Americas Market Update 29 May 2025

Bunker fuel benchmarks have moved in mixed directions across the Americas, and standby tugs may be required to assist vessels in New York.

IMAGE: Containers stacked on a freight ship in a port in Argentina. Getty Images

IMAGE: Containers stacked on a freight ship in a port in Argentina. Getty Images

Changes on the day to 08.00 CDT (13.00 GMT) today:

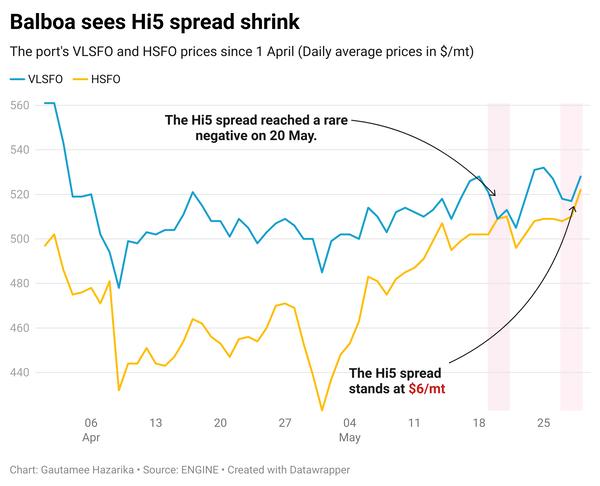

- VLSFO prices up in Zona Comun ($7/mt), Balboa ($4/mt), and down in Houston ($7/mt), Los Angeles ($2/mt) and New York ($1/mt)

- LSMGO prices up in Los Angeles ($16/mt), and down in Balboa ($5/mt), Houston and New York ($2/mt)

- HSFO prices up in New York ($3/mt), Balboa ($1/mt), unchanged in Houston and down in Los Angeles ($1/mt)

Los Angeles's LSMGO price recorded the sharpest increase of $16/mt in the past session, while prices in Balboa and at the east coast ports of Houston and New York have declined.

Though New York's HSFO price inched upwards in the past session, it is currently trading at a discount of $5/mt to Philadelphia, $43/mt to Freeport, Bahamas, and $97/mt to Charleston.

In New York, possible disruptions are expected at the port due to high wind gusts until the end of the week. This can lead to delays in bunker deliveries. “Standby tug may be needed, if conditions require,” a source noted.

On Wednesday, the US Court of International Trade challenged the President’s authority to impose unilateral reciprocal tariffs under the International Emergency Economic Powers Act (IEEPA), stating that such actions require approval in Congress.

Lars Jensen, chief executive of Vespucci Maritime, notes, “In practical terms, this ruling introduces added uncertainty for US importers. Beyond the usual risks tied to shifting tariff policies, there’s now doubt over whether the announced tariffs can even be legally enforced."

"It also raises the possibility that tariffs paid in recent weeks could be refunded if, after appeals, the measures are deemed unlawful—giving shippers a strong case for reimbursement," Jensen added.

Brent

The front-month ICE Brent contract has lost $0.33/bbl on the day, to trade at $64.70/bbl at 08.00 CST (13.00 GMT).

Upward pressure:

Brent crude’s price has gained over $1/bbl in the past session, after the US Court of International Trade blocked President Donald Trump’s “Liberation Day” tariffs, according to media reports.

“Oil prices are firmer this morning after a US court blocked President Trump’s 'Liberation Day' tariffs,” two analysts from ING Bank noted.

Market participants are also looking out for potential new US sanctions on Russian and Iranian crude exports.

Earlier this week, President Trump said that his Russian counterpart, Vladimir Putin, was “playing with fire,” after Moscow intensified airstrikes on Ukrainian cities. Meanwhile, a nuclear agreement between Washington and Tehran seems to be increasingly off the table after the fifth round of talks between delegates from both countries failed to yield any progress.

“Oil markets strengthened yesterday as sanction risks against Russia increase, while the market appears to be losing hope that we’ll see a nuclear deal between the US and Iran,” the ING Bank analysts said.

Downward pressure:

This week’s biggest news will be the upcoming OPEC+ meeting where the group will discuss production quotas for July.

A group of eight OPEC+ members are currently unwinding 2.2 million b/d of output cuts.

“We're assuming the group will agree on another large supply increase of 411k b/d,” ING Bank analysts said.

The Saudi Arabia-led coalition is set to hold an online meeting on Saturday, a day earlier than previously scheduled.

“We expect similar increases through until the end of the third quarter, as the group increases its focus on defending market share,” the analysts added.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.