Europe & Africa Market Update 8 May 2025

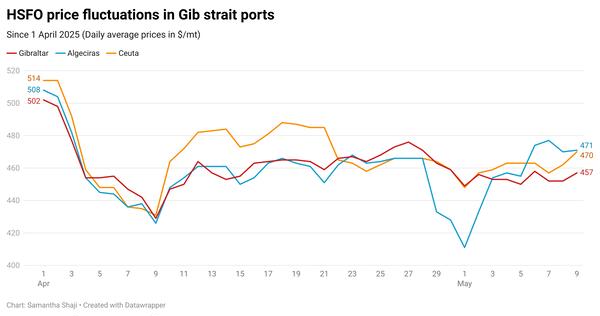

Bunker benchmarks in European and African ports have stumbled yet again, after two consecutive days of gains.

IMAGE: Aerial view of the Bay of Gibraltar. Getty Images

IMAGE: Aerial view of the Bay of Gibraltar. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($12/mt), Rotterdam ($7/mt) and Gibraltar ($2/mt)

- LSMGO prices down in Gibraltar ($16/mt) and Rotterdam ($12/mt)

- HSFO prices up in Durban ($12/mt), Rotterdam and Gibraltar ($10/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $17/mt to $222/mt

In the past session, most bunker fuel prices have taken a fall yet again, tracking Brent’s downward movement.

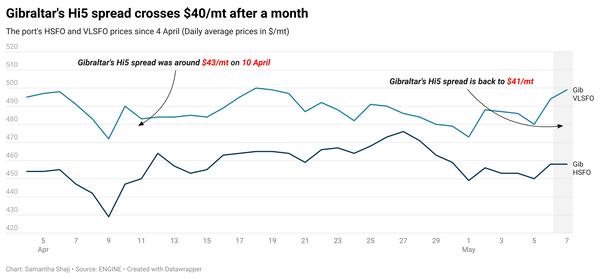

Gibraltar’s LSMGO has recorded the steepest decline of $16/mt in the past day, while its VLSFO price has remained relatively stable.

The port still faces congestion due to limited bunker barge availability, port agent MH Bland said. There are now 15 vessels waiting to bunker, two less than yesterday’s 17.

The port agent also advised that though Ceuta is fully operational, suppliers are facing up to 6-8 hours of delays in deliveries.

The ARA hub is seeing tight VLSFO availability, increasing recommended lead times to 8-10 days, from 7-8 days last week, a trader told ENGINE. HSFO supplies are also tight in the European hub while LSMGO remains readily available.

Brent

The front-month ICE Brent contract has declined by $1.01/bbl on the day, to trade at $61.75/bbl at 09.00 GMT.

Upward pressure:

Brent has drawn some support after the US Energy Information Administration (EIA) reported a drop is US crude stocks.

Commercial US crude oil inventories declined by 2 million bbls to touch 438 million bbls for the week ending 2 May, according to data from the EIA. The latest EIA data “leaves crude oil inventories at their lowest level since March,” two analysts from ING Bank noted.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Besides, fresh developments in the US-China trade dispute provided some support to Brent. US treasury secretary Scott Bessent is set to meet with a top Chinese official in Switzerland on 10 May to continue negotiations over the tariff war that has disrupted global trade.

Downward pressure:

Brent’s price slumped after the US Fed’s policy meeting, as the market found little reason for optimism over demand growth.

In a largely anticipated move, the US Federal Open Market Committee (FOMC) maintained its key interest rate at a range between 4.25-4.50%.

The news follows mounting tensions among global trade partners amid the ongoing US tariff dispute and growing concerns over oil demand.

“It was a sea of red across commodities as news that the Federal Reserve left US interest rates on hold, and signs it's likely to remain there,” ING Bank analysts said.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.