Balboa’s Hi5 spread narrows amid VLSFO and HSFO supply imbalance

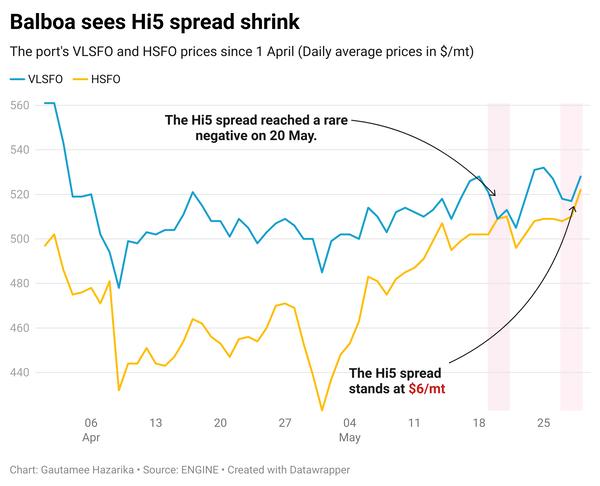

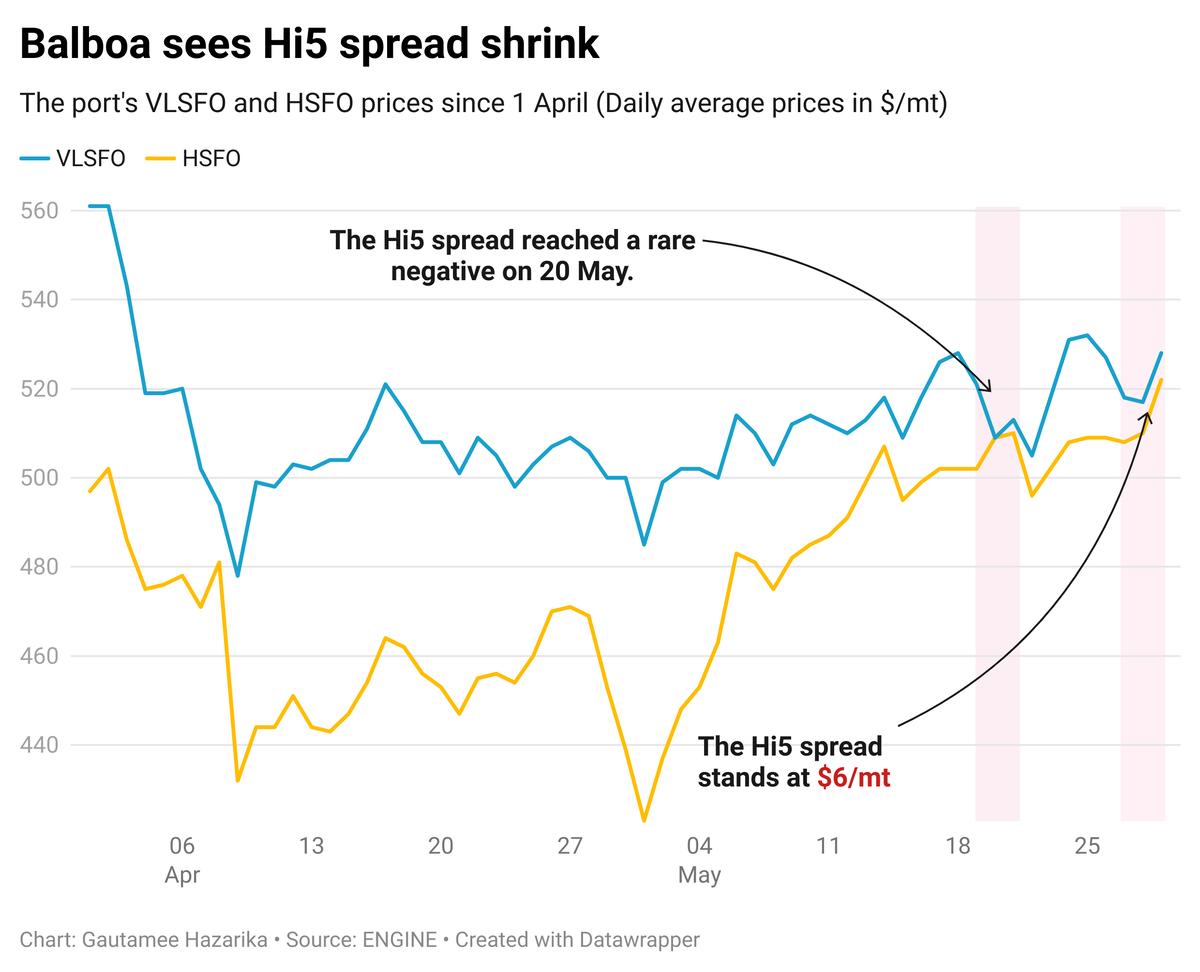

Balboa’s bunker fuel market has witnessed a notable shift as the Hi5 spread has shrunk over the past 2-3 weeks, even turning negative in recent trading sessions.

The Hi5 spread is the price difference between VLSFO and HSFO and a key indicator of scrubber economics.

A wider spread means that ships with scrubbers fitted can gain an advantage by buying cheaper HSFO compared to their competitors without scrubbers that have to consume VLSFO or LSMGO. A narrower spread reduces that advantage.

Balboa's Hi5 spread now stands at $6/mt and has contracted significantly from $77/mt just three months ago, reflecting a major change in supply and demand dynamics.

According to sources, HSFO availability is currently extremely tight in the port, while a few suppliers have replenished their inventories with fresh VLSFO supplies, which has made this market more competitive.

Considerably greater imports of low sulphur fuel oil (LSFO) compared to HSFO since the start of April could be a key factor contributing to the narrowing of the Hi5 spread.

Panama has imported an average of 37,000 b/d of fuel oil since 1 April, data from cargo tracker Vortexa shows.

Of this, LSFO has made up 78% of the total and HSFO the remaining 22%. The LSFO is likely mostly VLSFO, but Vortexa uses a broader category of fuel oils with low sulphur content.

LSFO has made up a larger share of Panama’s total fuel oil imports in the past two months (78%) than in the year to date (68%). Conversely, HSFO’s share of the total over the past two months (22%) has been smaller than for the year to date (32%).

This signals a shift towards more LSFO - and by extension VLSFO - in the country’s recent import mix.

LSFO imports have primarily originated from Brazil and the US Virgin Islands over the past two months, while HSFO volumes have mainly been sourced from Mexico and Chile.

Balboa’s Hi5 spread has averaged around a narrow $15/mt since 9 May.

On 20 May, Balboa’s VLSFO price fell by $21/mt, while its HSFO price rose by $7/mt. These price shifts pushed the Hi5 spread below zero, a rare occurrence in the port’s fuel market history.

Drought delays but not bunker delays

Drought conditions and low water levels in the Panama Canal have held back some vessels from transiting. A source noted that last weekend, a vessel faced delays because of low water levels in the canal and had to wait a day to clear the last locks.

However, the ongoing drought conditions don’t seem to have much impact on bunker fuel demand or prices in Balboa.

"That was the only vessel I saw get delayed. Bunker deliveries are done at the outer anchorages, so they aren’t affected," the source added.

“Demand-wise, I don’t believe there has been any change,” a trader remarked.

“The only alternative route is down South America, but there aren’t many convenient bunker locations along that trip.”

By Gautamee Hazarika

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.