Europe & Africa Fuel Availability Outlook 7 May 2025

VLSFO lead times increase in the ARA

Tight bunker supply in Las Palmas

Good prompt availability in Lome

IMAGE: Aerial view of the Port of Durban. Getty Images

IMAGE: Aerial view of the Port of Durban. Getty Images

Northwest Europe

VLSFO supply in the ARA hub has tightened from last week. Lead times for prompt supply has increased to 8-10 days, from last week’s 7-8, a trader told ENGINE. HSFO prompt supply remains tight and lead times are consistent with last week’s 7-8 days. LSMGO is readily available with lead times of 3-5 days.

The ARA’s independently held fuel oil stocks dropped by 2% in the month in April, according to Insights Global data. At 7.13 million bbls, the ARA's fuel oil stocks were at their lowest average in any month this year.

The region imported 198,000 b/d of fuel oil in April, the same amount as in March, according to data from cargo tracker Vortexa. The ARA has imported low sulphur fuel oil (LSFO) and HSFO in a 45/55 ratio in April, leaning towards HSFO, as opposed to the converse in the previous week.

The UK was the region’s topmost import source in April, taking up 34% of its total share. Other import sources include Mexico and the US (13% each), France (11%) and Lithuania (7%).

The region’s independent gasoil inventories - which include diesel and heating oil – averaged 4% lower in April. The ARA hub imported a total of 202,000 b/d of gasoil and diesel in April, a significant decrease from 346,000 b/d imported in March, according to Vortexa data.

Bunker supply remains limited in off Skaw and in the Swedish port of Gothenburg, with lead times of 10 days advised for both locations across fuel grades, which is consistent with last week, a trader told ENGINE.

Prompt bunker supply is good in Germany’s Hamburg port, a trader said. All bunker grades require lead times of 3-5 days, consistent with the last few months.

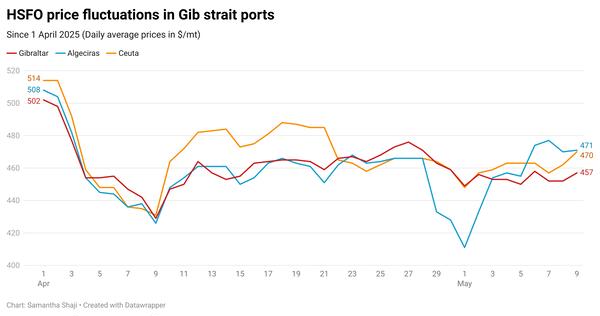

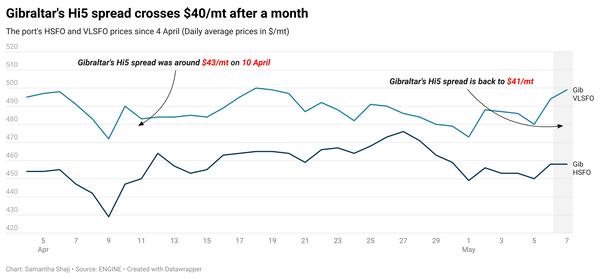

Mediterranean

Prompt bunker availability is still tight in Gibraltar Strait ports, a trader said. Recommended lead times for HSFO and VLSFO are 10 days, and seven days for LSMGO.

After numerous days of bad weather, the Gibraltar Strait ports are now fully functional, according to port agent MH Bland. Algeciras and Ceuta face no congestion while Gibraltar faces a backlog of vessels waiting to bunker, due to limited bunker barge availability.

The Port of Las Palmas is seeing tight prompt bunker supply, with lead times of 12-14 days across fuels, according to a trader. Bunker operations in the port are expected to continue as usual with a good weather forecast for the coming week, another trader added.

The Spanish port of Barcelona continues to have good bunker supplies, with lead times of 5-7 days advised.

Suppliers in the Greek port of Piraeus have very tight barge schedules for prompt VLSFO and LSMGO deliveries, according to a source. HSFO availability is dependent on enquiry.

The Turkish port of Istanbul has tight VLSFO supplies, but has readily available LSMGO.

This week, Malta Offshore has tight prompt bunker supply of VLSFO and LSMGO, the trader said.

Africa

The South African port of Durban has good bunker supply, with 2-4 days advised, a trader said. However, demand is left wanting.

Port Louis in Mauritius continues to have normal bunker availability. Lead times of 3-5 for prompt delivery are advised for all grades.

VLSFO prompt supplies are readily available in Luanda, with lead times of 3-4 days advised. LSMGO supply is very tight, a trader said.

Walvis Bay currently has good prompt supply for all grades, with lead times of 3-6 days advised.

In the African port of Lome, availability of all grades is good, with lead times of 5-7 days recommended.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.