Europe & Africa Market Update 13 May 2025

European and African benchmarks have again moved in mixed directions, and congestion has eased in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO up in Durban ($6/mt) and Rotterdam ($3/mt), and down in Gibraltar ($6/mt)

- LSMGO prices up Rotterdam ($35/mt), and down in Gibraltar ($11/mt)

- HSFO prices up in Rotterdam ($11/mt) and Gibraltar ($2/mt), and down in Durban ($7/mt)

In the second consecutive session this week, conventional fuel prices have moved in mixed directions in the ports of Rotterdam, Durban and Gibraltar.

Rotterdam’s LSMGO price has recorded the highest gain in this session, with an increase of $35/mt. The benchmark has been pushed upwards by a higher-priced 150-500 mt stem fixed at $629/mt and a 0-50 mt stem fixed at $625/mt.

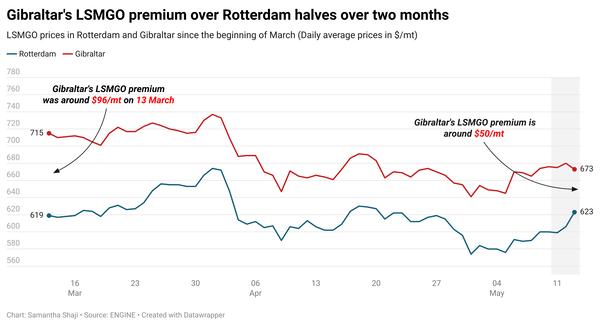

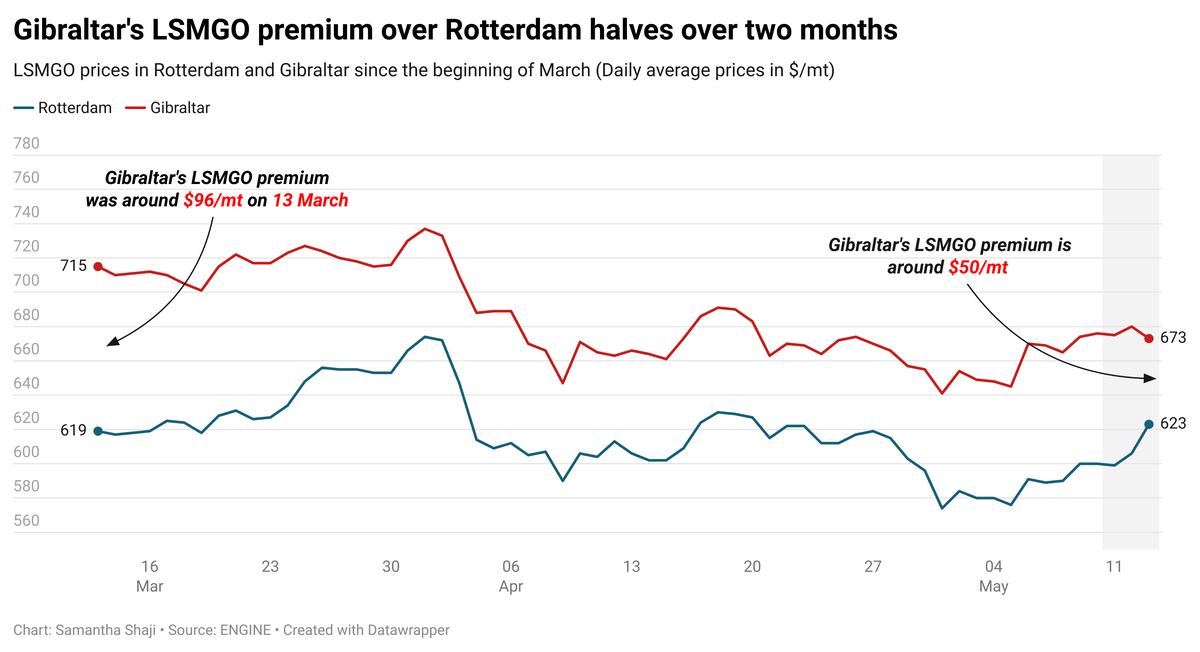

This massive price increase for Gibraltar's LSMGO benchmark has brought its LSMGO premium over Rotterdam’s down from $98/mt yesterday to $52/mt today.

Two lower-priced 150-500 mt VLSFO stems fixed in Gibraltar at $512/mt and $520/mt have exerted downward pressure on the port’s VLSFO benchmark, resulting in a $6/mt loss on the day.

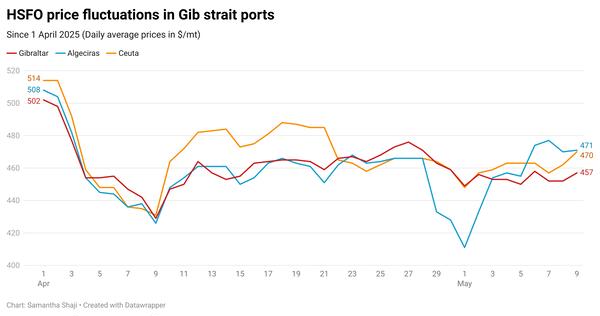

Suppliers in Gibraltar currently has a backlog of three vessels due to a lack of space to bunker, port agent MH Bland said. This comes after days of severe congestion due to limited bunker barge availability in the port.

Bunker operations in the port of Algeciras continue as usual, the port agent said, adding that there could be significant delays.

Across the Strait in Ceuta, 14 vessels are scheduled to arrive for bunkers today and no delays are expected at the anchorage or at berth, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has declined by $0.35/bbl on the day, to trade at $65.20/bbl at 09.00 GMT.

Upward pressure:

Brent’s price felt some upward pressure following a pause in the tariff saga between China and the US – the world’s top two oil consumers, after a successful meeting in Geneva, Switzerland.

“Sentiment across risk assets improved with the pause in US-China tariffs,” two analysts from ING Bank noted.

Over the weekend, Washington decided to reduce levies on most Chinese goods from 145% to 30% and Beijing agreed to lower tariffs on US goods from 125% to 10% for a 90-day initial period.

“The move to reduce tariffs for 90 days was certainly more aggressive than many expected, highlighted by the big upward moves in risk assets, including oil,” ING Bank analysts added.

Downward pressure:

While demand remains a major concern for the oil market, additional supply from OPEC+ is expected to increase oil supply through the rest of the year and subsequently put downward pressure on Brent’s price.

“The supply side should keep downward pressure on the market,” ING Bank analysts noted.

Last month, the Saudi Arabia-led group of oil producers surprised the global oil market by announcing plans to increase the group's output to 411,000 b/d for May and to extend that increase through June – the second month in a row. The group plans to expedite the unwinding of their joint 2.2 million b/d output cuts.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.