East of Suez Market Update 16 Jul 2025

Prices in East of Suez ports have moved in mixed directions, and availability of all grades is good in Hong Kong.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($1/mt), and down in Zhoushan ($8/mt) and Singapore ($4/mt)

- LSMGO prices up in Fujairah ($1/mt), and down in Zhoushan ($9/mt) and Singapore ($5/mt)

- HSFO prices down in Fujairah, Zhoushan ($3/mt) and Singapore ($1/mt)

- B24-VLSFO at a $172/mt premium over VLSFO in Singapore

- B24-VLSFO at a $178/mt premium over VLSFO in Singapore

VLSFO prices have declined in both Zhoushan and Singapore, falling by $8/mt and $4/mt, respectively, over the past day, while Fujairah’s price has remained broadly steady. Zhoushan’s VLSFO now carries a premium of $13/mt over Fujairah and $6/mt over Singapore.

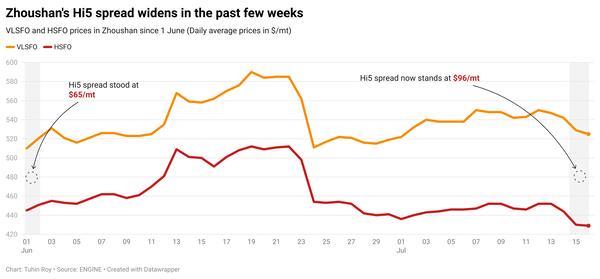

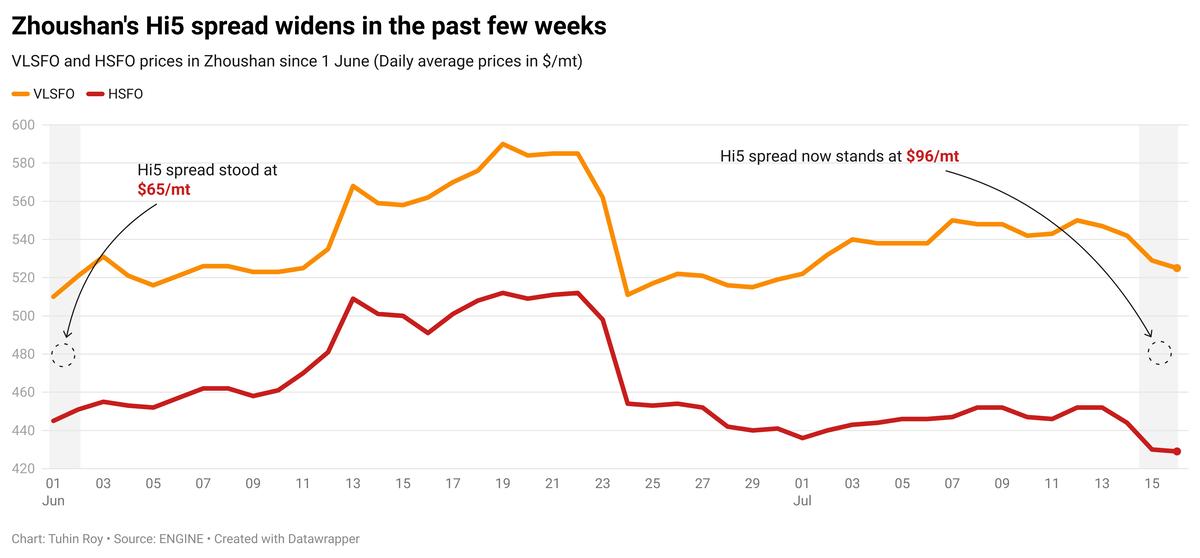

In Zhoushan, the drop in VLSFO outpaced the decline in HSFO, narrowing the port’s Hi5 spread by $3/mt to $96/mt today.

VLSFO supply in Zhoushan remains stable amid subdued demand, with most suppliers quoting lead times of around six days—unchanged from last week. HSFO lead times are also about six days, consistent with the previous 5–7day range. LSMGO lead times are steady as well, averaging around six days.

In Hong Kong, lead times for all fuel grades remain unchanged at approximately seven days. However, adverse weather is forecast on 20 July and 22 July, which could affect bunker delivery schedules.

Brent

The front-month ICE Brent contract has dropped by $0.36/bbl on the day, to trade at $68.56/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

In its monthly oil market report, OPEC has maintained its supply and demand projections for this year, providing some support to Brent’s price today.

The Vienna-headquartered group expects global oil demand growth to hit 1.3 million b/d for both 2025 and 2026.

Global oil consumption is expected to average 105.1 million b/d this year, largely unchanged from OPEC's estimate a month ago.

Downward pressure:

US crude oil inventories rose by 19.1 million bbls in the week ending 11 July, according to estimates from the American Petroleum Institute (API).

The latest data has surprised oil market analysts, who had previously projected a 2 million-bbl draw. An increase in US crude stockpiles generally signals weaker demand and can drag Brent's price lower.

Besides, US President Donald Trump’s approach to securing a ceasefire between Russia and Ukraine fell short of directly targeting Russia's energy infrastructure.

This news has eased some supply disruption concerns and put further downward pressure on Brent.

“No immediate action from the US against Russia following President Trump’s 'major statement' means that the focus returns to the expected oil surplus later in the year,” ING Bank analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.