suez Market Update 8 Aug 2025

Prices in East of Suez ports have moved in mixed directions, and VLSFO and LSMGO availability is good in Malaysia’s Port Klang.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($4/mt), and down in Fujairah ($3/mt) and Zhoushan ($2/mt)

- LSMGO prices down in Singapore ($7/mt), Zhoushan ($6/mt) and Fujairah ($5/mt)

- HSFO prices up in Singapore ($1/mt), unchanged in Fujairah, and down in Zhoushan ($1/mt)

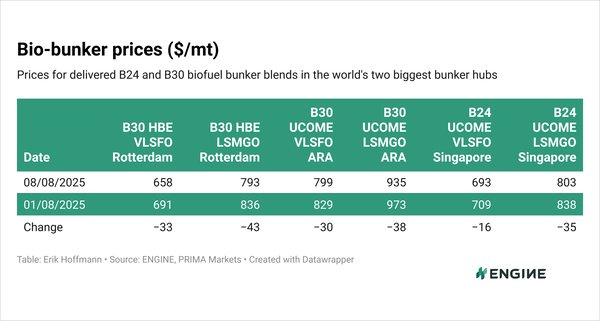

- B24-VLSFO at a $200/mt premium over VLSFO in Singapore

- B24-VLSFO at a $234/mt premium over VLSFO in Fujairah

VLSFO benchmarks across East of Suez ports have remained largely stable over the past day, with no significant price changes. In Singapore, VLSFO is priced at a premium of $16/mt over Fujairah and is nearly at parity with Zhoushan.

VLSFO delivery schedules in Singapore vary widely—some suppliers can deliver within three days, while others require bookings up to three weeks in advance. HSFO delivery now takes 7–12 days, slightly longer than last week's range of 9–11 days. LSMGO lead times remain steady, with most suppliers quoting 5–8 days, nearly unchanged from the previous week.

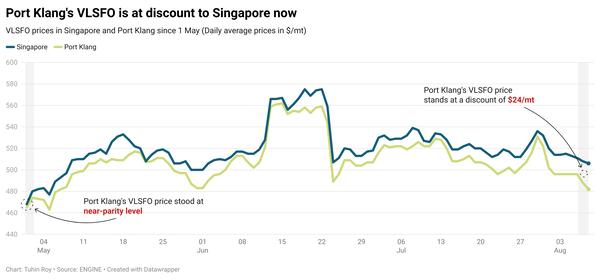

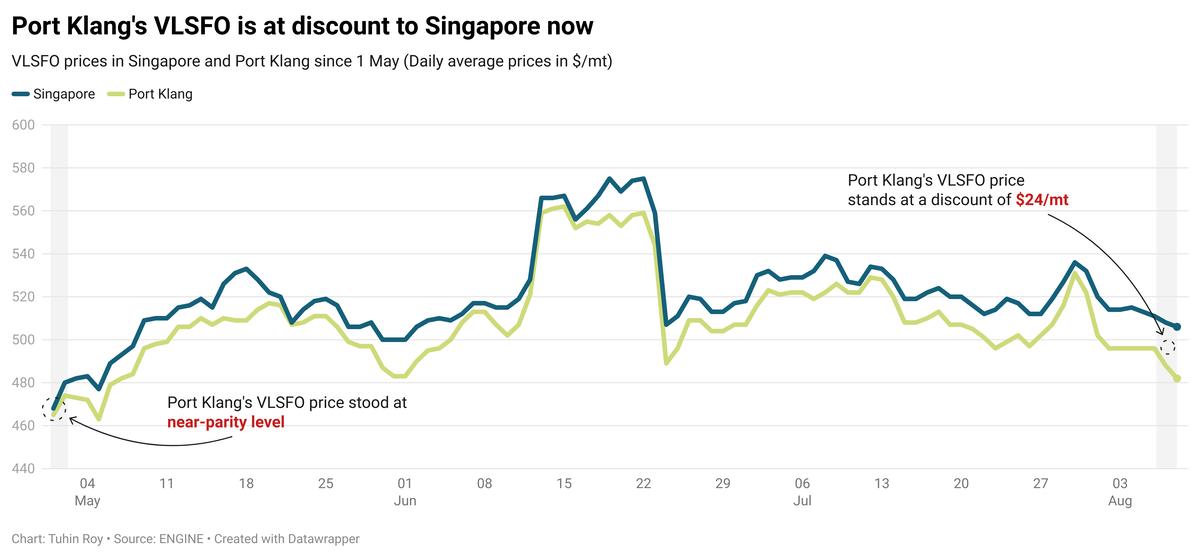

Meanwhile, Malaysia’s Port Klang continues to price its VLSFO benchmark at a $24/mt discount to Singapore.

Both VLSFO and LSMGO grades are readily available at Port Klang, with immediate delivery possible for smaller volumes. However, HSFO supply there remains tight.

Brent

The front-month ICE Brent contract has moved $0.47/bbl lower on the day, to trade at $66.65/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has gained some support following the latest trade data from China.

The country has imported a total of about 326.6 million mt of crude in the first seven months of this year, about 2.8% higher than the corresponding period in 2024, market intelligence provider JLC reported, citing data from the General Administration of Customs (GACC).

Higher crude oil imports can signal demand growth in the second-largest crude oil consumer of the world. This can support Brent’s price growth, according to analysts.

Downward pressure:

Brent crude’s price has declined amid growing expectations that the US President Donald Trump and his Russian counterpart Vladimir Putin will meet soon to discuss a potential resolution to the Russia-Ukraine conflict.

The meeting could take place “as soon as next week,” remarked two analysts from ING Bank. However, it is unclear if Ukrainian President Volodymyr Zelenskyy will take part in the discussions.

This development holds significance for the global oil market, as Trump has been pressing for a ceasefire in Ukraine and has threatened secondary tariffs on buyers of Russian oil.

“This [meeting] is important because it could affect the secondary tariffs on India, depending on how discussions go,” the two analysts added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.