East of Suez Market Update 6 Jun 2025

Prices in East of Suez ports have moved in mixed directions, and lead times vary widely across all grades in several South Korean ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($2/mt), unchanged in Fujairah, and down in Singapore ($4/mt)

- LSMGO prices up in Zhoushan ($3/mt) and Fujairah ($1/mt), and down in Singapore ($1/mt)

- HSFO prices up in Fujairah and Zhoushan ($2/mt), and unchanged in Singapore

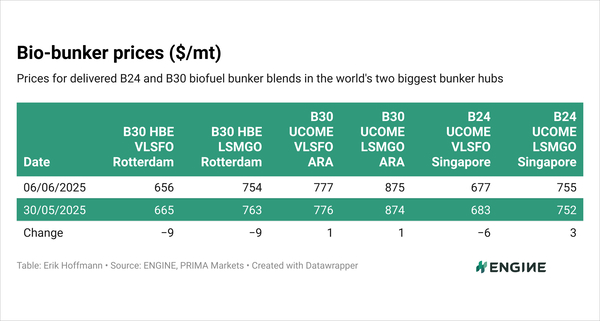

- B24-VLSFO at a $184/mt premium over VLSFO in Singapore

VLSFO prices across three major Asian bunker ports have remained largely stable, with no significant fluctuations. Zhoushan’s VLSFO carries a premium of $21/mt over Fujairah and $13/mt over Singapore.

In Zhoushan, availability has improved due to low demand, with most suppliers now offering lead times of 4–7 days, down from 7–10 days last week. HSFO lead times have also shortened from 5–7 days to 3–5 days. In contrast, LSMGO lead times have increased from 3–5 days to 4–7 days.

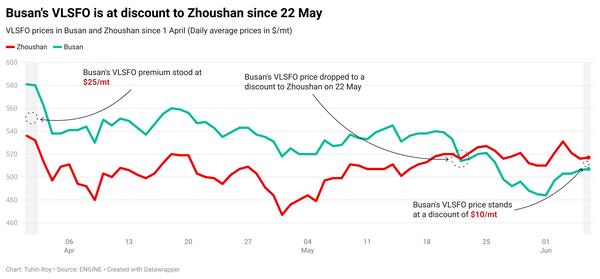

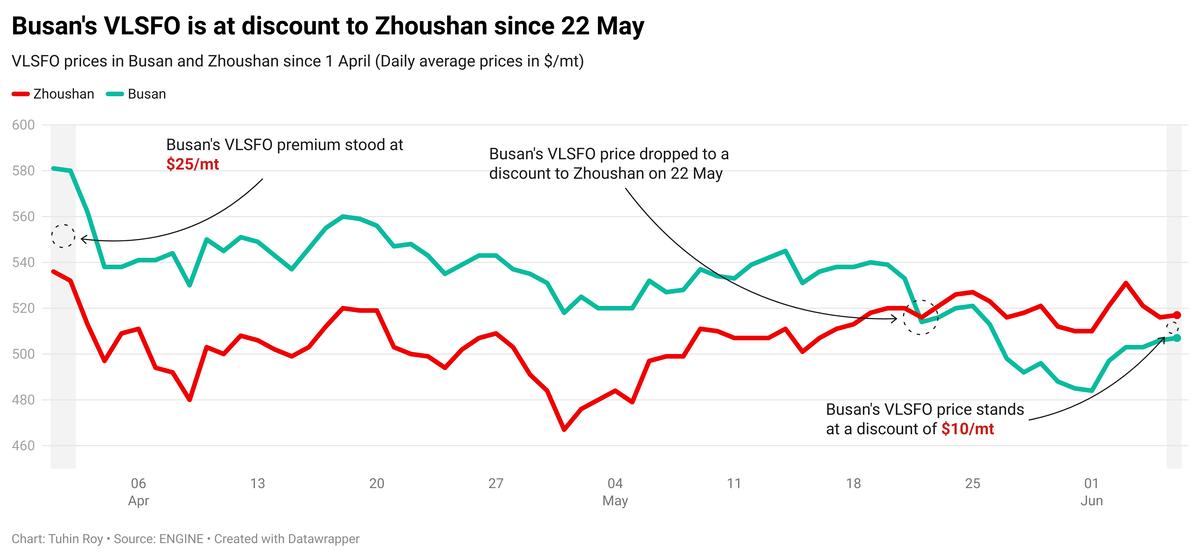

In South Korea, Busan’s VLSFO is priced at a $10/mt discount to Zhoushan.

Lead times for all fuel grades at several South Korean ports have widened significantly, now ranging from 3–11 days, compared to around two days last week.

Bunker operations in Ulsan, Onsan, Busan, and Yeosu may be affected by high waves between 10–12 June. Similar disruptions are expected in Daesan and Taean on 12 June.

Brent

The front-month ICE Brent contract has remained unchanged on the day, to trade at $65.10/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has gained some support following reports of fresh talks between US President Donald Trump and Chinese counterpart Xi Jinping.

The news has eased some economic concerns, supporting oil demand growth sentiment in the world’s two top oil consuming nations, analysts said. Both countries have resumed trade talks, Reuters reports.

Brent has found support “from optimism fuelled by a phone call between Presidents Donald Trump and Xi Jinping,” VANDA Insights’ founder and analyst Vandana Hari said.

“The two leaders agreed to resume trade negotiations, prompting relief after a recent escalation in tensions,” she added.

Downward pressure:

The prospect of further OPEC+ supply hikes continues to dent oil market sentiment.

Last week, eight members of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to collectively increase their supply by 411,000 b/d in July, compared to June’s production levels.

The coalition’s leader Saudi Arabia wants to increase oil supply to regain market share, according to media reports.

“We suspect OPEC is taking the opportunity of stronger seasonal demand and a lack of response from non-OPEC producers to regain market share,” ANZ Bank’s senior commodity strategist Daniel Hynes said. “What is not clear is whether that will extend into the second half of the year,” he added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.