East of Suez Market Update 9 Jun 2025

Prices in East of Suez ports have moved up, and availability is good across all grades in Zhoushan.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($11/mt), Fujairah and Zhoushan ($6/mt)

- LSMGO prices up in Fujairah ($12/mt), Singapore ($6/mt) and Zhoushan ($5/mt)

- HSFO prices up in Fujairah ($12/mt), Zhoushan ($6/mt) and Singapore ($4/mt)

- B24-VLSFO at a $202/mt premium over VLSFO in Singapore

- B24-VLSFO at a $237/mt premium over VLSFO in Fujairah

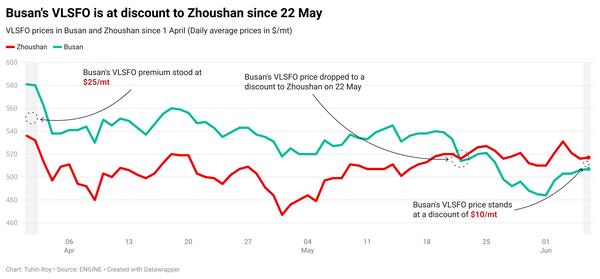

VLSFO benchmarks across the three major Asian ports have followed Brent’s upward trend, rising by $6–11/mt over the weekend. In Fujairah, VLSFO stands at a $21/mt discount to Zhoushan and a $13/mt discount to Singapore.

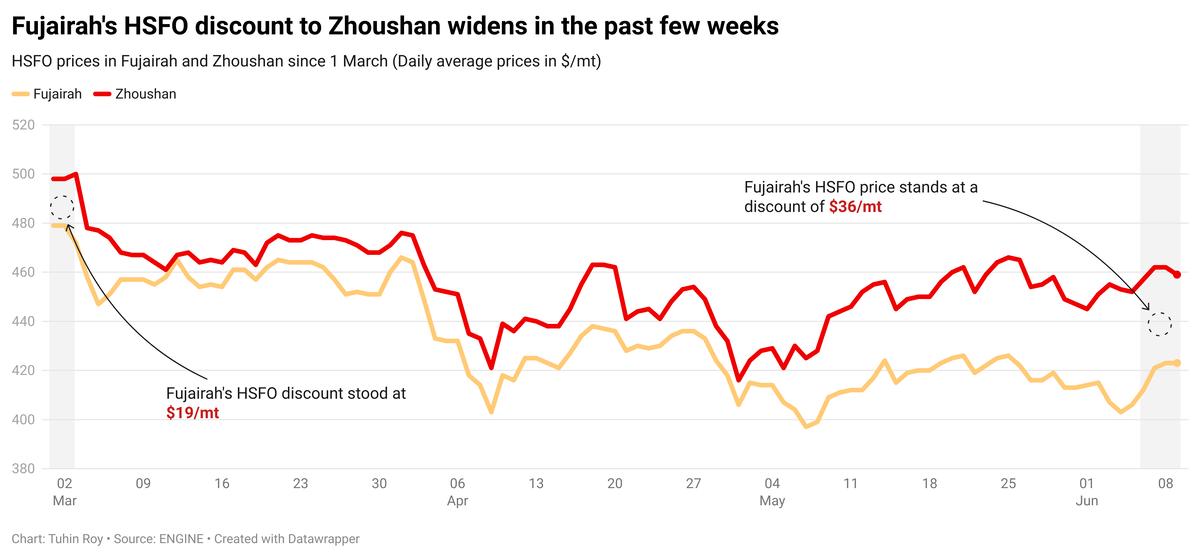

Fujairah also saw the steepest increase in HSFO prices among the three East of Suez ports, with a $12/mt rise. Despite this, its HSFO continues to stand at significant discounts of $36/mt to Zhoushan and $22/mt to Singapore.

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades holding steady at 5–7 days.

In Zhoushan, VLSFO supply is stable, and most suppliers continue to advise lead times of 4–7 days. HSFO lead times there have increased slightly to 4–7 days, up from 3–5 days last week. Meanwhile, LSMGO lead times have improved in Zhoushan, narrowing from 4–7 days last week to just 2–3 days now.

Brent

The front-month ICE Brent contract has gained by $1.45/bbl on the day from Friday, to trade at $66.55/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices have gained momentum as the global oil market's focus has now shifted to US-China trade talks set to commence in London later today.

Last week, a phone call held between US President Donald Trump and Chinese counterpart Xi Jinping led to a “very positive conclusion,” according to media reports. The news has boosted oil demand growth sentiment in the two top oil consumers.

“The US President and the Chinese President agreed to continue trade discussions in order to address issues related to tariffs and rare earth minerals,” Price Futures Group’s senior market analyst Phil Flynn remarked. “It will more than likely would lead to a resumption of oil imports into China from the United States,” he added.

On the supply side, Canadian wildfires in recent weeks have caused operational hurdles for oil production, pushing Brent’s price higher. Canadian wildfires typically occur between May and September.

Downward pressure:

US drilling activity has continued to decline amid the broader weakness in oil prices.

The total number of rigs drilling for crude oil in the US declined by nine to 442 units last week, according to Baker Hughes.

Lower drilling activity can indicate a slowdown in oil demand, market analysts said. This week’s data marked the sixth consecutive week of decline, two analysts from ING Bank noted.

“In the US market, drilling activity continues to slow,” the analysts said, marking the “longest period of declines since mid-2023.”

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.