East of Suez Market Update 7 Aug 2025

Most prices in East of Suez ports have moved down, and good weather allows bunker deliveries to resume in Zhoushan’s OPL area.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Singapore ($11/mt), Fujairah ($10/mt) and Zhoushan ($8/mt)

- LSMGO prices down in Fujairah ($26/mt), Singapore ($19/mt) and Zhoushan ($11/mt)

- HSFO prices down in Singapore, Zhoushan ($9/mt) and Fujairah ($8/mt)

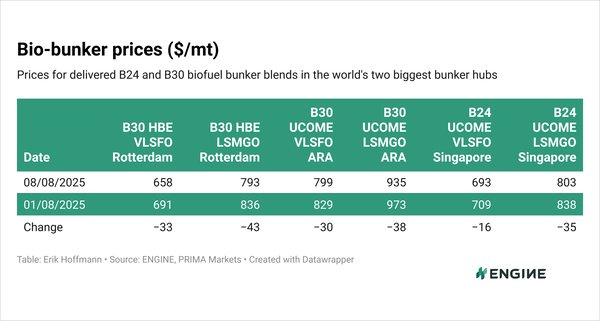

- B24-VLSFO at a $208/mt premium over VLSFO in Singapore

- B24-VLSFO at a $233/mt premium over VLSFO in Fujairah

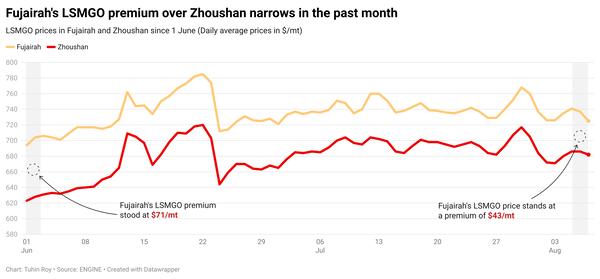

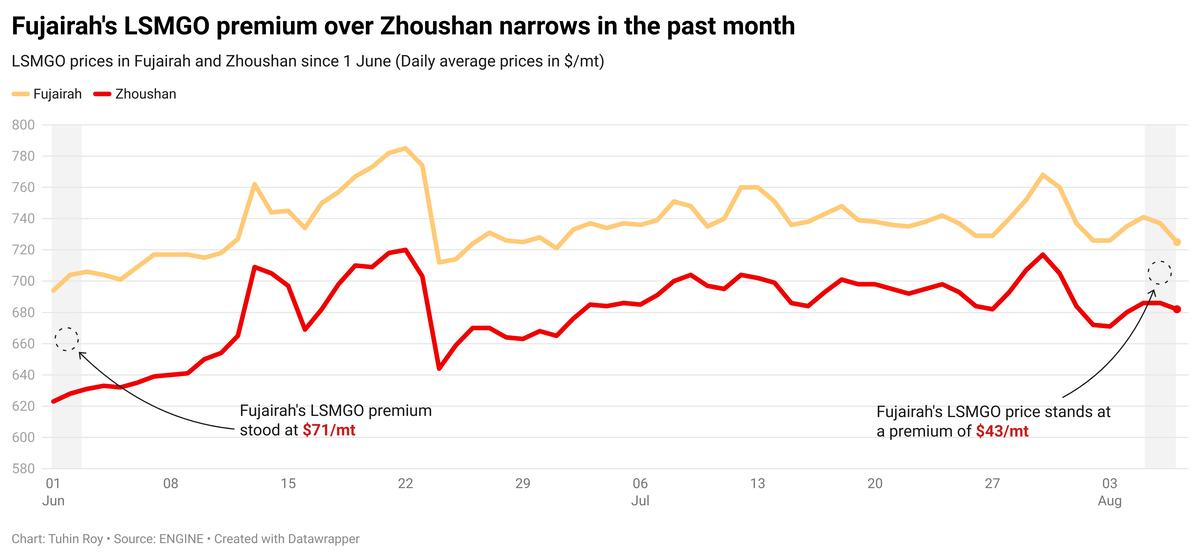

Fujairah’s LSMGO price has dropped by $26/mt over the past day—the sharpest decline among the three major Asian bunker ports. Despite the drop, Fujairah still holds a premium of $70/mt over Singapore and $43/mt over Zhoushan.

The port continues to face tight prompt bunker availability across all fuel grades, despite relatively low demand, with lead times holding steady at 5–7 days.

In Zhoushan, LSMGO delivery times have eased to 4–6 days, down from the previously quoted 5–7 days. HSFO also requires lead times of 4–6 days. Meanwhile, VLSFO supply has slightly improved, with most suppliers now advising lead times of 4–6 days, compared to 5–7 days last week.

Bunkering operations at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages resumed this morning after being suspended since 4 August due to bad weather. Currently, all anchorages in the Zhoushan bunkering hub are fully operational.

Brent

The front-month ICE Brent contract has declined by $1.46/bbl on the day, to trade at $67.12/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has found modest support from declining crude oil stocks in the US.

Commercial US crude oil inventories have fallen by 3 million bbls to touch 424 million bbls for the week ending 1 August, according to data from the US Energy Information Administration’s (EIA).

VANDA Insights’ founder Vandana Hari said the latest EIA data was bullish as it showed a “sizeable drawdown across crude and refined products.”

The EIA report came one day after the American Petroleum Institute (API) reported a bigger draw of 4.2 million bbls in US crude inventories during the same period.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price, according to market analysts.

Downward pressure:

Oil has extended losses as trade tensions flared between the US and India.

In a sharp escalation, US President Donald Trump on Tuesday signed an executive order imposing an additional 25% tariff on Indian goods, effectively doubling the tariff rate on Indian exports to the US to 50%.

The decline in Brent’s price comes as Washington increases pressure on New Delhi to reduce its imports of Russian energy.

Trump’s announcement has heightened fears of a broader economic fallout. Market analysts say the development could weigh on global commodities by dampening demand.

“Sentiment remained cautious and fluid over the potential impact of US President Donald Trump’s newly-announced additional 25% tariffs on India for importing Russian oil,” Hari said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.