East of Suez Market Update 15 Jul 2025

Prices in East of Suez ports have moved down, and prompt availability of all grades is tight in Fujairah.

IMAGE: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

IMAGE: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Fujairah ($20/mt), Zhoushan ($17/mt) and Singapore ($14/mt)

- LSMGO prices down in Fujairah ($29/mt), Zhoushan ($17/mt) and Singapore ($12/mt)

- HSFO prices down in Zhoushan ($25/mt), Fujairah ($24/mt), and Singapore ($22/mt)

- B24-VLSFO at a $179/mt premium over VLSFO in Singapore

- B24-VLSFO at a $183/mt premium over VLSFO in Singapore

Fujairah’s VLSFO price has dropped by $20/mt over the past day, marking the steepest decline among the three major Asian bunker ports. VLSFO price in Fujairah is currently at a discount of $12/mt to Zhoushan and $22/mt to Singapore.

LSMGO prices in the port have also seen a sharp decline of $29/mt in the past day. Despite this, Fujairah’s LSMGO remains at a premium of $55/mt over Singapore and $47/mt over Zhoushan.

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades unchanged at 5–7 days—similar to conditions in Khor Fakkan.

In Basrah, Iraq, VLSFO and LSMGO are readily available, while HSFO supply continues to be limited.

In Jeddah, Saudi Arabia, the availability of both LSMGO and VLSFO remains constrained. Bunker operations in Yanbu could be affected by adverse weather conditions expected on 18 July.

Brent

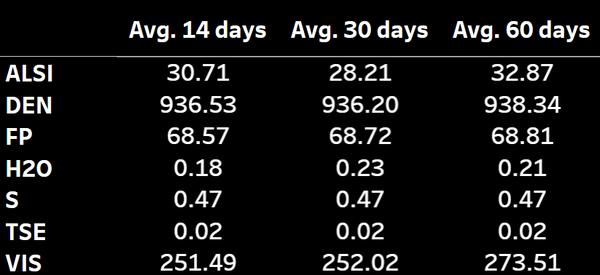

The front-month ICE Brent contract has moved $1.96/bbl lower on the day, to trade at $68.92/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found some support on the back of strong oil demand growth projection by the Saudi Arabia-led OPEC+ group of producers.

The Organization of the Petroleum Exporting Countries (OPEC) has forecast global oil demand to reach 123 million b/d by 2050, marking a growth of more than 19 million b/d since 2024.

OPEC projects Asia, Africa and the Middle East to be the key drivers of long-term oil demand growth. The market now awaits the group’s monthly oil market due later today.

Import data from China has also supported oil prices today. The country imported about 12.14 million b/d of crude oil last month, marking a month-on-month increase of 10.6%.

“Better [Chinese] refinery run rates supported these gains,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Downward pressure:

US President Donald Trump has reportedly dismissed the need for a Senate-backed sanctions bill on Russia, according to market analysts. This news has pushed Brent’s price lower.

The US President has instead proposed a 50-day window to reach a ceasefire deal with Ukraine, warning that secondary sanctions would follow if the talks fail.

“The pause eased concerns that direct sanctions on Russia could disrupt crude oil flows,” Hynes said.

Prices plunged lower after Trump also threatened to impose 30% tariffs on goods from the European Union (EU) and Mexico over the weekend, triggering fears of deteriorating trade relations that could weigh on global demand.

The announcement was followed by “a range of tariff demand letters last week that contained some of the highest rates on major US trading partners,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.