Europe & Africa Market Update 16 May 2025

Bunker benchmarks have gained significantly in European and African ports in the past session, and bunker operations off Malta remain suspended.

IMAGE: The Europoort area in the Port of Rotterdam. Getty Images

IMAGE: The Europoort area in the Port of Rotterdam. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO up in Gibraltar ($14/mt), Durban ($12/mt) and Rotterdam ($9/mt)

- LSMGO up in Gibraltar ($24/mt) and Rotterdam ($10/mt)

- HSFO up in Durban, Rotterdam ($15/mt) and Gibraltar ($11/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $10/mt to $236/mt

Prices for conventional fuels in Rotterdam, Gibraltar and Durban have gained to negate some of their losses from the previous session.

The ARA hub continues to see tight prompt availability of all fuel grades. Residual fuel oil stocks in the ARA hub are way below the five-year average for the time of year.

In the past session, Hi5 spreads in Durban and Rotterdam have widened whereas at Gibraltar, it has narrowed.

Gibraltar’s LSMGO premium over Rotterdam has reached $80/mt in this past session, after Gibraltar's price rose sharply.

The congestion in Gibraltar has eased, with the number of vessels waiting for bunkers reduced from 10 yesterday to seven today, according to port agent MH Bland. A lack of space for vessels in designated bunker areas and limited bunker barge availability remains key causes.

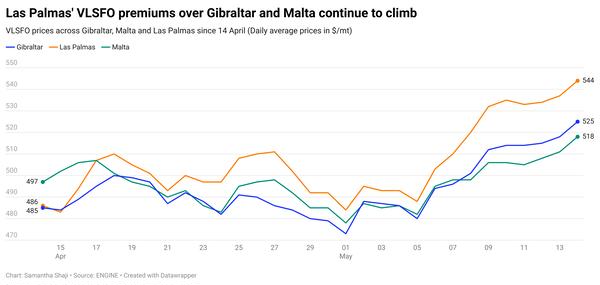

Bunker delays continue in Algeciras, with suppliers delayed by between 2-16 hours, the port agent added. Las Palmas is also seeing delays in its bunker operations.

Across the Gibraltar Strait in Ceuta, there are no delays or congestion, and eight vessels are expected to arrive for bunkers today, shipping agent Jose Salama & Co said.

Bunker operations have resumed in the port of Huelva. However, operations are to be carried out only via barges in the anchorage area, the port agent noted.

Wind gusts of up to 29 knots have disrupted bunker operations off Malta, MH Bland said.

Brent

The front-month ICE Brent contract has moved $0.59/bbl higher on the day, to trade at $64.25/bbl at 09.00 GMT.

Upward pressure:

Brent's price has gained upward momentum as some concerns about the weakness in the US economy have eased.

The US inflation rate, based on the Consumer Price Index (CPI), increased to 2.3% last month year-on-year, down from the 2.4% growth seen in March, according to the US Bureau of Labor Statistics (BLS).

The data has left room for interest rate cuts by the US Federal Reserve (Fed) this year, according to analysts. “The market isn’t leaning aggressively into [interest rate] cuts yet, but the door is clearly open,” SPI Asset Management managing partner Stephen Innes noted.

Lower interest rates in the US can boost demand, making dollar-denominated commodities like oil cheaper for holders of other currencies.

Besides, the US dollar has weakened over the past day, providing some support to Brent’s price. “The dollar kicked off the week with a bounce… but the momentum didn’t last,” Innes added.

A weaker greenback can make commodities like oil more affordable for non-dollar holders, ultimately boosting oil demand in the global market.

Downward pressure:

Brent’s price gains have been capped following US President Donald Trump's remarks on the US-Iran nuclear talks. Trump said on Thursday that Washington and Iran were very close to signing an agreement to halt the latter’s nuclear activities.

Tehran has “sort of” agreed to the terms, Trump said during the press brief on Thursday. “We're in very serious negotiations with Iran for long-term peace.”

If finalised, the deal could see the US lifting sanctions on Iranian oil. The move could add more Iranian crude to an already saturated global oil market and push prices lower, according to market analysts.

The weekly official US oil stocks figure from the US Energy Information Administration (EIA) showed an increase of 3.5 million bbls in commercial crude stocks, to touch 442 million bbls for the week ending 9 May.

“Oil prices did get a little pressure with a surprise build in crude oil inventories as reported by the Energy Information Administration (EIA),” Price Futures Group’s senior market analyst Phil Flynn said.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.