Europe & Africa Market Update 28 May 2025

Fuel prices in European and African ports have tracked Brent’s downward movement, and delays in suppliers’ schedules at Algeciras have increased.

Changes on the day to 09.00 GMT today:

- VLSFO prices remain unchanged in Durban, and down in Gibraltar ($9/mt) and Rotterdam ($5/mt)

- LSMGO prices down in Rotterdam ($8/mt) and Gibraltar ($7/mt)

- HSFO prices down in Rotterdam ($13/mt), Gibraltar ($6/mt) and Durban ($5/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $1/mt to $235/mt

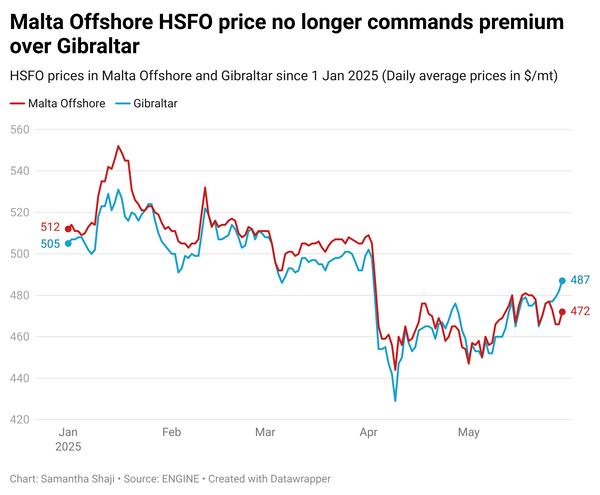

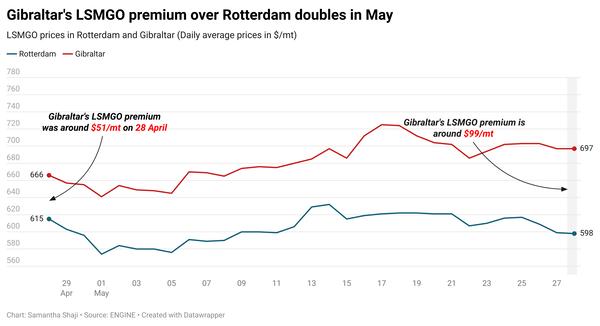

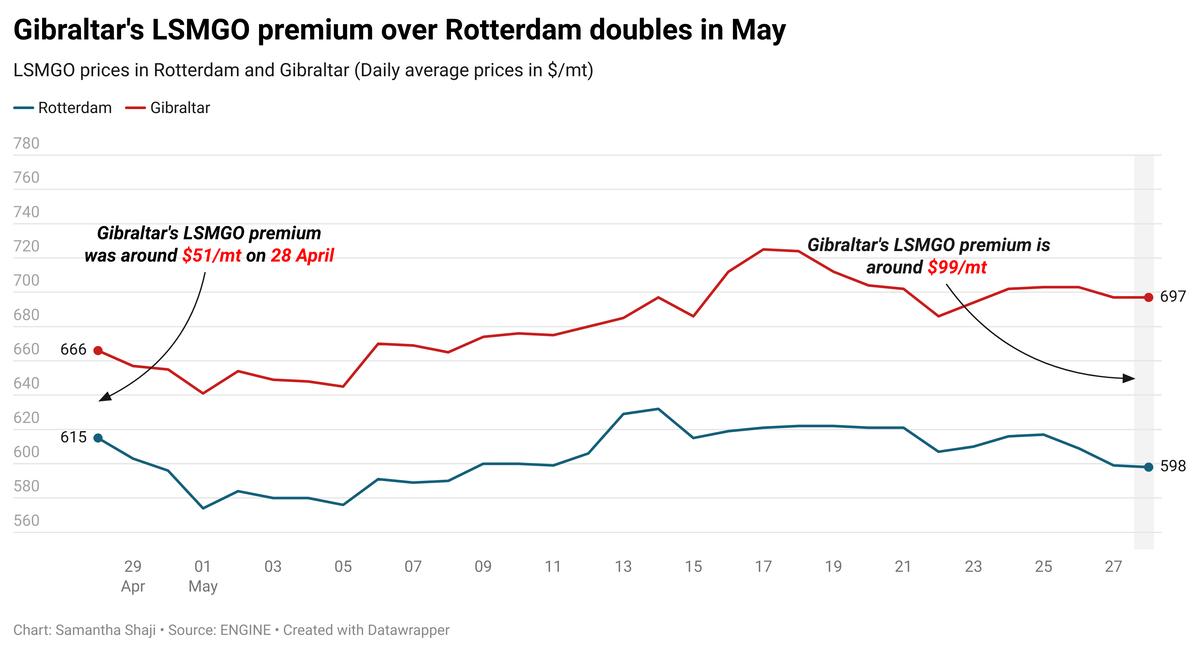

Gibraltar’s LSMGO price premium over Rotterdam is approaching $100/mt, nearly double what it was a month ago. The port's current premium has returned to its March levels.

There are nine vessels awaiting bunkers at Gibraltar today, three more than yesterday, according to port agent MH Bland. Limited barge availability is the sole reason for this congestion, the port agent says.

From 12–14-hour delays yesterday, suppliers in Algeciras are now running 16-72 hours behind schedule, according to MH Bland. The Port of Algeciras Authority continues to prioritise using the Delta anchorage for bunkering to help manage congestion at the port, the port agent adds.

Nine vessels are expected to arrive in Ceuta for bunkers today, according to shipping agent Jose Salama & Co. One supplier is running 4-6 hours behind schedule.

Wind gusts of 19 knots are expected to impact bunker deliveries off Malta today, MH Bland says. Bunker Area 3 is currently operational.

Weather conditions in Las Palmas are currently unstable for bunkering with worse conditions expected tomorrow, according to a trader.

Brent

The front-month ICE Brent contract has moved $0.63/bbl lower on the day, to trade at $64.20/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has gained some momentum amid increased prospect of fresh sanctions against Russian crude oil and other petroleum products.

The escalation follows comments made yesterday by US President Donald Trump. In a social media post, Trump said that his Russian counterpart, Vladimir Putin was “playing with fire,” after Moscow intensified airstrikes on Ukrainian cities in the recent days.

Moscow has intensified its attacks despite Washington’s efforts to broker a ceasefire. “This increases the risk of further sanctions against Russia, putting Russian energy flows at risk,” two analysts from ING Bank remarked.

Earlier this month, the European Union (EU) adopted a 17th package of sanctions against Moscow, which targeted its shadow fleet of nearly 200 oil tankers.

This was followed by a statement from finance ministers of the G7 group of developed nations, threatening to “maximize pressure such as further ramping up sanctions,” if no progress is made towards a peace deal with Ukraine.

Downward pressure:

The primary factor weighing down Brent crude’s price today is a stronger US dollar.

A stronger US dollar makes commodities like oil costlier for non-dollar holders, ultimately denting demand in the market.

“Crude oil prices came under pressure yesterday, with USD strength providing some headwinds for the market,” ING Bank analysts said.

Besides, expectations of higher OPEC+ output have dampened market sentiment, dragging Brent crude lower. The Saudi Arabia-led group will meet on Saturday to review supply quotas for its members and decide July production levels.

“[Market] Participants are taking a wait-and-see approach to Saturday’s OPEC+ meeting, when members will decide on July output levels,” ING analysts added.

The coalition is expected to increase output by another 411,000 b/d in July, for the third consecutive time.

The meeting, initially set for Sunday, has reportedly been rescheduled to an earlier date.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.