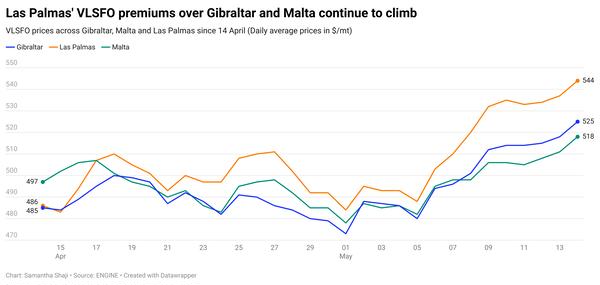

Europe & Africa Fuel Availability Outlook 14 May 2025

Prompt supplies tight in the ARA

Gibraltar Strait congestion persists

ULSFO now available by truck in Piraeus

IMAGE: Ships docked in the Port of Piraeus in Athens, Greece. Getty Images

IMAGE: Ships docked in the Port of Piraeus in Athens, Greece. Getty Images

Northwest Europe

Prompt bunker availability of all conventional fuels has tightened in the ARA hub. Lead times of 5-6 days are advised for HSFO, while for VLSFO and LSMGO they are at 7-8 days. Lead times for HSFO and VLSFO remain largely consistent with last week, while that for LSMGO has increased from last week’s 3-5 days.

The ARA’s independently held fuel oil stocks have averaged 6% higher so far in May than across April, according to Insights Global data. At 7.40 million bbls, the region’s fuel oil stocks have increased on a monthly average basis for the first time this year.

The ARA has imported 164,000 b/d of fuel oil in May, down compared to April’s 198,000 b/d, according to data from cargo tracker Vortexa.

The UAE has emerged as the ARA's topmost import source, making up 39% of the total share. Other import sources include Turkey (16%) and Poland (15%).

The region’s independent gasoil inventories - which include diesel and heating oil – have averaged 3% lower than in April. The ARA hub has imported a total of 347,000 b/d this month, a slight decrease from 358,000 b/d in April, according to Vortexa data.

In the Swedish port of Gothenburg and off Skaw, bunker supply remains limited, a trader told ENGINE. Lead times of 10 days are advised for both locations across fuel grades.

Mediterranean

In Gibraltar Strait ports, prompt bunker availability remains tight with lead times of 8-9 days for all fuel grades, a trader said.

The ports continue to face some congestion, according to port agent MH Bland.

On Wednesday, Gibraltar had seven vessels awaiting bunkers due to limited bunker barge availability, the port agent said.

Algeciras also has some bunker delays. Its port authority has advised bunker suppliers to only use the Delta anchorage for bunker calls, in an effort to reduce the ongoing congestion there. Ships calling at Algeciras for other services should use the Alpha, Bravo or Charlie anchorages.

Across the Strait in Ceuta, three vessels were waiting to bunker at berths and seven vessels were scheduled to arrive for bunkers on Wednesday, according to shipping agent Jose Salama & Co.

The Portuguese port of Lisbon has good bunker supply and lead times of 3-5 days are recommended, according to a trader.

Lead times of 7-8 days are advised for all grades off Malta.

In Piraeus, prompt supply of conventional fuels remains on the tighter side, with HSFO availability subject to enquiry.

A supplier has started offering ULSFO by truck in Piraeus, as an alternative to LSMGO for vessels sailing in the new 0.10% sulphur-capped Emission Control Area (ECA) in the Mediterranean.

Suppliers in the Turkish port of Istanbul have prompt LSMGO supply, while lead times of 7-8 days are recommended for ULSFO. HSFO and VLSFO supplies remain very tight.

Africa

Availability of all grades is good in Lome, with lead times of 5-7 days recommended.

VLSFO is readily available in Luanda with 3-4 days of notice recommended, while LSMGO supply is still very tight, a trader said.

There is decent prompt availability of all grades off Walvis Bay. Lead times of 3-6 days advised.

The South African port of Durban has good bunker supply, with 2-4 days of lead time advised and weak demand, a trader said. LSMGO supply remains dry.

Port Louis in Mauritius has normal bunker availability. Lead times of 3-5 days are advised for all grades.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.