East of Suez Market Update 5 Jun 2025

Prices in East of Suez ports have moved in mixed directions, and VLSFO availability has improved in Zhoushan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($11/mt), Singapore ($4/mt) and Fujairah ($1/mt)

- LSMGO prices up in Singapore ($1/mt), and down in Zhoushan ($8/mt) and Fujairah ($7/mt)

- HSFO prices unchanged in Fujairah, and down in Zhoushan ($4/mt) and Singapore ($2/mt)

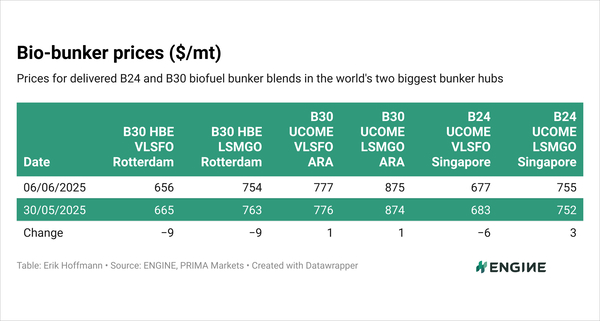

- B24-VLSFO at a $176/mt premium over VLSFO in Singapore

Zhoushan’s VLSFO price has dropped by $11/mt over the past day—the sharpest decline among the three main Asian bunker ports. Despite this, the port’s VLSFO price still stands at a premium of $19/mt over Fujairah and $7/mt over Singapore.

Availability has improved in Zhoushan amid low demand, with most suppliers now advising lead times of 4–7 days, down from 7–10 days last week. HSFO lead times have also shortened from 5–7 days to 3–5 days. However, LSMGO lead times have increased from 3–5 days to 4–7 days.

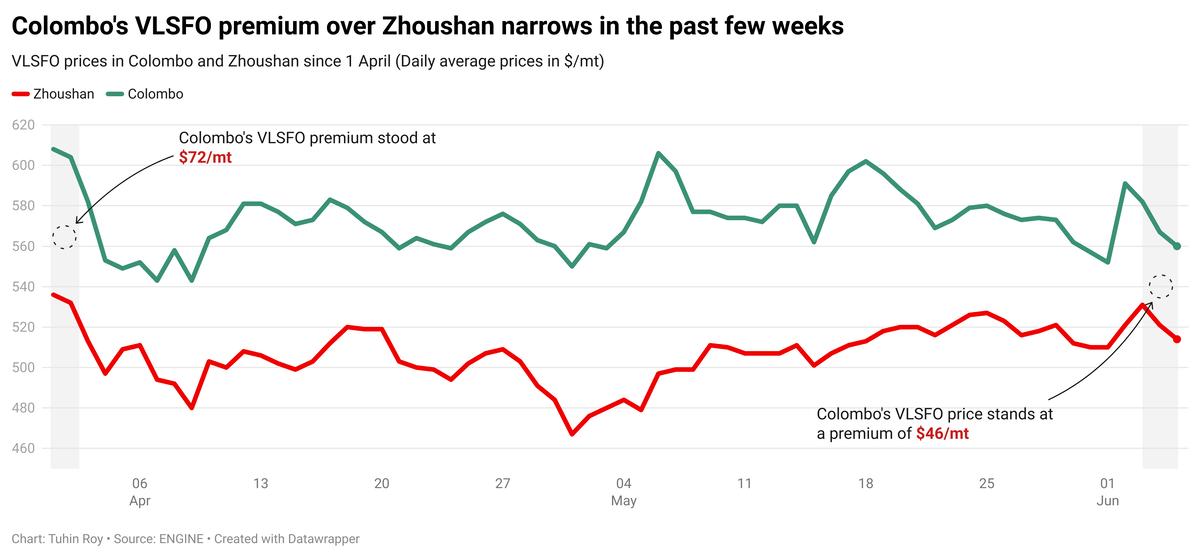

In Sri Lanka, Colombo’s VLSFO price continues to remain at an elevated level to Zhoushan, with a $46/mt premium.

Lead times at both Colombo and Hambantota ports have dropped significantly—from around nine days last week to about three days now.

Brent

The front-month ICE Brent contract has moved $0.39/bbl lower on the day, to trade at $65.10/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Wildfires in Canada’s energy hub of Alberta has curtailed about 350,000 b/d of crude oil production, according to a Bloomberg report. This news has provided some support to Brent crude’s price.

“Overall, there are blazes that are 10 hectares or larger in size that are within 10km of about 420kb/d [420,000 b/d] of oil production,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Additionally, a decline in US crude stocks has supported oil prices. Commercial US crude oil inventories have decreased by about 4.3 million bbls to touch 436 million bbls for the week ending 30 May, according to data from the US Energy Information Administration (EIA).

A decrease in US crude stockpiles generally signals stronger demand and can support Brent's price.

Downward pressure:

Brent futures have declined following media reports stating that Saudi Arabia plans to significantly increase crude oil output in the upcoming months.

The coalition’s de-facto leader wants to continue with aggressive oil supply hikes to regain market share, Bloomberg reports, adding that it wants to bring back 411,000 b/d of crude oil in August and potentially September.

“Saudi Arabia is said to want to increase output at this level in August and possibly September in an effort to regain lost market share,” Hynes said.

Earlier this week, eight members of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to collectively increase their supply by 411,000 b/d in July, compared to June’s production levels.

The announcement marked the third month in a row that they plan to expedite the unwinding of their joint 2.2 million b/d output cuts. The group will meet again on 6 July to decide on August production levels.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.