East of Suez Market Update 4 Jun 2025

Prices in East of Suez ports have moved in mixed directions, and prompt availability of all grades remain tight in the UAE ports of Fujairah and Khor Fakkan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($7/mt) and Fujairah ($6/mt), and down in Zhoushan ($5/mt)

- LSMGO prices up in Singapore and Zhoushan ($12/mt) and Fujairah ($7/mt)

- HSFO prices up in Singapore ($3/mt), unchanged in Zhoushan, and down in Fujairah ($6/mt)

- B24-VLSFO at a $181/mt premium over VLSFO in Singapore

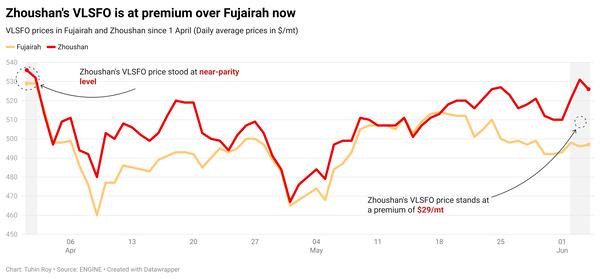

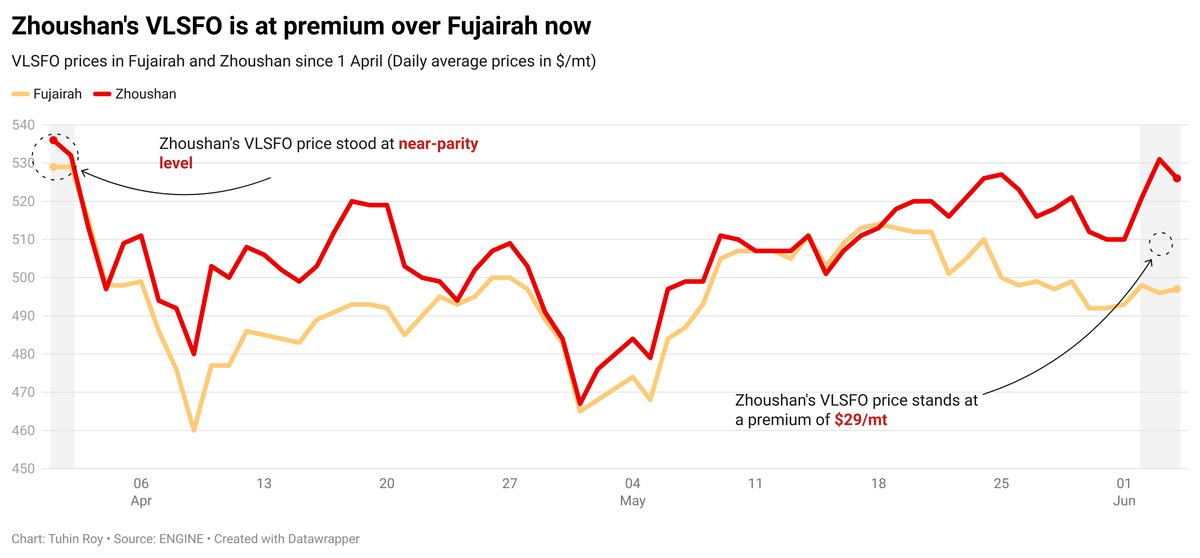

Zhoushan’s VLSFO price has declined over the past day, while prices in Singapore and Fujairah have increased. Despite the dip, Zhoushan’s VLSFO still stands at a premium of $29/mt over Fujairah and $14/mt over Singapore.

VLSFO supply in Zhoushan has improved, with most suppliers now recommending lead times of 4–7 days, down from 7–10 days last week. HSFO lead times have also shortened from 5–7 days to 3–5 days. In contrast, LSMGO lead times in Zhoushan have increased from 3–5 days to 4–7 days.

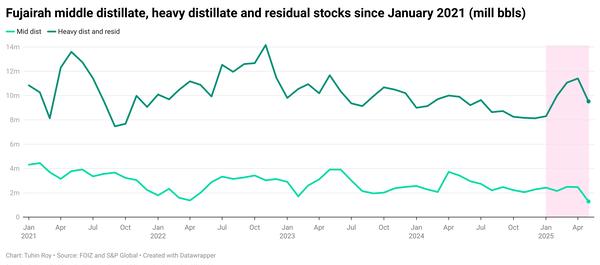

In Fujairah, bunker availability remains tight, with lead times for all fuel grades steady at 5–7 days, similar to those in Khor Fakkan.

Meanwhile, in Iraq’s Basrah, both VLSFO and LSMGO are readily available, though HSFO supply continues to be limited.

Brent

The front-month ICE Brent contract has risen by $0.67/bbl on the day, to trade at $65.49/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures have risen amid concerns over potential supply disruptions from Canadian wildfires and expectations that Iran will reject a US nuclear deal proposal aimed at easing sanctions on the major oil producer.

“Wildfires in Alberta, Canada, provided a boost to prices,” noted two analysts from ING Bank.

Despite a temporary relief due to wet weather, market participants still expect the wildfires—burning across Canada since May—to impact supply.

“However, this relief could be short-lived amid forecasts for drier and warmer weather towards the end of this week,” the ING analysts added.

Meanwhile, a senior Iranian diplomat told Reuters on Monday that Iran is likely to reject the US proposal to resolve the long-standing nuclear dispute between the two nations, saying the plan does not serve Iran’s interests. If US-Iran talks collapse, sanctions on Iran could remain in place, continuing to limit its oil exports and thereby supporting global oil prices.

“The market is also concerned over renewed pressure on Iranian oil exports,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

Downward pressure:

The Organisation for Economic Cooperation and Development (OECD) has lowered its global economic growth forecast, projecting a slowdown from 3.3% last year to 2.9% in both 2025 and 2026.

"Global economic prospects are weakening, with substantial barriers to trade, tighter financial conditions, diminishing confidence and heightened policy uncertainty projected to have adverse impacts on growth," the OECD said in its latest report.

Concerns over global economic growth has put some downward pressure on oil prices.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.