Europe & Africa Market Update 30 May 2025

Prices of most fuel grades in Europe and Africa have declined tracking Brent, and congestion has eased in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($10/mt), Rotterdam and Gibraltar ($8/mt)

- LSMGO prices up in Gibraltar ($8/mt), and down in Rotterdam ($8/mt)

- HSFO prices down in Gibraltar ($11/mt) and Rotterdam ($7/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $4/mt to $230/mt

Prices of most conventional fuels in Rotterdam, Gibraltar and Durban have recorded losses, except for Gibraltar’s LSMGO grade which has climbed up in the past session.

A higher priced 150-500 mt LSMGO stem fixed in Gibraltar at $733/mt has contributed to push the fuel grade’s price upwards.

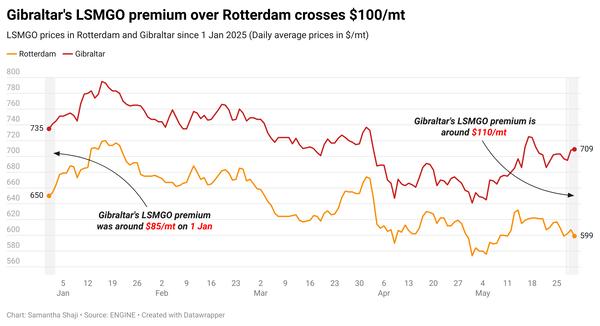

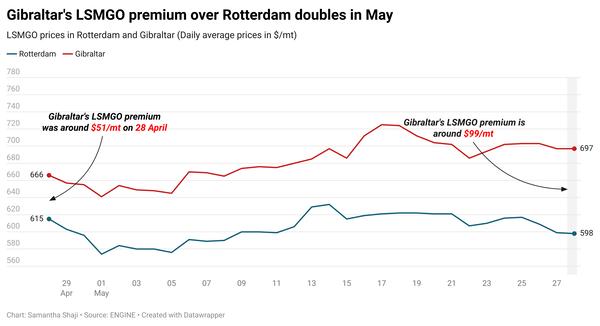

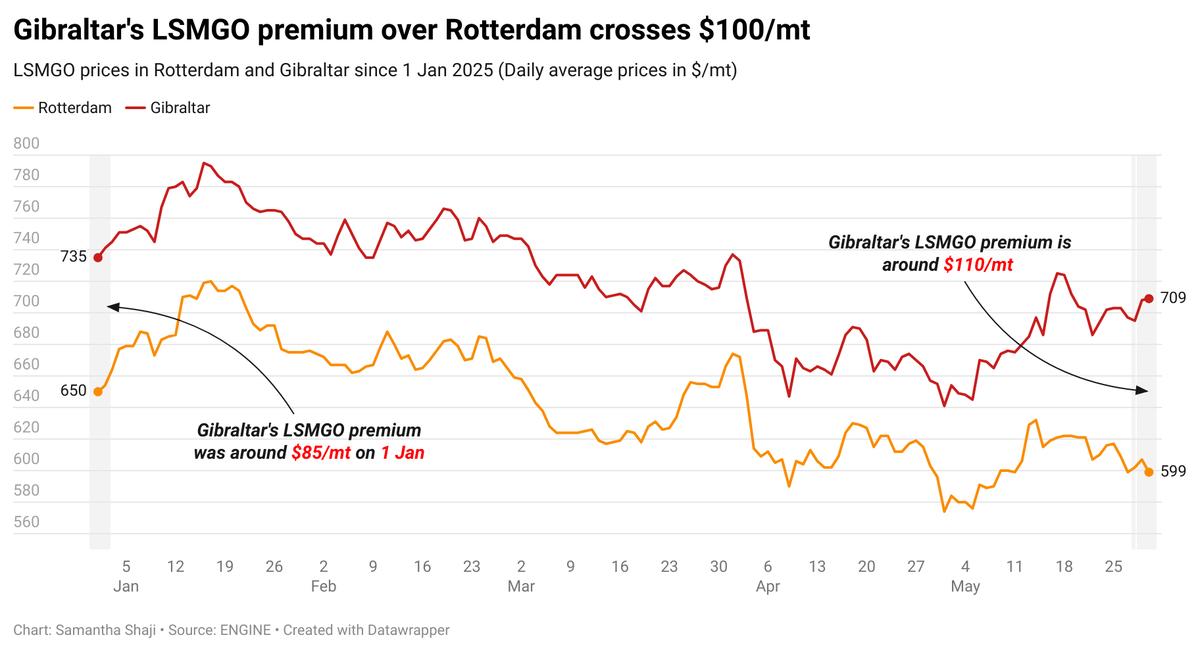

This uptick has also caused Gibraltar’s LSMGO’s price premium over Rotterdam to reach $109/mt, breaching the $100/mt mark.

With only five vessels waiting for bunkers today, a week-long congestion at Gibraltar is finally easing, according to port agent MH Bland. However, suppliers are still running 4-24 hours behind schedule, the port agent said. The port is expected to see conducive weather over the weekend.

The port of Algeciras is expected to see strong wind gusts over the weekend, the port agent noted. Consistent with the past two days, suppliers are running 16-72 hours behind schedule while operations continue in the Inner Anchorage area, the Delta anchorage and OPL.

Across the strait in Ceuta, two vessels are waiting for bunkers as some suppliers are running up to six hours behind schedule, port agents MH Bland and Jose, Salama & Co noted. Twelve vessels are expected to arrive for bunkers at the port today.

The port of Istanbul is expected to see weather-related disruptions today, while bad weather conditions are forecast in Piraeus between today and Sunday, according to a trader.

Brent

The front-month ICE Brent contract has declined by $1.04/bbl on the day, to trade at $64.60/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has found some support after the weekly official US oil stocks figures from the US Energy Information Administration (EIA) were released yesterday.

Commercial US crude oil inventories have decreased by about 2.8 million bbls to touch 440 million bbls for the week ending 23 May, according to data from the EIA.

“US inventory data added a little light to the gloomy outlook,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Earlier this week, the American Petroleum Institute reported a larger draw of 4.2 million bbls for the same week.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Downward pressure:

Brent crude’s price has slipped on growing concerns over a potential supply glut from OPEC+.

Kazakhstan does not plan to cut oil production in July, its deputy energy minister Alibek Zhamauov said, according to a Reuters report citing Russia’s Interfax news agency.

The Saudi Arabia-led alliance is widely expected to increase output for the third consecutive time at its upcoming meeting on Saturday.

The group of eight OPEC+ members, currently unwinding the 2.2 million b/d of output cuts, are expected to raise their collective production target by 411,000 b/d in July.

“The exact size of the hike is to be announced at the meeting but is expected to be larger than currently scheduled,” Hynes remarked.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.