Americas Fuel Availability Outlook 29 May 2025

US importers face tariff uncertainty

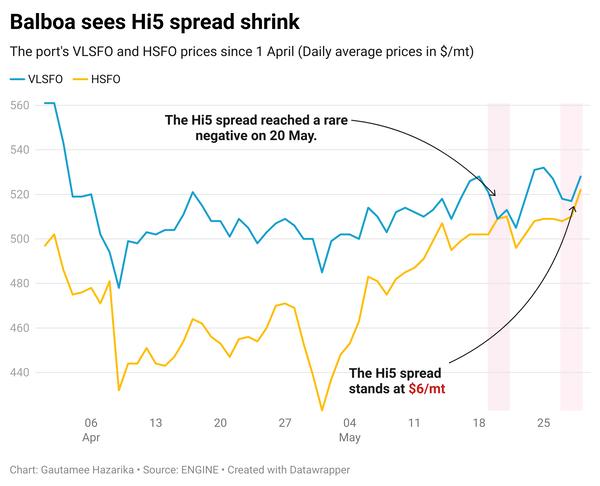

HSFO extremely tight in Balboa

Ecuador's largest refinery halts operations

IMAGE: Aerial shot of a massive cargo ship arriving in the Port of Long Beach, California. Getty Images

IMAGE: Aerial shot of a massive cargo ship arriving in the Port of Long Beach, California. Getty Images

North America

Bunker demand in Houston has improved, compared to the beginning of May. Fuel availability is good at the port for prompt delivery with recommended lead times of 5-7 days.

The closure of the Houston Ship Channel between the Intracoastal Waterway was lifted earlier on Tuesday, and the channel is now open to all traffic. The channel is a vital waterway for ports in Houston, Galveston, Baytown, and Texas City.

Within the last 24 hours, 72 vessels have arrived at the Houston port, and 138 ships are expected to come in the next 30 days.

New York recorded an increase in bunker demand compared to last week, causing an increase in spot market activity observed at the New York Harbour and Philadelphia.

VLSFO and LSMGO are available at the port for prompt delivery, with suppliers recommending lead times of 3-5 days. However, HSFO availability is tight this week and requires lead times of at least 7 days.

Possible disruptions are expected at the port due to high wind gusts until the end of the week. This can lead to delays in bunker deliveries. “Standby tug may be needed, if conditions require,” a source noted.

Bunker deliveries in the Galveston Offshore Lightering Area (GOLA) are currently underway, although delays are expected. Operations may face further disruptions this week due to high wind gusts.

At Los Angeles, bunker fuel availability and demand remain steady. Suppliers have recommended lead times of under a week.

Import volumes have dipped this week, with 64,403 TEU expected to arrive on 15 vessels between 25-31 May, which is a decline of 37.40% from the previous week and 29.91% below the same period last year.

However, a rebound is projected for the upcoming week between 1-7 June, with volumes rising to 94,189 TEU across 16 vessels, up 46.25% week-on-week and 4.77% higher year-on-year.

The West Coast port isn’t anticipating a major rise in imports during the current pause in China tariffs.

“We’ll likely see a modest increase in bookings from China, but nothing close to the 30% surge seen at the height of the COVID-19 peak,” said Executive Director Gene Seroka during a monthly briefing.

He noted that while bookings at Asian ports are increasing, persistently high shipping costs are prompting importers to remain cautious with their planning.

Meanwhile, the US Court of International Trade has challenged the President’s authority to impose unilateral reciprocal tariffs under the International Emergency Economic Powers Act (IEEPA), stating that such actions require approval in Congress.

The court issued a permanent injunction and ordered the administration to implement it within 10 days, potentially suspending tariffs such as the 30% on Chinese goods and 25% on select imports from Mexico and Canada.

Lars Jensen, chief executive of Vespucci Maritime, notes, “In practical terms, this ruling introduces added uncertainty for US importers. Beyond the usual risks tied to shifting tariff policies, there’s now doubt over whether the announced tariffs can even be legally enforced. It also raises the possibility that tariffs paid in recent weeks could be refunded if, after appeals, the measures are deemed unlawful—giving shippers a strong case for reimbursement.”

Montreal is bracing for possible disruptions from high wind gusts. The port is already experiencing backlog congestion, with barge operations limited to daylight hours.

Caribbean and Latin America

Market demand in Panama has been weak, according to suppliers.

While VLSFO and LSMGO are available for prompt delivery with lead times of 4–5 days, HSFO remains very tight and requires lead times extending more than 7 days.

Drought conditions continue to affect transit through the Panama Canal, causing delays in vessel movement.

A source noted, “The drought does influence bunker price indications, but the impact tends to show up as moderate fluctuations rather than sharp spikes or drops.”

Operations at Ecuador’s largest refinery, the 110,000 b/d Esmeraldas facility, have been halted following a fire. Petroecuador confirmed on Monday that the fire has been extinguished, but the shutdown remains in place as a precaution.

The shutdown could tighten local fuel supply and impact bunker availability in the region.

Ecuador’s competitive advantage comes from its high yield of residual fuel oil, making it more profitable for bunker buyers to lift HSFO at Ecuadorian ports due to its pricing advantage over low-sulphur grades in other regional ports.

In Argentina, a new oil tanking berth at Bahia Blanca is set to open in August 2025. This will handle Aframax and Suezmax tankers, which are expected to increase vessel traffic.

The San Pedro access channel, located upriver along the Paraná River in Argentina, has seen a sharp reduction in depth, from 9.80 m to 6.50 m, following the refloating of the grounded tanker Yasa Tokyo.

This drop in navigable draft by over 3 m poses challenges for deep-draft vessels, potentially affecting bunker calls and cargo operations at upriver ports, Antares Ship Agents informed.

Water levels in the Paraná River basin remain low but are showing a slight rise due to recent rainfall.

Forecasts expect stable conditions in the coming months, depending on continued precipitation in the Paraguay and Argentine basins and stable rainfall in Brazil.

In Brazil, bunker fuel availability is good in the key ports of Santos, Rio De Janeiro, and Rio Grande. VLSFO and LSMGO are available for prompt delivery with lead times of 5-7 days.

The port of Santos is currently congested and is expected to clear in the next 5 days. Fifty vessels have arrived at the port within the past 24 hours, and 154 ships are expected to arrive in the next 30 days.

In Zona Comun, VLSFO availability is tight with lead times ranging between 10-12 days. Four barges are currently active at the anchorage.

Possible disruptions are expected due to strong wind gusts between 30 May and 2 June. Deliveries were suspended on Wednesday but have since resumed; however, they may face another halt tomorrow, a source noted.

By Gautamee Hazarika

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.