Americas Market Update 28 May 2025

Bunker fuel benchmarks have moved in mixed directions in the key ports of the Americas, and deliveries have been suspended in Zona Comun.

IMAGE: New York Harbor. Getty Images

IMAGE: New York Harbor. Getty Images

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Houston ($14/mt) and Zona Comun ($2/mt), and down in Balboa ($5/mt), Los Angeles ($2/mt) and New York ($1/mt)

- LSMGO prices up in Houston ($6/mt) and New York ($1/mt), unchanged in Balboa, and down in Los Angeles ($1/mt)

- HSFO prices up in Houston ($3/mt) and Los Angeles ($2/mt), unchanged in New York, and down in Balboa ($2/mt)

Houston has recorded the biggest price increases across fuel grades in the latest session. The port's LSMGO discount to New York has narrowed by $5/mt to $47/mt.

New York's VLSFO is currently at discounts of $78/mt to the Bahamas' Freeport and $6/mt to New Orleans. Fuel supply remains steady in New York and recommended lead times are 5-7 days.

Port officials in Los Angeles have reported a surge in cargo shipments during the 90-day pause in tariffs between the US and China. While cargo volumes are expected to drop by 20% for May as a whole, they anticipate the volumes will level off by June.

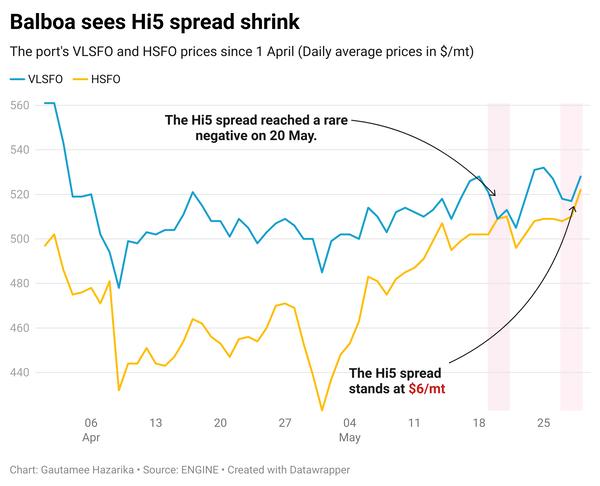

Balboa’s VLSFO price has once again fallen by more than its HSFO. The Hi5 spread has narrowed to $8/mt today, down from $11/mt yesterday.

A vessel transiting the Panama Canal encountered drought conditions and low water levels over the weekend. It was briefly delayed, a trader said.

"The ship had to wait for a day until water levels rose sufficiently to clear the final locks," he said.

However, the trader noted that the drought conditions are unlikely to impact bunker demand in Balboa significantly, as the alternative is to sail around South America, which is much longer and offers few convenient bunker locations.

In Argentina's Zona Comun, bunker deliveries have been suspended due to rough weather conditions. Bunkering is expected to be disrupted until the end of the day.

Brent

The front-month ICE Brent contract has gained $0.42/bbl on the day, to trade at $65.03/bbl at 08.00 CST (13.00 GMT).

Upward pressure:

Brent’s price has gained some momentum amid increased prospect of fresh sanctions against Russian crude oil and other petroleum products.

The escalation follows comments made yesterday by US President Donald Trump. In a social media post, Trump said that his Russian counterpart, Vladimir Putin was “playing with fire,” after Moscow intensified airstrikes on Ukrainian cities in the recent days.

Moscow has intensified its attacks despite Washington’s efforts to broker a ceasefire. “This increases the risk of further sanctions against Russia, putting Russian energy flows at risk,” two analysts from ING Bank remarked.

Earlier this month, the European Union (EU) adopted a 17th package of sanctions against Moscow, which targeted its shadow fleet of nearly 200 oil tankers.

This was followed by a statement from finance ministers of the G7 group of developed nations, threatening to “maximize pressure such as further ramping up sanctions,” if no progress is made towards a peace deal with Ukraine.

Downward pressure:

The primary factor weighing down Brent crude’s price today is a stronger US dollar.

A stronger US dollar makes commodities like oil costlier for non-dollar holders, ultimately denting demand in the market.

“Crude oil prices came under pressure yesterday, with USD strength providing some headwinds for the market,” ING Bank analysts said.

Besides, expectations of higher OPEC+ output have dampened market sentiment, dragging Brent crude lower. The Saudi Arabia-led group will meet on Saturday to review supply quotas for its members and decide July production levels.

“[Market] Participants are taking a wait-and-see approach to Saturday’s OPEC+ meeting, when members will decide on July output levels,” ING analysts added.

The coalition is expected to increase output by another 411,000 b/d in July, for the third consecutive time.

The meeting, initially set for Sunday, has reportedly been rescheduled to an earlier date.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.