Europe & Africa Market Update 19 May 2025

Bunker prices in most European and African ports have increased with Brent, and suppliers are reporting delays in Gibraltar.

Changes on the day from Friday, to 09.00 GMT today:

- VLSFO prices up in Durban ($27/mt), Gibraltar ($12/mt) and Rotterdam ($7/mt)

- LSMGO prices up in Gibraltar ($11/mt) and Rotterdam ($3/mt)

- HSFO prices up in Rotterdam ($11/mt) and Durban ($10/mt), and down in Gibraltar ($1/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $5/mt to $231/mt

Bunker prices across all grades have increased in Rotterdam over the weekend. A steeper rise in the port’s HSFO price has narrowed its Hi5 spread by $4/mt, to $39/mt now.

Gibraltar’s VLSFO and LSMGO prices have also risen, while its HSFO price has edged down. A higher-priced LSMGO stem fixed in Gibraltar in the past session has contributed to boost the benchmark.

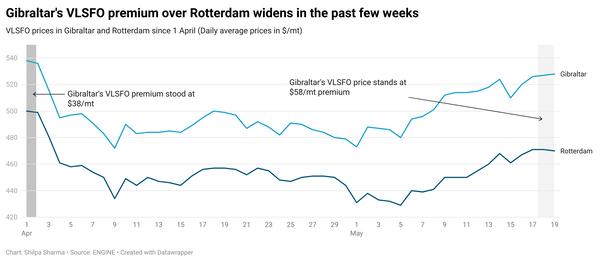

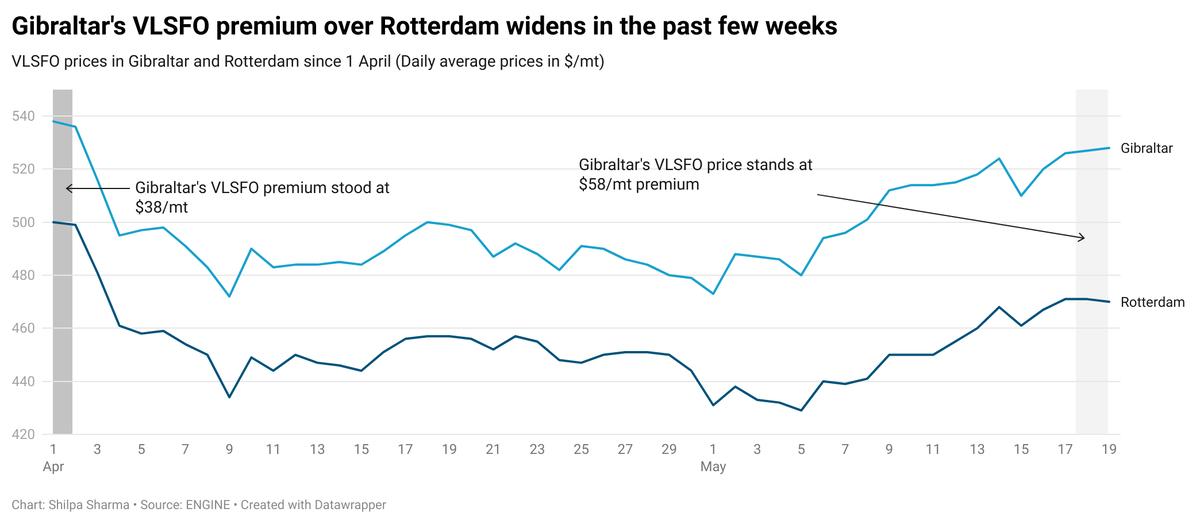

The rise in Gibraltar’s VLSFO price has surpassed Rotterdam's gain over the weekend, widening Gibraltar’s VLSFO premium over Rotterdam by $5/mt to $60/mt.

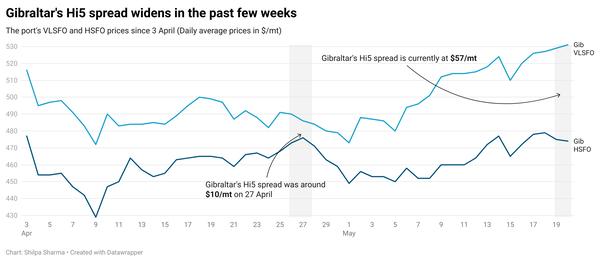

Meanwhile, Gibraltar’s Hi5 spread has widened by $13/mt, to $61/mt now.

The port recorded 445 bunker calls in April, registering a 39% increase from March, according to Gibraltar Port Authority (GPA). It received 1,503 bunker calls in the first four months of this year, recording a 1% rise from 1,494 ships from the same period last year.

Strong congestion is reported in Gibraltar today, with eight vessels currently waiting to receive bunkers there, up from seven on Friday, according to port agent MH Bland. A lack of space for vessels in designated bunker areas and limited bunker barge availability remain key causes. Bunker suppliers are running behind schedule in Gibraltar.

In the adjacent Algeciras port, suppliers are reporting delays of 2-16 hours, the port agent added. One supplier in Algeciras is fully booked until early next month, a trader said.

In Ceuta, bunkering is progressing normally. Nine vessels are due to arrive today, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has gained $0.74/bbl on the day from Friday, to trade at $64.99/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price gained over the weekend after Iran downplayed the likelihood of a near-term nuclear deal with the US.

On Friday, Iran’s Foreign Minister, Seyed Abbas Araghchi, said that Tehran had not received any formal proposal from the US. “Iran has not received any written proposal from the United States, whether directly or indirectly,” he said on social media platform X (formerly Twitter).

The country’s Supreme Leader, Ayatollah Ali Khamenei, lashed out at US President Donald Trump, accusing him of dishonesty and power abuse, Bloomberg reported.

If finalised, the deal could see the US lifting sanctions on Iranian oil. “Crude oil rebounded as Iran cast doubt on an imminent nuclear deal with the US,” ANZ Bank senior commodity strategist Daniel Hynes remarked.

“Iran’s President Pezeshkian said that Tehran won’t abandon its pursuit of civilian nuclear energy under any circumstance,” he added.

Downward pressure:

Oil felt some downward pressure as market investors shifted focus to a highly anticipated call scheduled between US President Trump and his Russian counterpart, Vladimir Putin, to discuss the war between Russia and Ukraine.

“The market will be on the lookout for any signs of potential de-escalation,” two analysts from ING Bank said.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.