East of Suez Market Update 17 Jul 2025

Prices in East of Suez ports have moved up, and VLSFO lead times vary widely in Singapore.

IMAGE: Oil tankers and onshore oil storage terminals in Singapore. Getty Images

IMAGE: Oil tankers and onshore oil storage terminals in Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($6/mt), Zhoushan ($5/mt) and Fujairah ($3/mt)

- LSMGO prices up in Zhoushan ($12/mt), Fujairah ($5/mt) and Singapore ($3/mt)

- HSFO prices up in Zhoushan ($8/mt), Singapore and Fujairah ($3/mt)

- B24-VLSFO at a $175/mt premium over VLSFO in Singapore

- B24-VLSFO at a $177/mt premium over VLSFO in Singapore

VLSFO benchmarks at East of Suez ports have risen slightly, within a narrow range of $3–6/mt, with Singapore at the upper end. Singapore’s VLSFO is currently priced at a $10/mt premium over Fujairah but stands at a $5/mt discount to Zhoushan.

VLSFO lead times in Singapore remain highly inconsistent. While some suppliers can deliver within seven days, others recommend placing orders up to four weeks in advance due to long-term nominations. Supply delays are also being driven by limited stock and pending replenishments.

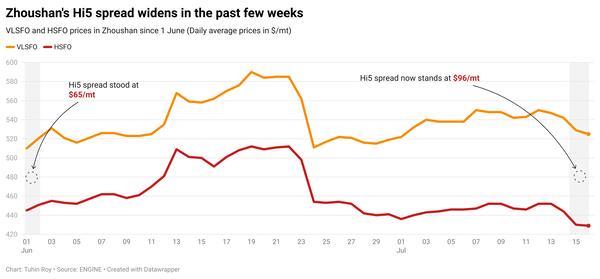

In contrast, VLSFO supply in Zhoushan remains steady amid low demand, with most suppliers maintaining lead times of about six days—unchanged from the previous week.

Zhoushan’s LSMGO price has increased by $12/mt, marking the steepest rise among the three major Asian bunker hubs. Despite this, it remains at a $50/mt discount to Fujairah but holds a $13/mt premium over Singapore.

LSMGO lead times in Zhoushan continue to average around six days, while in Fujairah, prompt availability is tight with lead times stable at 5–7 days. Meanwhile, Omani ports, including Sohar, Salalah, Muscat, and Duqm, have stable LSMGO supply.

Brent

The front-month ICE Brent contract has declined by $0.14/bbl on the day, to trade at $68.42/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil has found some support after the US Energy Information Administration (EIA) reported a surprise draw in US crude oil stocks.

Commercial US crude oil inventories have declined by 3.9 million bbls to touch 422 million bbls for the week ending 11 July, according to data from the EIA.

The drop in oil stocks was “more than expected,” according to ANZ’s senior commodity strategist Daniel Hynes.

A decline in crude stockpiles typically indicates stronger demand and can push Brent's price higher.

Downward pressure:

Brent crude’s price has declined for a third straight session as investors continue to grow wary of a potential supply surplus later this year.

Total crude oil production by OPEC+ members averaged 41.56 million b/d last month, about 349,000 b/d higher than in May.

Oil production by OPEC+’s de-facto leader Saudi Arabia, increased by 173,000 b/d on the month to 9.36 million b/d in June. Production in the UAE increased by 83,000 b/d to about 3.1 million b/d last month.

Besides, the US EIA expects global oil production to rise by 1.8 million b/d this year, before increasing by another 1.1 million b/d in 2026.

“The planned increases to OPEC+ production combined with strong supply growth outside of OPEC+ continue to drive strong growth in global liquid fuels production in our forecast,” the EIA said earlier.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.