East of Suez Market Update 18 Jul 2025

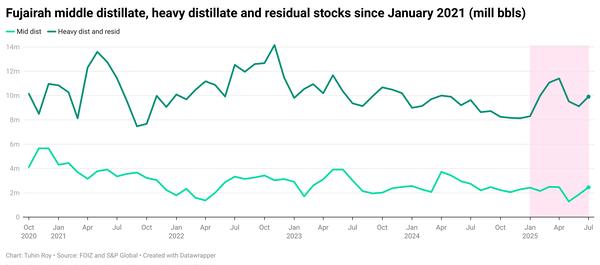

Prices in East of Suez ports have moved up, and prompt availability of all grades is tight in Fujairah.

IMAGE: Harbour craft in front of an oil tanker in Fujairah. Port of Fujairah

IMAGE: Harbour craft in front of an oil tanker in Fujairah. Port of Fujairah

Changes on the day to 17.00 SGT (09.00 GMT) today:

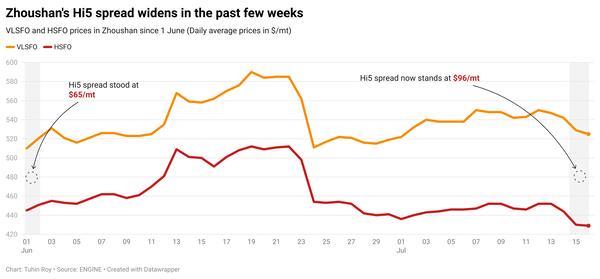

- VLSFO prices up in Fujairah ($7/mt), Zhoushan ($6/mt) and Singapore ($3/mt)

- LSMGO prices up in Zhoushan ($10/mt), Singapore and Fujairah ($9/mt)

- HSFO prices up in Singapore ($5/mt), Fujairah and Zhoushan ($4/mt)

- B24-VLSFO at a $196/mt premium over VLSFO in Singapore

- B24-VLSFO at a $230/mt premium over VLSFO in Singapore

Fujairah’s VLSFO price has increased by $7/mt over the past day—the sharpest rise among the three major Asian ports. Despite this, it remains priced at a discount of $14/mt to Zhoushan and $6/mt to Singapore.

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades steady at 5–7 days, similar to conditions in nearby Khor Fakkan.

In South Korea, Busan continues to price its VLSFO at a $16/mt premium to Fujairah.

VLSFO and HSFO supply has improved across several South Korean ports, with recommended lead times now slightly shorter at around three days, compared to last week's 2–4 days. However, LSMGO lead times remain inconsistent, ranging from 3–10 days.

Adverse weather may disrupt bunker operations at multiple Korean ports. Ulsan and Onsan are expected to face interruptions from 18–19 July, Busan and Yeosu from 18–19 July and again from 22–24 July, while Daesan and Taean may see disruptions from 18–19 July and 22–23 July due to strong winds and high waves.

Brent

The front-month ICE Brent contract has gained by $1.62/bbl on the day, to trade at $70.04/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has moved higher due to oil supply-related concerns, snapping a three-day losing streak.

Several oilfields in Iraq’s semi-autonomous Kurdistan region halted production, following drone strikes that targeted infrastructures operated by various companies.

The attacks have reduced crude output from about 280,000 b/d to 140,000 b/d to 150,000 b/d, Reuters reported, citing two energy officials.

“Iraq has lost about 200kb/d [200,000 b/d] of production due to drone attacks on several fields in Kurdistan,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Besides, Brent’s price gained after the European Union (EU) reached an agreement on the 18th sanctions package against Russia that was proposed last month. The measures aim at further crippling Moscow’s oil and energy revenues.

“Near-term oil fundamentals remain supportive, with the market set to remain fairly tight through this quarter,” two analysts from ING Bank noted.

Downward pressure:

Brent’s price gains were capped by some concerns of a supply glut in the second half of this year as OPEC+ members continue to hike production levels every month.

Total crude oil production by OPEC+ members averaged 41.56 million b/d last month, about 349,000 b/d higher than in May.

Oil production by OPEC+’s de-facto leader Saudi Arabia, increased by 173,000 b/d on the month to 9.36 million b/d in June.

“OPEC+ output is rising and Saudi Arabia increased flows to 6.43mb/d [6.43 million b/d] in H1 July,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.