Europe & Africa Fuel Availability Outlook 28 May 2025

Tight prompt availability off Malta

Very tight VLSFO supply in Barcelona

Significantly shorter lead times in Las Palmas

IMAGE: Cargo ships in the Port of Las Palmas, Spain. Getty Images

IMAGE: Cargo ships in the Port of Las Palmas, Spain. Getty Images

Northwest Europe

With lead times increased to 7-8 days for all fuel grades in the ARA hub, prompt availability of bunkers remains tight, a trader told ENGINE.

The ARA’s independently held fuel oil stocks have averaged 2% greater in May so far compared to April, according to Insights Global data.

The region has imported 150,000 b/d of fuel oil this month, a step down when compared to April’s 198,000 b/d, according to data from cargo tracker Vortexa.

Saudi Arabia maintains its position as the region’s topmost import source, claiming about 22% of the total share. Other import sources include the UK (20%), the UAE (17%) and Poland (13%).

The region’s independent gasoil inventories - which include diesel and heating oil – have remained relatively stable. The ARA hub has imported 385,000 b/d in May, recording a steep increase from April’s 202,000 b/d, Vortexa data shows.

At 19%, Saudi Arabia is the region's top import source for gasoil and diesel. Cargo volumes have also arrived from the US (16%) and the UAE (13%).

Bunkers are readily available in the Swedish port of Gothenburg and off Skaw, a trader told ENGINE. Lead times of 10 days are advised for both locations across fuel grades.

Consistent with the last few weeks, prompt bunker supply is good in Germany’s Hamburg port, a trader said. All bunker grades require lead times of 3-5 days.

Mediterranean

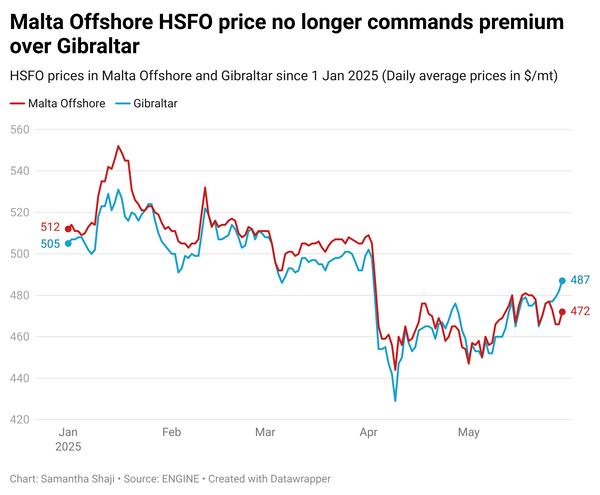

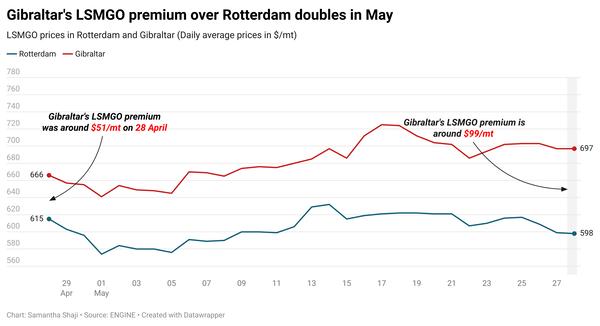

Prompt bunker availability is tight in Gibraltar Strait ports, with lead times of 8-9 days advised, according to a trader.

Congestion persists in Gibraltar, according to port agent MH Bland. There were nine vessels awaiting bunkers on Wednesday, three more than on Tuesday. Limited bunker vessel availability has been causing this congestion.

Suppliers in Algeciras were running 16-72 hours behind schedule on Wednesday, according to MH Bland. The port continues to prioritise using the Delta anchorage for bunkering to help manage congestion in the port.

In Ceuta, one supplier is running 4-6 hours behind schedule, the port agent noted.

Bunker availability is good in Las Palmas and lead times have come significantly down, to 3-4 days now, a trader said. Weather conditions are currently unstable for bunkering in the port. The weather is expected to worsen on Thursday, but then calm with smoother conditions after that, another trader said.

Lisbon has good bunker supply and lead times of 3-5 days are recommended.

VLSFO availability in Barcelona is challenging and very tight, a source says.

Prompt availability is challenging off Malta, with lead times of 5-7 days recommended, according to a trader. Inconsistent weather conditions are expected to disrupt bunkering on Thursday, the trader added.

In Piraeus, lead times of 5-7 days are advised for HSFO and LSMGO, according to a trader. Possible bunker disruptions are expected between 30-31 May.

Africa

Availability of all grades is good in Lome, with lead times of 5-7 days recommended.

VLSFO is readily available in Luanda with 3-4 days of notice recommended, while LSMGO supply is still very tight, a trader said, consistent with the past couple of weeks.

Walvis Bay is seeing good prompt availability of all grades, with 3-6 days of notice recommended.

The South African port of Durban has good bunker supply, with 2-4 days of lead time advised and weak demand, a trader said. LSMGO supply remains dry.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.